These suburbs aren’t bargains anymore: Here’s where you should look instead

If you wanted to find a bargain property in an expensive suburb, there’s some bad news for you.

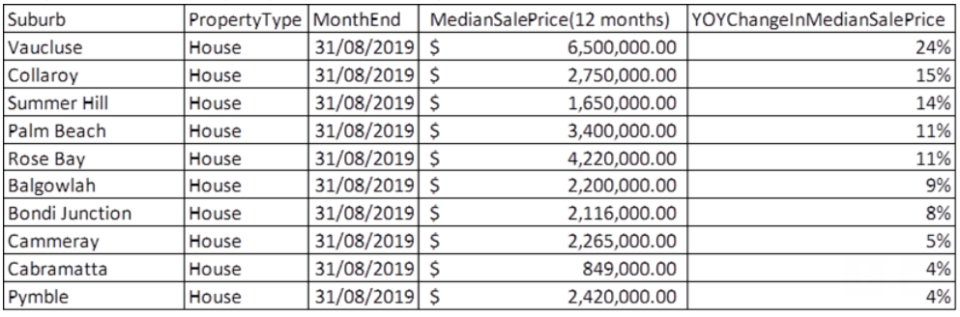

According to realestate.com.au, it’s probably too late to nab a high-end property in Sydney at a bargain price, with homes in suburbs like Vaucluse up 24 per cent over the course of one year to a staggering $6.5 million.

Related story: The Aussie state where it’s easiest to buy property

Related story: The one Aussie suburb where properties sell in just 22 days

Related story: House prices falls are coming to an end – and my house price bet is looking safe

“Vaucluse is a lovely suburb but with a median price of $6.5 million it is well out of reach for most people,” realestate.com.au chief economist Nerida Conisbee said.

“Premium Sydney price growth is extremely strong at the moment and the majority of the suburbs seeing the strongest growth are priced well over $2 million.

“We can see on realestate.com.au that buyers are definitely back, however, if you were looking to nab a bargain (relatively speaking) in many of Sydney’s very expensive suburbs, you have probably left it too late.”

Collaroy has also seen strong growth in the last 12 months, up 15 per cent to a median sale price of $2.75 million, and homes in Summer Hill are 14 per cent more expensive this time of year than they were in 2018, now at $1.65 million.

Top growth suburbs in Sydney, 12 months to August 2019

Where should I look instead?

If you’re happy to look interstate, Melbourne’s Albert Park suburb is down 15 per cent over the last year - despite having the highest views per listing on realestate.com.au.

“If we see a similar pattern in this market to Sydney, then we are likely to see this pricing situation in premium markets turn around relatively soon,” Conisbee said.

What about in Queensland?

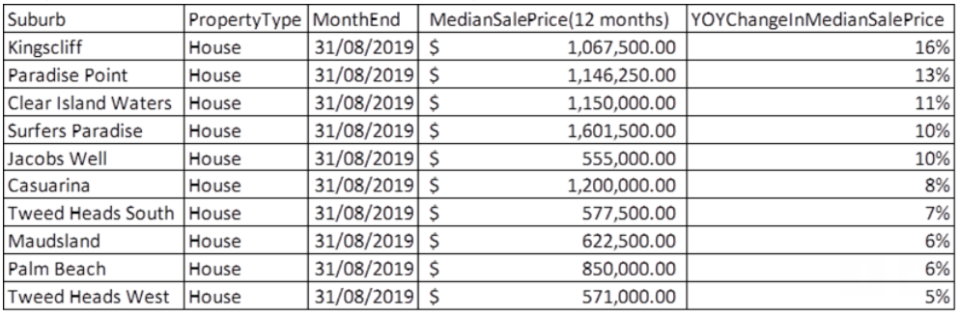

The Gold Coast – which is one of the most popular regions for interstate movers – has seen similar market movements to Sydney, with strong growth recorded in premium suburbs.

“Five of the top growth areas are priced over $1 million and Kingscliff has just pushed over this price point in the past 12 months,” Conisbee said.

“A number of factors seem to be driving this. Interstate money, low levels of new supply over the last couple of years, better infrastructure (e.g., the light rail), growth in jobs and a continuation of the high rental demand theme we have been seeing for some time now.”

She added that Gold Coast housing is well set up for strong price growth over the long term, given a lack of land for single dwellings, meaning a shift to more sub-divisions or higher density living.

Where should I look instead?

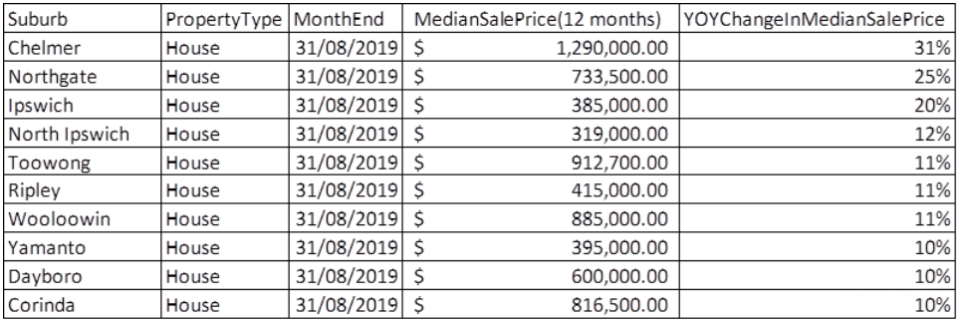

Conisbee said the top growth suburbs in Brisbane are moving in a different trajectory.

“Many very affordable suburbs are doing well. It is likely that Brisbane will start to see similar conditions to Gold Coast and Sydney soon – high search activity is occurring in premium suburbs and it usually is only a matter of time before this flows through to pricing.”

What’s behind this trend?

High-end property markets tend to be the first to react to changes in property conditions, research firm CoreLogic has said.

“Over recent months we have started to see some stabilising of housing market conditions,” analyst Cameron Kusher said in August.

“The data also shows that the largest improvement is occurring across the most expensive properties. Assuming this continues over the remainder of the current financial year the share of million dollar sales, particularly in Sydney and Melbourne, may increase over the coming year.”

Yahoo Finance’s All Markets Summit is on the 26th of September 2019 at the Shangri-La, Sydney. Check out the full line-up of speakers and agenda for this groundbreaking event here.

Yahoo Finance

Yahoo Finance