Cheapest home loans: Here’s who’s winning the Aussie interest-rate war

After two back-to-back cash rate cuts in June and July, bringing the national interest rate to an historic low of 1 per cent, Australia is waiting to see what the Reserve Bank of Australia will do next.

The two rate cuts prompted the big four banks to cut their rates in turn, with ANZ, NAB, CBA and Westpac passing on the cuts to varying degrees.

Related story: Has your bank passed on the RBA’s back-to-back interest rate cut?

Related story: RBA cuts cash rates AGAIN, to a new record low

Related story: 4 cheapest Aussie home loans this month, according to Barefoot Investor

But as the home loan interest rate war heats up, there are other smaller, lesser-known institutions which now offer a better deal than the Big Four banks.

Am I on a good deal?

According to financial educator and adviser Nicole Pedersen-McKinnon, as reported in SMH, if your home loan rates starts with ‘3’, you’re on a decent deal.

If you’re on a ‘4’, you could be paying more than you need to – and basically no one should be on a home loan rate that starts with ‘5’ after those rate cuts.

Cheapest home loan revealed

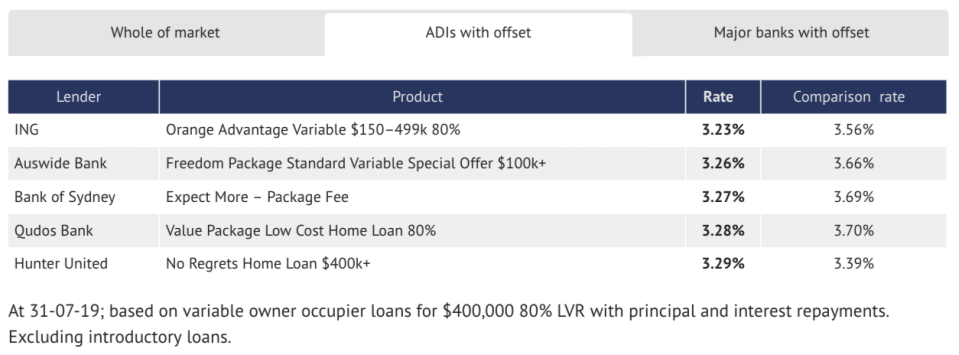

According to Canstar data, these are the five cheapest home loans among all authorised deposit-taking institutions (ADIs):

When comparing comparison rates - which includes fees, charges and the interest rate - Hunter United has the lowest-cost offer at just 3.39 per cent.

This is followed by ING, Auswide Bank, Bank of Sydney, and lastly Qudos Bank, which has a comparison rate of 3.70 per cent.

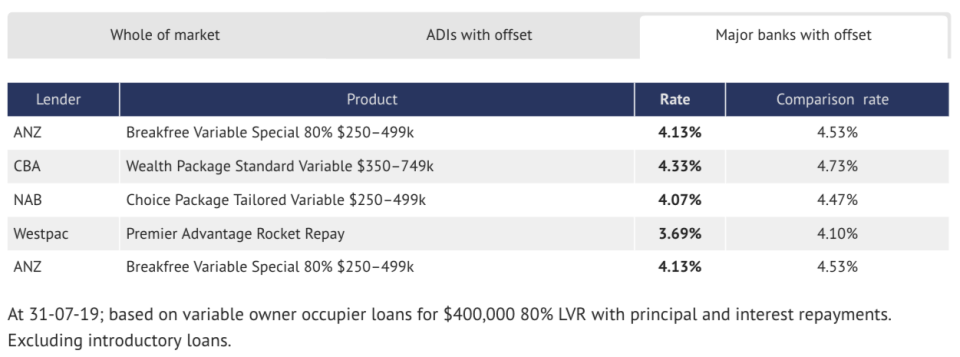

Compared to mortgage rates by the major banks, these rates are significantly cheaper than the lowest comparison rate among the Big Four – which is Westpac with a 4.10 per cent comparison rate – as shown in the table below.

How much would the cheaper options save me?

If you have a Commonwealth Bank home loan, with a new comparison rate of 4.73 per cent and you decide to switch to ING’s Orange Advantage Variable Loan at 3.56 per cent, you stand to save thousands, Pedersen-McKinnon said.

According to ABS figures, Australians with an average $384,700 mortgage would save $251 per month, or $3,012 per year if they made the switch, she pointed out.

Refinancing? Here’s what to look out for

If you’re simply looking to refinance, Athena Home Loans is offering a comparison rate of 3.05 per cent, according to Finder data.

But financial adviser Nicole Pedersen-McKinnon warns that you need to just avoid making the mistake of taking the loan over a fresh wave of 25 years.

“This cuts monthly repayments further… But it means that overall, your interest bill rises.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance