The banks offering sub-3% home loan rates

There are now a range of home loans out there with a bargain interest rate of less than 3 per cent, but there's an unfortunate catch.

The Reserve Bank's rate cuts in June, July and this month have incentivised many financial institutions to cut their mortgage rates to unprecedented lows. But only for new customers, according to comparison site InfoChoice.com.au.

Loyalty is dead, said InfoChoice chief Vadim Taube.

"When lenders announce rate cuts for fixed rate loans, they only apply to new customers. Existing customers continue to pay the fixed rate that applied at the beginning of the loan."

Out of the big four, ANZ (2.98 per cent), NAB (2.98 per cent) and Commonwealth (2.99 per cent) now have fixed owner-occupied home loans below the 3 per cent barrier.

Some smaller lenders have gone even further, like ING, which this week started offering 2.89 per cent.

According to the InfoChoice database, there are 44 fixed-rate products on two-year terms with rates under 3 per cent. Fior three-year terms, there are 48 products.

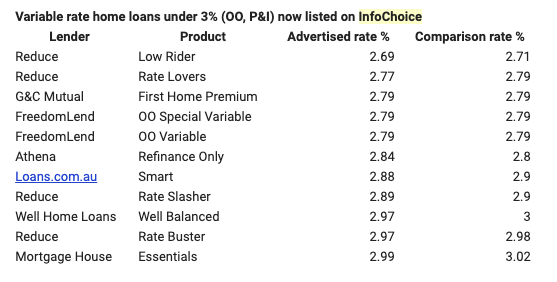

There are even 11 owner-occupied variable rate mortgages with interest rates under the magic 3 per cent threshold:

Such low fixed-rate home loans suggest financial firms expect the Reserve Bank to cut rates even further in the future.

"Banks are apparently expecting the RBA to keep rates low well into 2021 and 2022 and that’s why they are setting two and three-year fixed rates at these very low levels," said Taube.

"Borrowers need to factor this into their calculations. If rates change, a fixed rate will stay the same until the end of the term."

Federal treasurer Josh Frydenberg, like many of his predecessors, has urged unhappy mortgage holders to switch to another provider for a cheaper loan.

And Taube agrees.

"Borrowers who don’t like their rate are entitled to ask for a better deal and move to a better offer if they don’t get a good deal."

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance