How much do Aussies your age have in savings?

The average Australian has $28,246 in cash savings, with men having $36,531 in back-up funds, and women with a significantly lower $20,368.

Related story: How much should I have in my superannuation by now?

Related story: How much do you need to live comfortably in each Aussie capital?

Related story: How much in savings do I need to buy a house in each capital city?

However, across generations, those differences become even more distinct, new research from Finder has found.

By age

Generation Z: Born in 1995 and after, so up to 24 years old, this age group has an average $10,116.

Generation Y: Born between 1980 and 1994, or aged between 25 and 39, people in this age group have an average $19,752.

Generation X: Born between 1960 and 1979, or aged between 40 and 59, this age group has an average $34,257.

Baby Boomers: Born up until 1959, or aged 60 and older, the average Baby Boomer has $42,043.

By gender

Comparing it by gender, across all age groups men have more in savings than women.

Gen Z men (up to 24 ) $14,304 to

Gen Z women (up to 24 ) $7,748

Gen Y men (25 to 39) $25,314

Gen Y women (25 to 39) have $15,382

Gen X men (40 to 59) $42,004

Gen X women (40 to 59) $25,779

Baby Boomer men (60 +) $49,240

Baby Boomer women (60+) $32,183

“Women are still likely to be primary carers, and take parental leave and/or leave to look after older family members,” money specialist at Finder Sophie Walsh told Yahoo Finance.

“This has a knock-on effect on income and therefore savings.”

Additionally, women earn 14 per cent less than men across the workforce as a whole, also contributing to a disparity in savings.

There’s so many reasons why #TheGapMatters. Here’s just one: women retire with about 40% less superannuation than men. Share with us why 14% matters to you. #EqualPayDay

— WGEA (@WGEAgency) August 28, 2019

According to research published by the government’s Workplace Gender Equality Agency, “factors that relate to the gendered impact of children and family”, including years away from paid work, part-time work and unpaid care together account for 39 per cent of the gender pay gap.

Savings differ across locations

Average savings also differ across location, with those in metro areas tending to have more ($31,489) than Australians living in regional areas ($19,470).

Australians living in the Australian Capital Territory also have the most in savings ($43,374), compared to those in South Australia who generally have the least ($19,275).

How many Australians are on the same income as me?

Your income can have a direct impact on how much you have in savings.

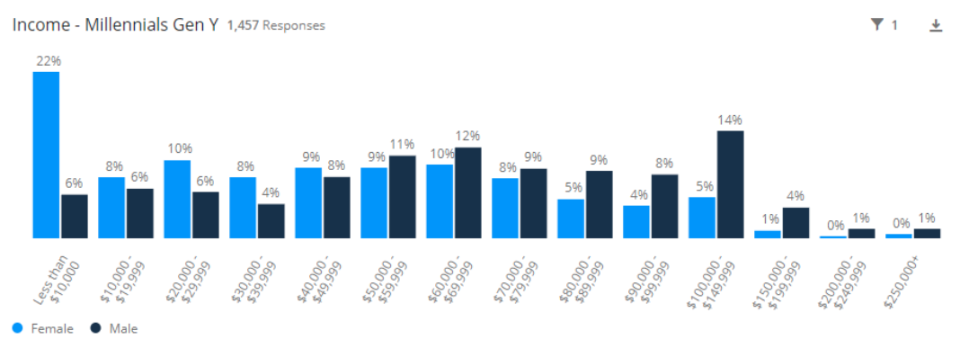

Across Gen Y, women are higher represented in the lower income brackets (less than $10,000 - $49,999), with men higher represented across the highest salary bans - only 1 per cent of women earn in the $150,000-$199,999 bracket, compared to 4 per cent of men.

And 22 per cent of women in this age bracket earn less than $10,000, compared to 6 per cent of men.

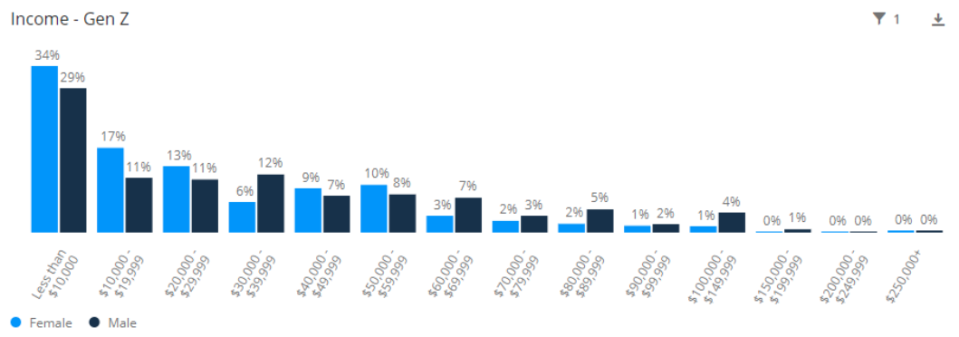

It’s a slightly different story for younger Gen Z, with 34 per cent of women taking home less than $10,000, compared to 29 per cent of men.

But women are still represented more highly in lower bands than their male counterparts.

“Whether you make $20,000 a year or $20,000 a month, the best way to protect yourself and your family is building your savings,” Walsh said.

“Regularly contributing to an emergency or rainy day account can provide you with peace of mind if you end up without an income.

“Choose a high-interest rate account and have part of your pay sent to it each month so you won’t be tempted to spend it. Even having a basic level of income protection insurance can be a good safety net if something goes wrong.”

Savings rates drop after interest rate decisions

The Reserve Bank of Australia yesterday issued what has been described as a “death knell for savers” by cutting the interest rate by another 0.25 per cent, bringing it down to a record low of 0.75 per cent.

According to financial comparison site, that cut sees the average interest rate for savings accounts plummet to 0.90 per cent, significantly below 1.60 per cent inflation.

“While RBA cuts are welcome news for homeowners, they’re a terrifying prospect for the nation’s savers,” said Mozo director Kirsty Lamont.

While ANZ and Westpac have not yet made an announcement about the rate cut, but neither NAB nor the Commonwealth Bank passed on the full 25 basis point cut to home loan interest rates, citing a need to keep savings interest rates above water.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance