31 surprising locations where property values are tipped to rise

Satellite and regional cities are the winners of Australia’s property decline, new research reveals, with Australians heading out of the major cities and pushing up prices in regional Australia.

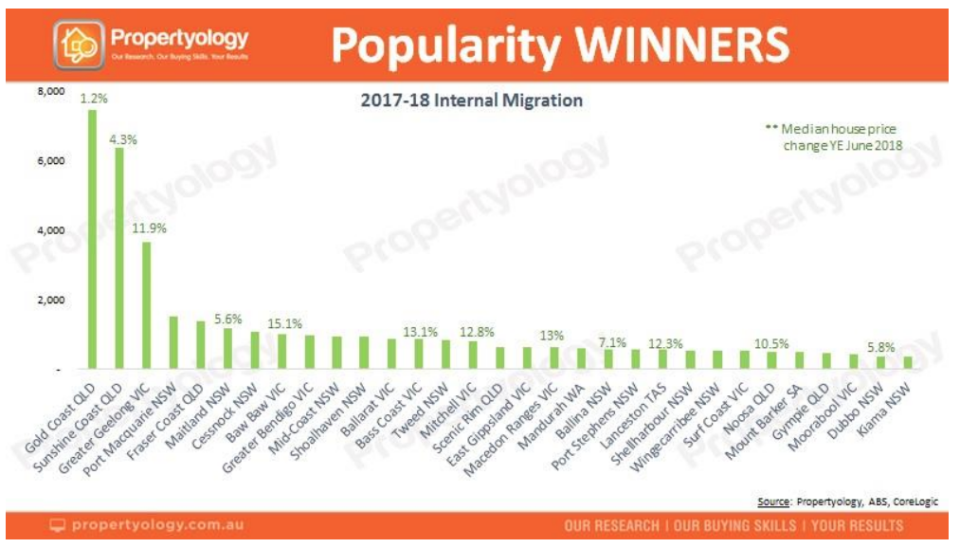

Data from property market research group Propertyology found that regions like Baw Baw and Bass Coast in Victoria have seen prices grow 15.1 per cent and 13.1 per cent respectively in the year ending June 2018, as domestic migration saw the regions’ populations surge.

Related story: Aussie property markets are finally on the move

Related story: The Aussie suburbs where you’re better off buying than renting

The 31 locations where property values will rise

Surging internal migration

“Both of Australia’s two largest cities are currently in the middle of their biggest property market downturns since the late 1980s – this is occurring at a time when both cities produced two consecutive years of all-time record high population growth,” Propertyology head of research Simon Pressley said.

“Yes, we all need to live somewhere, but there’s no law that says one has to buy the roof over their head. In fact, the vast majority of overseas migrants don’t buy for several years, if at all – they rent. This is especially the case in Australia’s most expensive city.”

While the Gold Coast and the Sunshine Coast in Queensland saw the highest surges in popularity, broader analysis shows that satellite cities, or cities on the fringe of capital cities, as well as major regional cities are destinations of choice for Australia’s internal migrants.

And, a steady increase in population is likely to strengthen property prices in these regions, Propertyology said.

While the average Australian might move every seven to 10 years, the decision to relocate to another city is a big one, and needs to be backed-up by solid lifestyle, work and income prospects.

“The population of regional Australia increased by a further 89,132, to sit at a significant 8,424,137 as at 30 June 2018.

More and more people are re-evaluating their need to remain in a capital city and being lured to the many wonders

in other parts of our diverse country,” Pressley said.

“Regional economies are continuing to strengthen with about 60,000 jobs reportedly unable to be filled by locals. The

federal government has recently announced a review into migration policy so that there’s more supply of skilled

labour in regional cities where demand continues to rise. It’s indicative of the strength in regional communities.”

But exercise restraint

Emphasising this point, Pressley said it isn’t the population growth or migration figures that matter the most, but the underlying factors contributing to them.

If the population is growing from sustainable reasons, then it follows that it’s a strong property market.

This is why internal migration is a stronger indicator than international migration, Pressley argued.

He said that while a lot of focus is on Sydney and Melbourne’s population growth, this is largely international.

“It’s not as if the population growth is from existing Australian residents gravitating to those big expensive cities,” he argued.

But, he added, population growth on its own is only a simplistic indicator.

“At the end of the day, buyer behaviour and not population growth is what determines fluctuations in real estate

prices.”

“Buyer behaviour is determined by where people want to live, what they can afford to buy, lifestyle preferences,

where they can get suitable employment, and individual stages of their life,” he said.

“Other factors include local confidence, buyer incentives, and the pursuit of financial independence.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance