Housing market sprints ahead as buyers urged to get in now

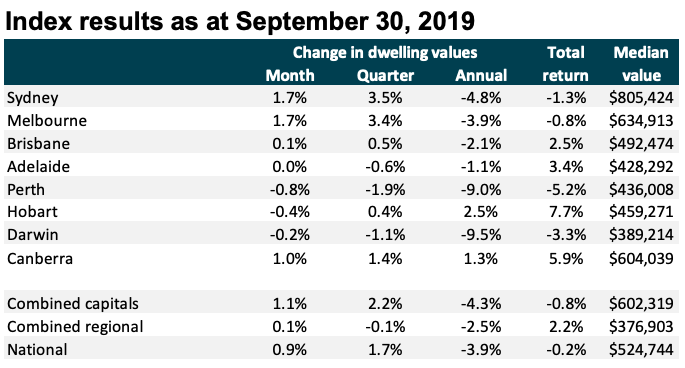

Australia’s housing market has marked its largest monthly increase since March 2017, with values up 0.9 per cent in September.

This marks the second consecutive month of gains, following a gain of 0.8 per cent in August, bringing quarterly gains to 1.7 per cent, and annual performance to -3.9 per cent growth.

It comes as the Reserve Bank of Australia prepares to hand down its interest rate decision for October, with pundits split over whether the board will keep rates on hold or cut. The two cuts in June and July have been credited with fueling the recent resurgence in property market growth.

But CoreLogic head of research Tim Lawless said the Australian property market still has a long way to go before it reaches 2017 heights.

Related story: Did our parents actually have it easier buying property? Expert weighs in

Related story: 600,000 Aussie households in rental stress as Rent Assistance falls behind

Related story: Is this the answer to Australia’s slow wage growth and economic woes?

“Although housing values are now consistently tracking higher, at least at a macro-level, the national index remains 6.8 per cent below the October 2017 peak, indicating that buyers still have some time to take advantage of improved housing affordability before values return to record highs.”

But, he added that as interest increases, stock dwindles, contributing to buyer urgency.

“The number of listings across the capital cities is 10 per cent lower than a year ago, and fresh listings being added to the market are 15 per cent lower than a year ago. As buyer activity rises, the lack of available stock could see a renewed sense of FOMO supporting further price growth.”

Sydney and Melbourne lead price growth

Sydney and Melbourne led the growth, both recording 1.7 per cent price increases over September, following strong growth in August.

According to Lawless, these increases are likely down to broadly strong economic growth in the states.

“While all regions are benefiting from low mortgage rates and improved access to credit, economic and demographic conditions in New South Wales and Victoria continue to outperform most areas of the country,” Lawless said.

“Population growth is higher, unemployment is lower and jobs growth is stronger, providing a solid platform for housing demand.”

Additionally, higher levels of investor participation in the two eastern states is also likely driving demand. Data from the Australian Bureau of Statistics shows investors made up 32 per cent of mortgage demand in NSW, and 26 per cen tn Victoria.

Brisbane (0.1 per cent), and Canberra (1.0 per cent) were the only states to record an increase while Adelaide (0.0 per cent) stayed steady.

“Although markets outside of Sydney and Melbourne aren’t showing the same recovery trend, most areas have either seen a reduction in the rate of decline or are seeing a modest trajectory of growth as low mortgage rates and a slight loosening in credit policy support buyer demand,” Lawless added.

Rents continue to fall

If you’re renting and haven’t asked your landlord for a discount in the last four months, now could be a good time. Nationally, rents trended down 0.1 per cent over September, the fourth month in a row of declines.

Rents have fallen 0.3 per cent over the September quarter, with Sydney down 1.0 per cent, Melbourne down 0.3 per cent, Canberra down 1.1 per cent and Perth down 0.4 per cent.

Mixed bag across Australia

The strong growth in Sydney and Melbourne doesn’t offset the continued downturns in other states, with Perth values falling 0.8 per cent over September, and four of the top five weakest capital city sub-regions all located in Perth.

But the rebound will continue, Lawless added.

“A variety of other indicators outside of our hedonic index are pointing towards further strength in the housing market, including auction clearance rates which are continuing to track around the mid-to-high 70 per cent range, with the results remaining high on larger volumes,” he said.

“The correlation between the auction success rate and housing values is holding true, with the strength in auction markets providing a timely insight into the fit between buyer and seller pricing expectations.”

He said improved housing values could boost consumer attitudes and fuel spending, but said debt levels were also at record highs relative to incomes.

“The sector is vulnerable to a shock or change in household circumstances,” he concluded.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance