Did our parents actually have it easier buying property? Expert weighs in

It’s a recurring joke across all generations: your parents inevitably had it harder than you did, whether that was walking 5 kilometres in the snow to get to school – uphill both ways, mind you – or entering the property market.

And that joke has come to take up space in mainstream Australian culture, via criticisms of the “avocado-toast generation”, with pundits suggesting younger Australians would find it much easier to access the property market if they just gave up on the odd ritzy brunch.

But is that criticism fair?

Related story: 600,000 Aussie households in rental stress as Rent Assistance falls behind

Related story: Is this $20,000 one-bedder the cheapest house in Australia?

Related story: These suburbs aren’t bargains anymore: Here’s where you should look instead

According to CoreLogic’s head of research, Tim Lawless, the answer to that question has a few parts.

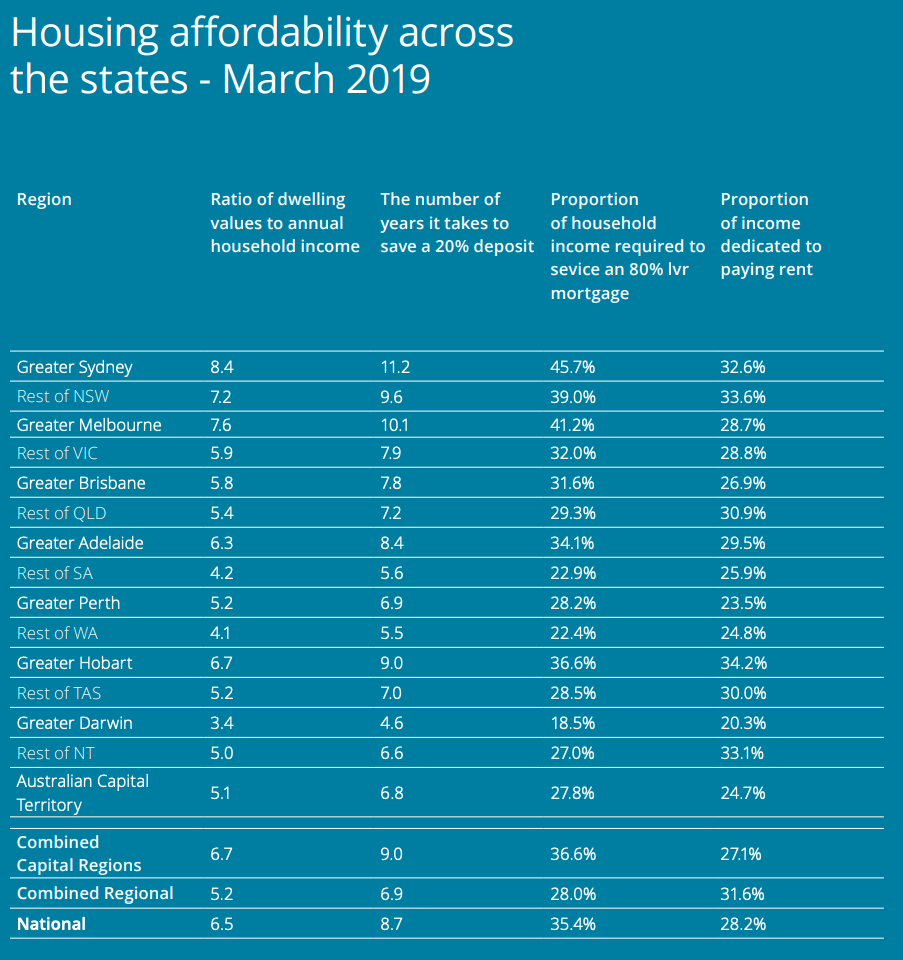

“If you look at the dwelling price to income ratio... looking back 20-odd years ago, that particular ratio is 4.5-5 times depending on what city,” Lawless said.

Today, dwelling prices are around 6.5-7 times the average income.

“It's pretty clear just on those numbers that housing prices are much higher relative to incomes, so that affects mostly people who don't have the benefit of home ownership and people who are fresh to the market,” Lawless continued.

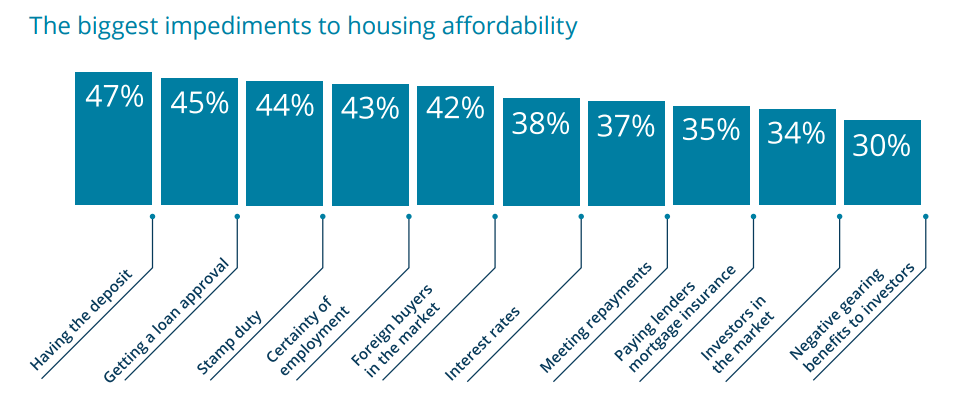

The CoreLogic report, Perceptions of Housing Affordability 2019, highlights this, with having a deposit considered the biggest impediment to being able to access the market.

That was followed by getting loan approval and stamp duty.

Across Australia it takes an average 8.7 years to save a 20 per cent deposit, based on an assumption that a household would save 15 per cent of their annual household income.

It takes even longer in Greater Sydney, where the average buyer would take 11.2 years to save up for a 20 per cent deposit.

But this isn’t the whole story, added Lawless.

While it’s more difficult to get a foot in the door, once the deposit has been paid it’s actually easier to service a loan now than it was 20 years ago.

“You can look at how much of my income do I need to dedicate to servicing a mortgage,” Lawless said.

“At the moment it's a lot lower than what it was 15-20 years ago because of the fact that mortgage rates are so low and that's a fact that favours homeowners that are in the process of paying down their debt.”

There were two ways of looking at housing affordability: how hard it is to get into the market, and how hard is it to service my asset and my debt once I’m in the market, he added.

“In terms of getting into the market, it’s much harder for a younger generation that don't have the benefit of savings or equity behind them.

“But once you've got your foot in the door, it's actually a little bit easier to pay down that debt and reduce your principal.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance