RBA cuts interest rates AGAIN, to new record low

The Reserve Bank of Australia has cut interest rates by another 0.25 per cent, following its first cut since August 2016 just last month.

This brings the new cash rate to 1 per cent.

However, while a record low, the decision was not a surprise.

The National Australia Bank had tipped three rate cuts before Christmas 2019, echoing similar predictions from JP Morgan which predicted four rate cuts before Christmas.

And in a speech to the Committee for Economic Development of Australia Reserve Bank governor Philip Lowe himself said that there was room for improvement in the Australian economy.

“It is not unrealistic to expect a further reduction in the cash rate as the Board seeks to wind back spare capacity in the economy and deliver inflation outcomes in line with the medium-term target,” Lowe said.

According to the Finder RBA Cash Rate Survey, 68 per cent of economists and experts predicted the RBA would cut rates in July.

Related story: Australians’ net wealth nearly doubles since 2007

Related story: Sydney and Melbourne property prices rise for first time since 2017

Related story: Is your house your biggest investment? Here’s 5 ways to protect it

Related story: What will the Australian property market look like in 10 years?

“A follow up cut has been foreshadowed as the impacts of a single cut to make real inroads in an economic sense are questionable. But the economy is in a delicate place and the RBA has reinforced the limitations of what can be achieved solely through lowering the cash rate,” Laing + Simmons’ Leanne Pilkington said.

“The economic indicators are not so rosy and the banks haven't fully passed on previous rate cuts so the RBA likely to lower rates either now or in near future,” added the Australian National University’s Alison Booth.

Rate cuts unlikely to stop here

Nearly three quarters of experts surveyed (73 per cent) expect the Reserve Bank will continue cutting until the cash rate hits 0.75 per cent or lower.

However, 32 per cent believe the cash rate will hit 0.50 per cent.

And while the RBA has historically moved in increments of 0.25 per cent, there’s nothing stopping it from making the leap in one go.

“I've argued that larger steps than [25 basis points] would be apposite, but smaller ones convey a less panicky picture to onlookers," Nicholas Gruen of Lateral Economics said.

What do the rate cuts mean for my home loan?

If you have a fixed rate home loan, not a lot.

But if you have a variable home loan, your bank is expected to pass along the cut.

"We do expect the banks to pass on in full to the Australian people the benefits of sustained reductions in their funding costs," Treasurer Josh Frydenberg told reporters in Canberra on Monday.

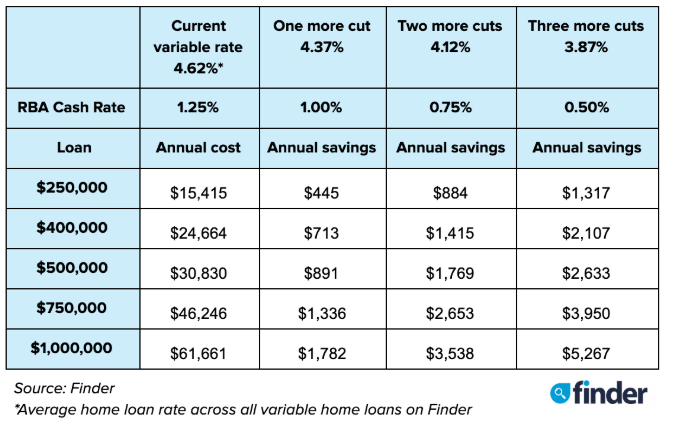

This is what it will look like if the banks do pass along the cut:

Where did the interest rate cut come from?

While Australia’s sustained property value decline is showing some small signs of easing in Sydney and Melbourne, the rest of the economy is not looking so shiny.

The broader property market slid 0.2 per cent in value, bringing the yearly growth to -6.9 per cent, new analysis from CoreLogic revealed.

“The likelihood of an interest rate cut had been rising throughout June, particularly since the weak GDP reading in early June and following RBA Governor Phil Lowe’s speech which indicated that a single 25 basis point cut to rates (which was delivered last month) was unlikely to shift the path that we are on,” CoreLogic research analyst Cameron Kusher said today.

Related story: Penalty rates cut again: Here’s how your paypacket has been affected

Related story: Australia needs ‘fiscal stimulus', but what does that actually mean?

“The decision to cut interest rates is an attempt from the RBA to support the economy; the decision has very little to do with housing market conditions.”

The Australian economy grew 0.4 per cent in the March quarter of 2019, the slowest rate since the end of the GFC in 2009 as weak household consumption weighed on growth.

Unemployment is also stuck at 5.2 per cent and wage growth is stagnant, increasing by just a little over 0.5 per cent in the first quarter of the year.

And for many workers, 1 July actually marked a wage cut as the new financial year began and previously legislated penalty rate cuts came into effect.

Reserve Bank governor Philip Lowe has admitted it will take more than an RBA rate cut to stimulate the economy, calling on the government to fast-track infrastructure spending to shift the unemployment rate.

“As a country, we should also be looking at other ways to get closer to full employment. One option is fiscal policy, including through spending on infrastructure," Lowe said.

"Another is structural policies that support firms expanding, investing, innovating and employing people. Both of these options need to be kept in mind as the various arms of public policy seek to maximise the economic prosperity of the people of Australia."

The Coalition government is currently attempting to persuade crossbenchers and the Labor party to support its controversial package of tax cuts, which it claims will boost the economy.

Labor responds to interest rate cut

Labor MP and former economist Andrew Leigh this afternoon tweeted that the cut was “not a sign of a healthy economy”.

He said the decision should give pause to the Coalition government as it attempts to pass its three stages of tax cuts.

This is not a sign of a healthy economy. As the Grattan Institute has pointed out, why would you now lock in expensive tax cuts for 2024, when we might need fiscal stimulus much sooner? https://t.co/7EsN3SN3iW #auspol #ausecon

— Andrew Leigh (@ALeighMP) July 2, 2019

The first two stages are targeted at low- and middle-income Australians, which Labor supports. However, Labor has held off supporting the third phase which delivers tax relief to high-income earners and has not yet been priced.

"Why would you now lock in expensive tax cuts for 2024, when we might need fiscal stimulus much sooner?"

Dollar, ASX both slump

The Australian dollar has slumped since the RBA announced its decision to cut interest rates.

As of 3:22pm, the Aussie dollar was buying 0.69 US dollars.

[CHART] Aussie dollar slumps as Australian overnight cash rate hits a record low #ausbiz #RBA #cashrate #interestrates pic.twitter.com/fOcCsDF3WT

— CommSec (@CommSec) July 2, 2019

That fall has been echoed by an ASX retreat on late Tuesday afternoon.

[CHART] RBA rate cut euphoria short lived as ASX 200 retreats from session highs weighed down by bank names #ausbiz #RBA pic.twitter.com/O0l4AU9as4

— CommSec (@CommSec) July 2, 2019

Statement by Philip Lowe, governor: Monetary Policy Decision

At its meeting today, the Board decided to lower the cash rate by 25 basis points to 1.00 per cent. This follows a similar reduction at the Board's June meeting. This easing of monetary policy will support employment growth and provide greater confidence that inflation will be consistent with the medium-term target.

The outlook for the global economy remains reasonable. However, the uncertainty generated by the trade and technology disputes is affecting investment and means that the risks to the global economy are tilted to the downside. In most advanced economies, inflation remains subdued, unemployment rates are low and wages growth has picked up. The slowdown in global trade has contributed to slower growth in Asia. In China, the authorities have taken steps to support the economy, while continuing to address risks in the financial system.

Global financial conditions remain accommodative. The persistent downside risks to the global economy combined with subdued inflation have led to expectations of easing of monetary policy by the major central banks. Long-term government bond yields have declined further and are at record lows in a number of countries, including Australia. Bank funding costs in Australia have also declined, with money-market spreads having fully reversed the increases that took place last year. Borrowing rates for both businesses and households are at historically low levels. The Australian dollar is at the low end of its narrow range of recent times.

Over the year to the March quarter, the Australian economy grew at a below-trend 1.8 per cent. Consumption growth has been subdued, weighed down by a protracted period of low income growth and declining housing prices. Increased investment in infrastructure is providing an offset and a pick-up in activity in the resources sector is expected, partly in response to an increase in the prices of Australia's exports. The central scenario for the Australian economy remains reasonable, with growth around trend expected. The main domestic uncertainty continues to be the outlook for consumption, although a pick-up in growth in household disposable income is expected to support spending.

Employment growth has continued to be strong. Labour force participation is at a record level, the vacancy rate remains high and there are reports of skills shortages in some areas. There has, however, been little inroad into the spare capacity in the labour market recently, with the unemployment rate having risen slightly to 5.2 per cent. The strong employment growth over the past year or so has led to a pick-up in wages growth in the private sector, although overall wages growth remains low. A further gradual lift in wages growth is still expected and this would be a welcome development. Taken together, these labour market outcomes suggest that the Australian economy can sustain lower rates of unemployment and underemployment.

Inflation pressures remain subdued across much of the economy. Inflation is still, however, anticipated to pick up, and will be boosted in the June quarter by increases in petrol prices. The central scenario remains for underlying inflation to be around 2 per cent in 2020 and a little higher after that.

Conditions in most housing markets remain soft, although there are some tentative signs that prices are now stabilising in Sydney and Melbourne. Growth in housing credit has also stabilised recently. Demand for credit by investors continues to be subdued and credit conditions, especially for small and medium-sized businesses, remain tight. Mortgage rates are at record lows and there is strong competition for borrowers of high credit quality.

Today's decision to lower the cash rate will help make further inroads into the spare capacity in the economy. It will assist with faster progress in reducing unemployment and achieve more assured progress towards the inflation target. The Board will continue to monitor developments in the labour market closely and adjust monetary policy if needed to support sustainable growth in the economy and the achievement of the inflation target over time.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance