The Australian and global investment outlook for 2020: What to expect

The Australian share market performed higher than expected this year, all things considered, and global markets calmed down from recession fears after the US Federal Reserve’s three rate cuts took effect – though the US-China trade war were a volatile variable.

But, as the close of one year hails the arrival of a new one, can Aussie investors expect to see the same good numbers again?

Related story: What could rock Australia’s economy in 2020: Josh Frydenberg

Related story: Where is the ASX and Australia’s economy headed next?

Related story: ‘Absolutely no surprise’: Leading economist brushes off economic growth downgrade

Straight from the horse’s mouth, here are the experts’ views on what investment markets will hold for us next year, whether you’re invested in Aussie stocks or global shares, and what we need to keep an eye on:

‘Expect a soft landing for global growth’: The macro overview

Investors need to look beyond the noise and avoid getting caught up in temporary swings in sentiment. Trade tensions, Brexit, late-cycle market dynamics, upcoming US elections, as well as the impact of China’s slowdown on the domestic economy and much more demand our attention as investors. Now is the time to put these forces into context with the fundamentals that will drive market performance over the next year.

We believe that the global economic recovery will continue in 2020, although it may have to sidestep substantial risks to sustain momentum. Those risks notwithstanding, renewed global monetary policy support, domestic fiscal spending and resilience in consumer spending and services should help to propel the cycle forward. We expect world real gross domestic product (GDP) growth to improve modestly in 2020 aided by an expected pickup in Australian GDP in 2020 compared to 2019. This view rests on an assumption of easing trade tensions; we are closely monitoring developments.

The disparities in global GDP growth will be:

US economic outperformance will continue, although the outperformance gap between the US and other regions may start to shrink.

Europe continues to lag due to cyclical and structural problems, but a catalyst could trigger improvement, especially in the second half of 2020.

Australian economic performance is expected to see improvement through 2020 as headwinds from trade fade, the housing market stabilises and the government embarks on renewed fiscal spending.

Emerging markets (EM) will be critical contributors to global growth; that said, we expect economic performance in emerging markets to be highly variable. At the sector level, relative strength in services will partly offset relative weakness in manufacturing. Consumer spending will partly offset a slowdown in business investment.

But the risks to our outlook are not confined to the downside. Upside risks include the possibility that slowing growth could motivate fiscal stimulus in major economies.

Five major areas of uncertainty we’re watching in the year ahead

Geopolitics: What will be the outcome with respect to Brexit, trade tensions, Iran, US impeachment proceedings and more?

Economic resilience: Can consumers sustain strong spending without resolution of trade tensions and a turnaround in manufacturing?

Policy: Will the policy response extend beyond monetary intervention to include fiscal stimulus?

Structural reform: Will the pace of reform pick up in emerging markets and in Europe?

Elections: How will the outcome of 2020 elections in the US and elsewhere affect trade, policy and more?

What investors need to know

As important as it will be to track these critical areas of uncertainty, we also believe it’s critical for investors to consider world-changing forces that pose substantial portfolio risk, which a one-year outlook may not capture. Climate change is one of these forces. As we look to 2020 and beyond, we believe that regulatory pressure and carbon pricing initiatives are likely to accelerate, impacting asset valuations and capital allocations. This, in turn, will motivate investors to consider and take steps to manage the climate risk embedded in their portfolios and evaluate the investment opportunities that a changing climate-risk landscape will provide.

–Raf Chowdhury, Senior Investment Strategist, Investment Solutions Group, State Street Global Advisors

‘Not looking too bad’: Australian market outlook for 2020

The year 2019 has been a remarkable one for Australian equities. In fact, it has been the best year for the asset class since 2009, with the S&P ASX 200 delivering 26.1 per cent in local currency terms up to November 30. This is a much stronger return than we expected at the start of the year, and is also despite earnings growth trending downwards over the year from around 5-6 per cent to 2 per cent currently.

This impressive return despite deteriorating economic conditions shows that the market has rerated, supported by two key factors: the global easing of monetary policy, with interest rates being cut by central banks around the world, including the RBA and the US Fed, and reduced tail risks from the trade war after China and the U.S. agreed to resume talks in June.

Looking out to 2020, the good news is that we believe the domestic economy will improve from where we currently sit. And while investors shouldn’t be expecting equity market returns similar to 2019, and the economy is only growing around 1.7 per cent year-on-year, Q3 2019, the lowest rate since the GFC, we think a number of significant factors will help support a solid year ahead for returns.

Firstly, the Reserve Bank of Australia (RBA) kept its powder dry until the conclusion of the Federal election in May. It then responded decisively to the weakening domestic economy by cutting interest rates three times, pushing the official cash rate down to a record low of 0.75 per cent in October. Our expectation is that there will be one more 25 basis point rate cut from the RBA, with 50 basis points likely to be the effective floor for the cash rate.

We expect an improvement in global growth and trade. This view is partly based on an expected trade war truce between the U.S. and China, but also on a positive inventory restocking cycle which appears to be emerging. We are already seeing PMI indices in a number of countries starting to improve. While there are still a number of external risks and uncertainties, the backdrop for the global economy looks brighter in 2020 than last year.

We believe the RBA does not want to see a strong Australian dollar (AUD). This is because Australia’s major commodity exports such as iron ore and coal are priced in US dollars and a lower Australian dollar would also support domestic growth as well as putting upward pressure on inflation. While a stronger global economy would support the AUD we do not expect a dramatic currency move and a reasonable trading range for the USD/AUD in 2020 might be 65 to 75.

There are already signs that RBA rate cuts are starting to gain traction and stimulate the economy. The benefit of lower interest rates is most visible in Australia’s housing sector, which had until recently been in mild recession. Auction clearance rates in Sydney and Melbourne have nearly doubled, while home prices have risen by 5 to 10 per cent, depending on which region.

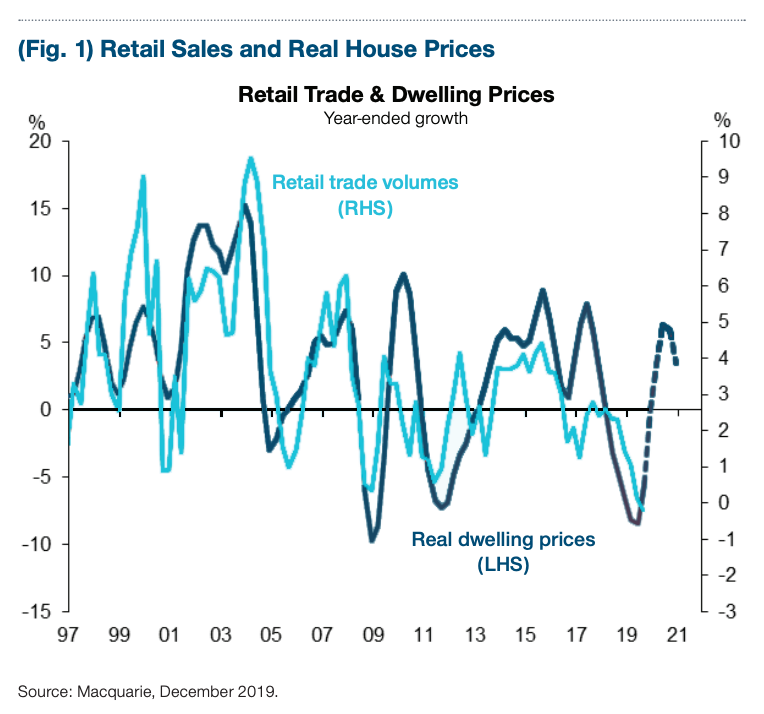

Australia’s housing correction has turned out to have been a mild one. While house prices in Australia still look expensive versus history and the household sector still appears to be highly leveraged, mortgage rates are at record lows. Besides residential investment, a recovery in housing is also important for the outlook for consumer spending. There tends to be a strong wealth effect in Australia from residential property to consumer demand, operating with a lag of about six to twelve months. As long as the improving trends in housing continue, we should start to see a positive impact on consumer spending by the middle of 2020.

Also read: A look back at house prices over the decade

Also read: Here’s where Australian property prices are going in 2020

Besides rate cuts from the RBA, we also expect to see a more expansionary fiscal policy from the government that will support growth in 2020. We have already seen tax rebates in July and a A$4 billion infrastructure package announced in November. We expect more to come, since Australia has strong public sector finances which allows the Coalition government to do more to support a sluggish economy.

We believe there is greater political advantage for the government from fiscal easing than from maintaining a conservative stance in order to post a large public sector financial surplus in FY19/20. The government surplus in FY19/20 on current budget projections could be as much as $10-15 billion, thanks in part to a budget assumption for the price of iron ore that now looks far too conservative. Additionally, the weaker AUD will further support budget tax receipts.

We see a stronger economy as benefiting some domestic cyclical stocks such as retailers that have been out of favour with investors. This is one area where our investment views are somewhat contrarian. We see the retail sector as being well-positioned to benefit from any additional economic strength, and there are already early signs that the better quality domestic discretionary and home improvement retailers are already benefiting from this dynamic. A more positive view relative to our peers on Australian domestic cyclicals is reflected in our holdings of stocks such as JB HiFi and Wesfarmers.

Housing and building materials stocks are likely to play a game of catch-up, but it will take time. Although building approvals continue to decline, there are signs they are stabilising, albeit there will likely be a lag of 12 to 18 months before residential housing activity begins to rise in a material way. We believe companies that service the housing sector and which are exposed to improving transaction levels as opposed to construction activity, such as REA, should benefit earlier.

Elsewhere, we think investors should be more cautious towards healthcare stocks after the sector outperformed so strongly in 2019. From having been a big overweight earlier in 2019 we are now underweight the sector with valuations pushing to all time highs for many stocks. We stay positive on our holdings leveraged to areas of strength in the global economy, such as James Hardie (US housing market), Treasury Wines (China consumer) and Aristocrat (US slot market).

Overall, we expect the Australian share market to deliver solid total returns next year. With the dividend yield for the ASX 200 around four percent, total returns of 6 to 8 percent for 2020 seem reasonable. Supporting a positive outlook, we think investors may become less risk averse if US-China trade discussions reach a positive conclusion and the domestic economy strengthens, which should help equity markets in 2020.

–Randal Jenneke, Head of Australian Equities, T. Rowe Price

‘Earnings returning’: A look at global stocks in 2020

Equity markets rebounded in 2019 once an uncomfortable period of Fed tightening and slower earnings growth passed. Despite a mid-year escalation in the trade war and European political upheaval, the Federal Reserve’s policy U-turn – cutting rates three times and resuming balance sheet expansion – helped calm recession fears.

While the industrial sector has gone into recession, its diminished importance to overall GDP and the continued resilience of the US consumer means we expect a soft landing for the global economy in 2020. Earnings are likely to bottom out and then recover: after a flat year in 2019, earnings growth is projected to be around 8 per cent in 2020.

Income hunt to drive return to equities

Markets are beginning to reflect this potential improvement. Any signs of over-exuberance, however, could make us more cautious. Amid all the political noise, we remain focussed on earnings as they account for the majority of stock price movement over the medium term and 80-90 per cent of price movement over a decade. Of course, you have to pay attention to interest rates and fund flows too. We expect interest rates to remain low, and perhaps go even lower. Given sizeable outflows from equities in 2019, we expect a recovery in 2020 precisely because interest rates will stay low and investors starved of income will be attracted by returns.

Value comeback possible, but financials remain constrained

Nonetheless, we remain wary of the increasing Japanification of major economies. Keeping rates very low for a long period leads to low economic growth and volatility. The latter prevents defaults rising in the short term, but over the long term increases the number of zombie companies kept alive by cheap credit rather than by solid earnings growth. To avoid these value traps, we maintain a quality bias with a preference for companies with strong balance sheets. If, however, growth begins to recover in 2020, there could be a shift back to the value and cyclical stocks that have previously been overlooked.

Banks are the exception. The pricing of their raw material – namely interest rates – will remain extremely low and perhaps go even more negative. In my view, there is no such thing as a negative rate. In fact, it is a levy on banks and savers such as pension funds. Negative rates introduce a kind of insidious default on assets. Ordinarily, central banks try to inflate away unsustainable debt levels after a financial crisis, but this time - despite ultra-low rates and quantitative easing - they have failed.

Motto for 2020 is: It’s Mostly Fiscal (‘IMF’)

As central banks run out of ammunition to stimulate growth, we expect attention to shift to fiscal policy. My motto for 2020 would be: it’s mostly fiscal (or ‘IMF’, in tribute to the International Monetary Fund former head Christine Lagarde who has called for fiscal expansion).

We are probably underestimating the fiscal room for manoeuvre in China and the US, while central bankers in Japan and Europe are both telling their states to spend more. US and Japan could benefit the most from any switch in spending towards new industries such as electric cars and robotics, while more traditional German industries risk being left behind.

US industrial and consumer strength diverges

Another first is that the US consumer sector has been flourishing even as the country’s industrial companies suffer a recession, posting declines similar to those in 2008. Usually, consumer and manufacturing areas move in concert. But despite the trade war, the US consumer remains strong, supported by monetary and fiscal policy. US citizens are taking advantage of lower rates to refinance their mortgages.

Meanwhile, industrials now account for a much smaller part of the economy than they did 10 years ago, so their weakness has less impact. We therefore anticipate a soft landing at the GDP level in 2020, with perhaps not even a single quarter of negative growth. The same is true for the European consumer, who is also holding up relatively well, despite the low-growth environment and German industrial weakness.

Chinese property is a risk

We continue to monitor headline risks such as the trade conflict, Brexit fallout, Italian debt and US electoral uncertainty. However, we focus more on the risks we can’t fully price yet, such as where the borrowing limit is in a state-run economy like China. The total debt to GDP figure in China is questionable because it depends on how you aggregate national, corporate and financial debt.

But, roughly speaking, total-debt-to-GDP in China has grown substantially over the last decade from 140 per cent to around 300 per cent, while high debt-to-GDP levels in economies such as the US and Japan have risen only slightly in comparison.

The property market is also a concern. China, along with Canada and Australia, avoided the worst of the debt-driven financial crisis a decade ago, but each has since experienced a property bubble. Informal estimates suggest that around 50m flats in China are empty, with investors banking more on further capital growth than rental income. (Real estate accounts for a fifth of China’s GDP).

But pinpointing when the bubble may burst is difficult. Prices have declined twice over the last five years in China without prompting a formal property recession. In Canada and Australia, price declines are already visible.

To sum up

We expect a modest improvement for equities in 2020 as earnings bottom out and start to pick up, aided by dovish policy in the US, Europe and China and a still strong consumer. As monetary policy runs out of road, however, and negative rates start to penalise bondholders, fiscal stimulus will be needed to boost growth.

–Romain Boscher, Global CIO, Equities, Fidelity International

What else to watch out for

Factors to watch in the year ahead include trade tensions and their impact, the resilience (or lack thereof) of US labour markets, the evolving global technology ecosystem, and US politics.

While these are undoubtedly important events, we believe investors tend to overestimate the importance of Presidential changes to the overall trajectory of the US economy. Furthermore, it is easy to overestimate the likelihood of large policy changes.

Tech sector risks

Technology firms are increasingly finding themselves caught in policymakers’ crosshairs, with concerns over data privacy, global taxation, market power, content moderation and the role of social media in politics.

As a result, we expect the operating environment for technology companies to be much less certain going forward than in the past.

–Ronald Temple, Co-Head of Multi-Asset and Head of US Equity, Lazard Asset Management

Note: Some quotes have been edited for the sake of brevity.

Yahoo Finance

Yahoo Finance