What would a global recession in 2020 look like?

A global recession in 2020 wouldn’t hit hard, but it would be a long, tough slog back to recovery.

That’s according to Oxford Economics economist John Payne, who said in a note that if a world-wide recession occurred this year it would more resemble the dot-com bubble of 2000 than the global financial crisis of 2008.

Related story: 5 charts on the global economy and markets to watch this year

Related story: The Australian and global investment outlook for 2020: What to expect

Related story: Australia is NOT heading for recession: Here are 9 reasons why

So while it seems unlikely the world will fall into recession any time soon, what would it look like if we did tumble into a significant economic downturn?

No recession in sight – but the risks can’t be ignored

Economic experts predict that economic growth will pick up modestly in 2020, though there some key issues that could weigh down recovery – trade tensions, for instance.

“Although the risks of recession have receded, they can’t be discounted,” said Payne. In September 2019, Oxford Economics modelling calculated a 30 per cent probability of a recession, but this has now dropped slightly to 25 per cent.

“Industry, world trade, and sentiment indicators have shown tentative signs of bottoming out, while the US and China have agreed to roll back some tariffs,” he said.

If a recession happened, what would it look like?

According to Payne, the downturn would feel more like the dot-com tech bubble at the turn of the millennium rather than a GFC-like crash for two reasons: firstly, eight out of 12 large economies have asset prices that don’t deviate away from fair value as much as they did before the GFC.

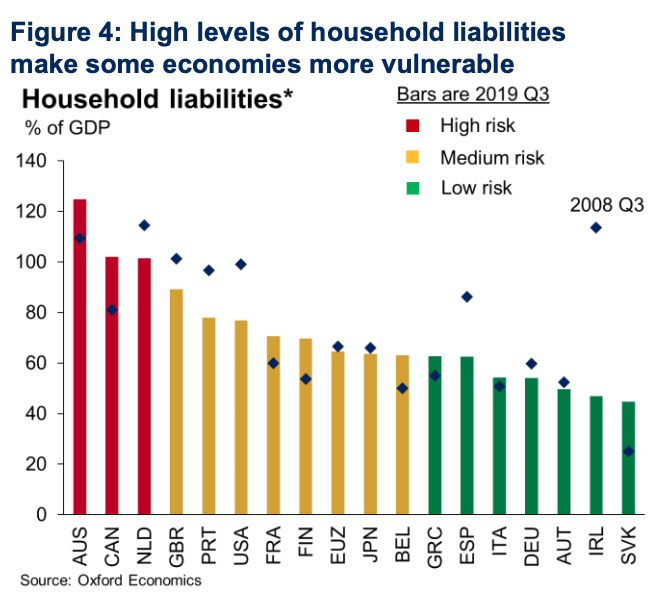

Secondly, consumers will be more resilient in the short-term, with only three of 18 advanced economies having household debts that exceed total GDP.

“In our global recession scenario, world GDP growth slows to just 1.3% in 2020 and 1.6% in 2021,” Payne said.

“The worst affected would be open economies, depressed by weak external demand for commodities and manufactured goods.” Australia’s economy was ranked as most at risk, due to the high level of household debt.

Emerging markets would also be badly hit as their currencies would depreciate sharply and force central banks to raise interest rates.

What could be done?

According to Payne, the US Federal Reserve would be the only major central bank that could provide conventional policy stimulus – other banks, like Australia’s Reserve Bank, have already cut too much and don’t have much further room to move.

“Fiscal stimulus is the obvious tool to combat the ongoing slowdown and a global recession,” the economist said. Fiscal stimulus involves increasing government consumption or lowering taxes.

“It would likely spur an initial boost to activity from increased discretionary spending. Governments in advanced economies would look to take advantage of ultra-cheap, long-dated debt and kick-start large public investment programmes.”

And this time round, we can’t bank on China to bail us out, added Payne.

“In previous downturns, China has injected large amounts of stimulus that spills over to the rest of the world.

“However, we believe Chinese policymakers’ are more prepared to tolerate slower growth and will be reluctant to boost credit growth to contain financial risks,” he said.

Could we use negative rates or quantitative easing? We could, but according to Payne, “these are likely to prove ineffective in boosting demand significantly.”

What will recovery look like?

It will be slow – Payne estimates it will take about three years for global GDP to rise 2 percentage points above the trough. This is a year longer than the dot-com bust of 2000, and about two years longer than the recovery following the GFC, which took less than 12 months.

And when the dust has settled, global GDP growth will be lower than previous recessions, settling at around 3 per cent annual growth within four years of the downturn.

“This is much lower than previous recoveries that typically reached 4%-5% growth. This reflects lower global trend growth as a result of secular stagnation,” said Payne.

Australia could create its own recession

However, the Australia Institute Centre for Future Work director and economist Jim Stanford said he was more concerned about Australia being at risk of a man-made recession than being caught up in a global slowdown.

“Our economy is already standing on the verge of a recession, for purely self-inflicted reasons,” he told Yahoo Finance, citing stagnant wage growth and consumer spending at its weakest levels since the GFC.

“With Australians horrified by images of wildfires, mass evacuations, and poisonous smoke conditions, consumer spending will contract significantly in the March quarter,” he said.

Retailers are buckling under the pressure, he added, and business capital investment is continuing to dry up.

“The negative fallout of the bushfires, on top of a weak economy that was already barely growing at all, could certainly push Australia into a home-made recession,” Stanford said.

“I would not be surprised if Australia’s GDP is already shrinking. Without urgent measures by the government to boost spending, lift wages, and restore confidence in fire-affected regions, that could turn into a full-fledged recession.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance