600,000 Aussie households in rental stress as Rent Assistance falls behind

Hundreds of thousands of Australian households are in rental stress, and half of those will still experience that stress four years later.

Additionally, of the 600,000 households struggling to afford rent, 170,000 families have just $35 a day or less after paying rent, a new report from the Productivity Commission has revealed.

Related story: Rent prices have fallen by as much as 41 per cent in these Aussie suburbs

Related story: Now's the time to negotiate: 4 ways to get yourself cheaper rent

Related story: What will it take to fix homelessness in Australia?

"More low-income households rent privately than ever before, in part because home ownership and public housing have become less attainable," Commissioner Jonathan Coppel said on Wednesday.

More families with children, Australians with disabilities and retirees are also renting.

“Increasingly, we see families stuck in rental stress. We found that over 600,000 households are in rental stress, that is, they spend more than 30 percent of their incomes on rent.”

The report found that the ‘stickiness’ of rental stress has increased over time. While the percentage of households in rental stress has decreased, the number of people has increased over time.

And Australians’ ability to escape rental stress has worsened, with half of those in rental stress still experiencing it four years later.

The ‘stickiness’ of rental stress has increased over time

This is even more pronounced among low-income renters in private rental accommodation.

The Productivity Commission noted that the majority of households that have escaped rental stress have done so by obtaining higher paid work.

Commonwealth Rental Assistance generally works, but is falling behind

While the report found that Commonwealth Rental Assistance (CRA) is generally well targeted and is the clearest path to lowering rental stress, it is falling behind average rents.

"Poor rental housing outcomes are a key driver of disadvantage. There has been a lot of discussion lately about whether income support payments are high enough," Coppel said.

Share of payments made to low-wealth and low-income households in 2018 among working-age households

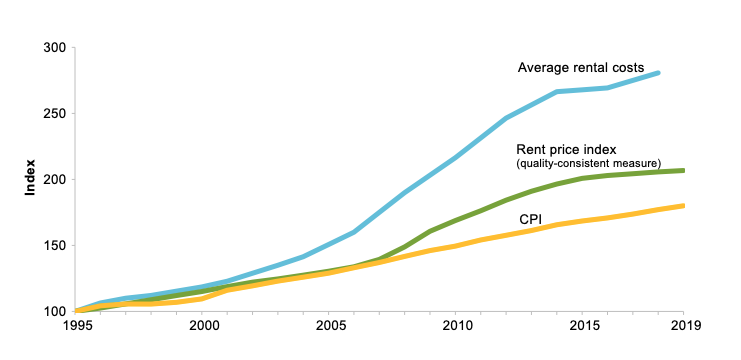

CRA is indexed to consumer price inflation, which has not kept up with soaring rents. That means that the number of Australians receiving the maximum CRA payment has continued to rise, with 80 per cent of CRA recipients now receiving the maximum amount, up from 57 per cent in 2001.

"The role of Commonwealth Rental Assistance in addressing disadvantage has not really been part of those conversations and there is merit in looking at whether raising the level of rental assistance would be effective," Coppel said.

The Australian Council of Social Service (ACOSS) welcomed the report, saying it shone light on the need for an increase to CRA.

“Australia is in a housing affordability crisis and entrenched, severe rental stress is one of the most damaging impacts. This leaves people without enough money to meet other household expenses, let alone to save to buy their own home, and all too often leads to homelessness,” ACOSS CEO Cassandra Goldie said.

Related story: Why Aussies are being squeezed out of the rental market

Related story: Australia’s most unaffordable city for renters named

Related story: In a snapshot: These are the worrying stats about housing in Australia

“Today’s report shows that in the last 20 years, the proportion of people in home ownership and social housing has fallen, leaving more people in the private rental market, including those on very low incomes.”

ACOSS said CRA needed to be increased by at least 30 per cent, or $20 a week.

Newstart recipients in dire rental straits

The Productivity Commission’s report follows analysis from RMIT University’s Simone Casey and Swinburne University of Technology’s Liss Ralston which found that Newstart recipients who rent in Melbourne have an average $98 to live on after paying for rent.

Using Real Estate Institute of Australia (REIA)’s figures, the researchers found that these renters were spending around 70 per cent of their income on rent alone.

Those renting in Sydney have an average $48.24 to live on after rental payments, or $6.89 a day.

Yahoo Finance’s All Markets Summit is on the 26th of September 2019 at the Shangri-La, Sydney. Check out the full line-up of speakers and agenda for this groundbreaking event here.

Yahoo Finance

Yahoo Finance