Why you should buy property in a market dip

The worst driver you can have now or any time is the fear of missing out (FOMO).

Instead, I recommend you become a buyer driven by a fear of lucking out (FOLO).

Sure, trying to time a property or stock market is nice but it’s very hard.

Related article: Is Aussie property bouncing back? Here’s where house prices are really headed next

Related article: 31 surprising locations where property values are tipped to rise

Related article: Sydney and Melbourne house prices could rebound as the rate of development in Australia slumps to a six-year low

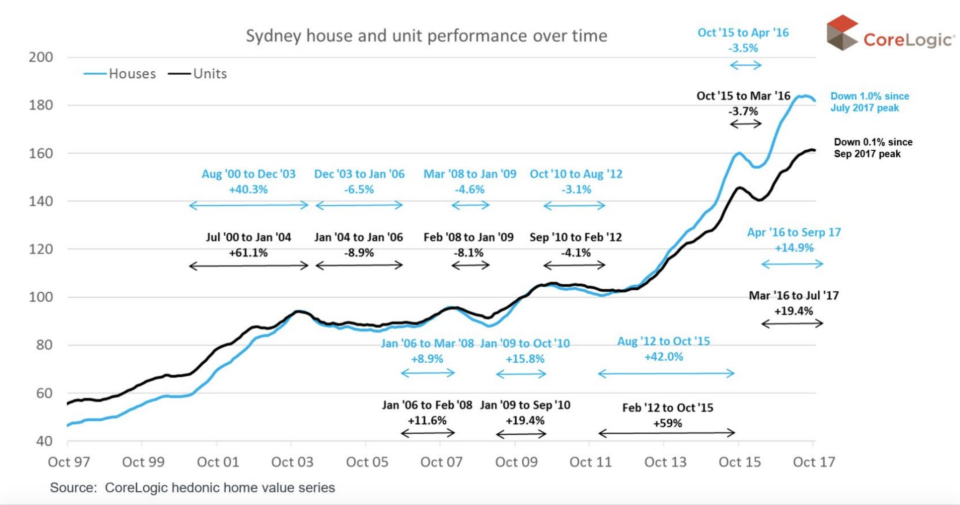

For example, the below chart shows how house prices back in October 2003-2013 went virtually sideways.

So if you had FOMO in 2002, you might have felt sick by 2003 but you weren’t as tummy-troubled as those who bought in Sydney and Melbourne in 2016 and saw the market slump over 2017 and 2018 - Sydney has dropped about 14 per cent since the drop and Melbourne around 11 per cent.

Late buyers in the boom market might have been a little annoyed about giving into FOMO in late 2016 or early 2017.

Buying property: Why buying at the bottom is best

But note how those who bought in 1997 at the bottom and even those who bought in 2001 near the top, would have never looked back.

Time makes property a good bet most of the time but buying in a market dip can be really rewarding.

And remember, you don’t have to rush.

Buying property: Is now the time to buy?

Right now, you’ll read that house price falls are now bottoming out and they might be right.

But there could be another leg down.

How could that happen?

If Donald Trump escalates the trade war, the US rolls into recession and unemployment starts rising in Australia - while I doubt this’ll happen - house prices would fall again.

Buying property: Time to start looking?

If you’re a house buyer, I think it’s a good time to be looking but don’t let FOMO make you irrational.

It is still a buyer’s market and Spring is bound to bring a supply of homes that didn’t sell over 2017 and 2018, which should stop house prices taking off again.

Show up to auctions and open houses but go as a kick-arse, hard-bargaining buyer.

And make sure you get a really good deal.

And remember, the next take off in house prices in Sydney and Melbourne could be a few years away or even longer!

Replace FOMO with FOLO and become a cautious, holding all the aces kind of property buyer.

Yahoo Finance's All Markets Summit will take place in the Shangri-La, Sydney on the 26th September and will bring together some of the best minds in business, government, academia and entrepreneurship to examine the most critical issues facing Australia.

Yahoo Finance

Yahoo Finance