How to save more cash when savings rates are this low

The Reserve Bank of Australia slashed rates earlier this month to a record low of 0.75 per cent, and while it’s good news for homeowners, it’s bad news for savers.

Dropping the official cash rate by 75 basis points this year alone has meant the interest banks are offering savers has drastically reduced, with some of the most competitive lenders reducing their highest savings rate by as much as 85 basis points.

For some savers, it means losses of more than a thousand dollars.

Also read: RBA flags negative rates, quantitative easing: What this means for you

Also read: The banks offering sub-3% home loan rates

“With a rate of 2.80 per cent per annum, if you deposited $1,000 a month for five years, you’d earn $1,353.92 less in interest, versus a rate of 1.95 per cent per annum,” Finder’s money expert Bessie Hassan told Yahoo Finance.

And if you were to deposit more than $1,000 per month, the difference in interest earner would be even greater.

So how can you beat record-low savings rates?

Investing

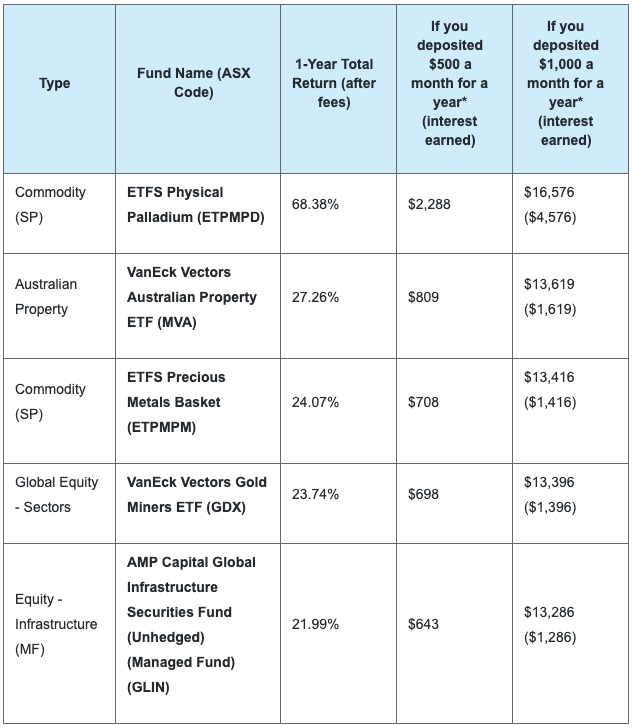

Hassan said the top-returning 1-year exchange-traded fund (ETF) returned more than 68 per cent on investment after fees.

But while there are perks to investing, Hassan said you need to keep in mind that money you use to invest is not guaranteed to grow.

“The biggest difference between an ETF and a savings account is risk,” she said.

“There is more to be gained and lost in the share market and although ETFs are sometimes not as volatile as a share of one company, you can still stand to earn – or lose – a lot.”

Here are the top five highest-performing ETF 1-year ETFs:

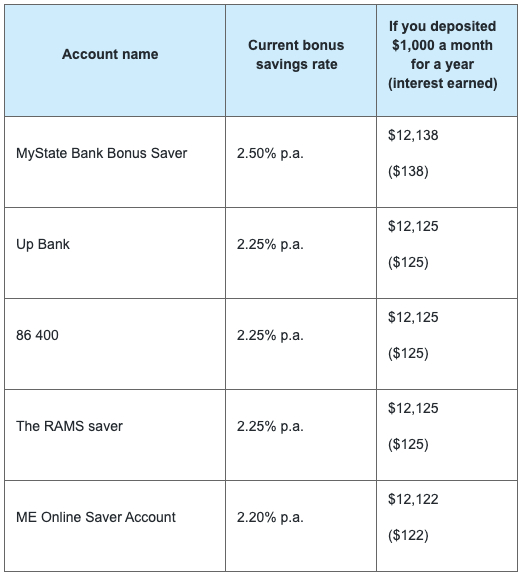

Find an account with a higher savings rate

Despite the cut to the cash rate, Hassan said there are still some accounts offering savers up to 2.50 per cent per annum, which is very competitive in today’s environment.

“Knowing your options and be prepared to switch can save you hundreds of dollars,” she said.

Here are the top five highest savings accounts:

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance