Sydney and Melbourne property prices rise for first time since 2017

Sydney and Melbourne have recorded their first monthly property value increases in almost two years, new figures reveal.

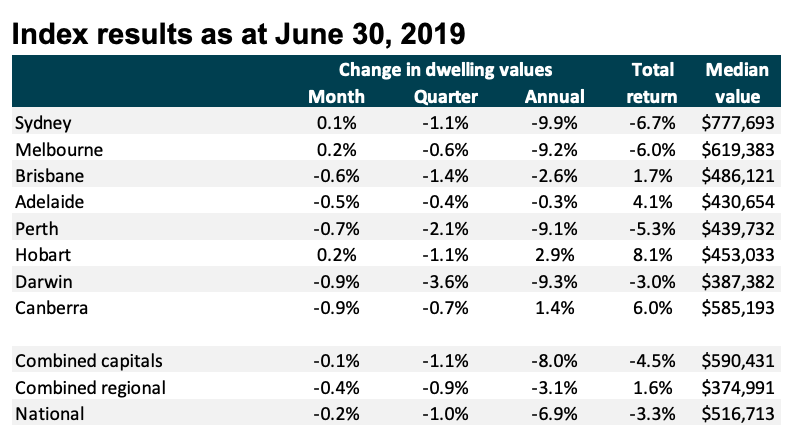

Melbourne dwelling values increased 0.2 per cent in June, the first increase since November 2017, while Sydney prices increased by 0.1 per cent, the first increase since July 2017.

Across the country, property values are still falling, but only by 0.2 per cent - the smallest decline since March 2018.

“The improvement in housing market conditions over the first five months of the year has largely been organic, however since mid-May there has been a raft of announcements that should provide a further positive flow through to housing demand,” CoreLogic head of research Tim Lawless said on Monday.

“Stability within the federal government, along with the removal of uncertainty surrounding changes to negative gearing and capital gains tax discounts, has brought about increased certainty and boosted confidence in the housing market,” he continued.

“Aided by the housing downturn, we have also seen an improvement around housing affordability, although dwelling values remain high relative to household incomes in Sydney and Melbourne. Add to this lower mortgage rates and the high likelihood that interest rate serviceability tests are set to improve.”

Related story: Is your house your biggest investment? Here’s 5 ways to protect it

Related story: What will the Australian property market look like in 10 years?

He said these factors are key to why the housing market is now indicating it will level out.

Additionally, lenders are receiving more enquiries from borrowers while auction rates have steadily improved to now sit above 60 per cent in Sydney and Melbourne through June.

“Overall, it looks like the tide may have turned for the housing market; however we aren’t expecting a rapid recovery phase.”

Talk to me about the other cities

Hobart was the only other city to record a rise in values, up 0.2 per cent, while Brisbane slid 0.6 per cent, Adelaide fell 0.5 per cent, Perth fell 0.7 per cent and Darwin and Canberra both fell 0.9 per cent.

However, despite Sydney and Melbourne’s subtle improvements, both cities’ annual change in dwelling values approached -10 per cent.

Sydney has fallen 9.9 per cent, while Melbourne has fallen 9.2 per cent.

Hobart and Canberra are the only cities to record increases in dwelling values over the year, up 2.9 per cent and 1.4 per cent respectively.

RBA rate decision

The Reserve Bank of Australia will make its rate decision for July tomorrow Tuesday 2 July. Reserve Bank board members have already indicated that Australia is in for more rate cuts.

Two thirds of property experts and economists on Finder’s RBA rate decision panel believe the central bank will pull the trigger again, bringing the official cash rate to a record 1.0 per cent.

“The RBA will have its scissors out for the foreseeable future to try to stimulate inflation and reduce unemployment, and lenders should be ready to follow suit,” Graham Cooke, insights manager at Finder said.

“The heat is on for those banks who only passed on a partial rate cut (less than 25 basis points) after the June rate reduction. Doing the right thing by their customers this time around – by passing on a cut in its entirety – could see them redeem themselves.”

Lawless said the slight improvement in Sydney and Melbourne prices was a sign that lower interest rates were already having an effect.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance