Has your bank passed on the RBA’s back-to-back interest rate cut?

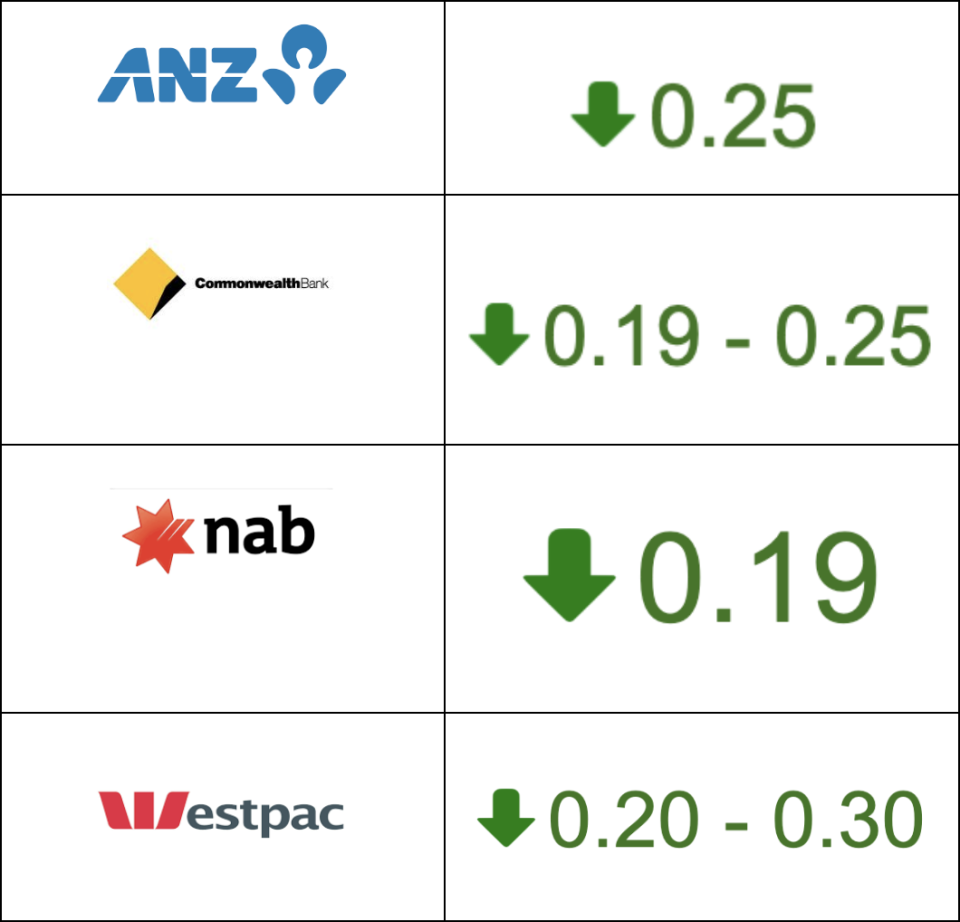

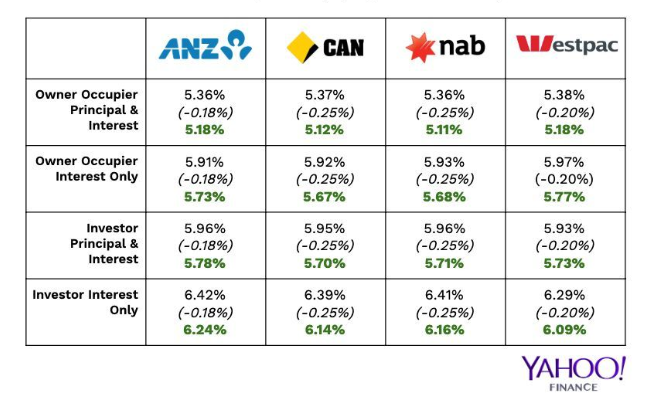

Update: Westpac passes on 0.20 per cent p.a cut for owner occupiers and a reduction of 0.30 per cent p.a. for investors with interest only repayments.

Westpac cuts rates by 0.20 per cent for owner occupiers and 0.30 for investors with interest only repayments.

NAB has passed on a 0.19 per cent rate cut.

CBA has passed on a 0.19 per cent rate cut onto its principal and interest customers, but the full 0.25 per cent to interest only customers.

ANZ bank has passed on the full 25 basis point rate cut, which will be effective Friday 12 July.

Non-bank lender Resimac announced that it will reduce variable rates on its Resimac Prime and Resimac Specialist ranges of mortgages by 0.25 per cent p.a, with rates for new applicants to start from 3.21 per cent p.a.

Athena Home Loans have also passed on the full 25 basis point cut.

The Reserve Bank of Australia announced today yet another interest rate cut of 25 basis points taking it to 1 per cent, after bringing rates to a record low of 1.25 per cent in June.

This means those with variable home loans could see more relief, but only if the banks choose to pass on the cut.

In June, ANZ dropped its rates by 0.18 per cent, while Westpac dropped theirs by 0.20 per cent. The Commonwealth Bank of Australia and NAB passed on the full 0.25 per cent rate cut, as did ING and other smaller banks.

Related article: RBA cuts cash rates AGAIN, to a new record low

Related article: Has your bank passed the RBA interest rate cut on?

Related article: Reserve Bank SLASHES the cash rate to a new record low

So what will these banks do now?

Find out below if your bank passed on the July interest rate cut

Westpac announces rate cut of 0.20 for owner occupied, and 0.30 per cent for investors with interest only payments

“We're reducing variable interest rates for home loan customers, including a reduction of 0.20 per cent p.a for owner occupiers and a reduction of 0.30 per cent p.a. for investors with interest only repayments.”

NAB has passed on a 0.19 per cent rate cut

“This is on top of the 25-basis point reduction last month, which means customers with an average $400,000 loan could save a total of $1296 a year,” ANZ chief customer officer, Mike Baird, said.

CBA passes on 0.19 and 0.25 per cent rate cut

“Commonwealth Bank has responded to the Reserve Bank of Australia’s (RBA) cash rate decision by reducing interest rates for home owners and making a deliberate choice to limit the interest rate reduction on the most popular savings account.”

ANZ passes on full rate cut

ANZ has passed on the full 25 basis point rate cut, unlike last cut where it only passed on a 18 basis point cut.

“Today we have decided we will reduce variable interest rates for our home loan customers by 0.25 per cent pa,” ANZ Group Executive, Australia retail and commercial, Mark Hand said.

“Importantly, we will apply this reduction across all our variable rate home loans.”

Standard Variable Rate Owner Occupiers paying principal and interest this reduces the Index Rate to 4.93 per cent pa, and for Standard Variable Rate Owner Occupiers paying interest only the Index Rate reduces to 5.48 per cent.

After the RBA’s June interest rate cut, this is where variable home loan rates stood

Historically, variable home loan rates have only followed the RBA cash rate with 92 per cent accuracy since 1990, while the average online savings account rate followed the cash rate with 99 per cent accuracy.

This means the banks like to cut your savings rate before they cut your home loan rates.

On top of that, according to Tom Godfrey, head of media and consumer advocate at Mozo, by holding back some of the official interest rate cuts since 2016, the big four banks have pocketed around $3.6 billion in total additional revenue.

“If passed on in full the average variable home loan rate would be 3.87 per cent down from 4.06 per cent last month,” Godfrey said.

“The average monthly saving could be $57 on a $400,000 loan for an owner occupier paying principal and interest, on top of the $58 monthly saving in June.”

My bank hasn’t passed the interest rate cut on, what do I do?

If your bank hasn’t passed on the rate cut, you should consider switching banks.

Realestate.com’s Nerida Consibee told Yahoo Finance in June that if your bank doesn’t follow the RBA’s decision, it would be a good idea to look at other loan providers.

Conisbee, who predicted the RBA would hold this time around, says a cut is something that banks should be passing on in full.

Here’s how to talk your way to cheaper home loan too.

Yahoo Finance will keep you updated once we know which banks have passed on the rate cuts.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance