5 charts on the global economy and markets to watch this year

The ASX is off to a stunning start in 2020, surging past 7,000 points for the first time – but when it comes to the global stock market, experts – while ‘cautiously optimistic’ – aren’t expecting to see the same numbers going into the new year.

In an environment heavily weighed down by geopolitical tensions, there are some key indicators which show how the global market and economy is moving.

“A combination of improving global growth boosting profits and still easy monetary conditions will help drive reasonable investment returns, albeit more modest than the very strong gains of 2019,” said AMP Capital chief economist Shane Oliver.

These are the key charts to keep an eye on this year:

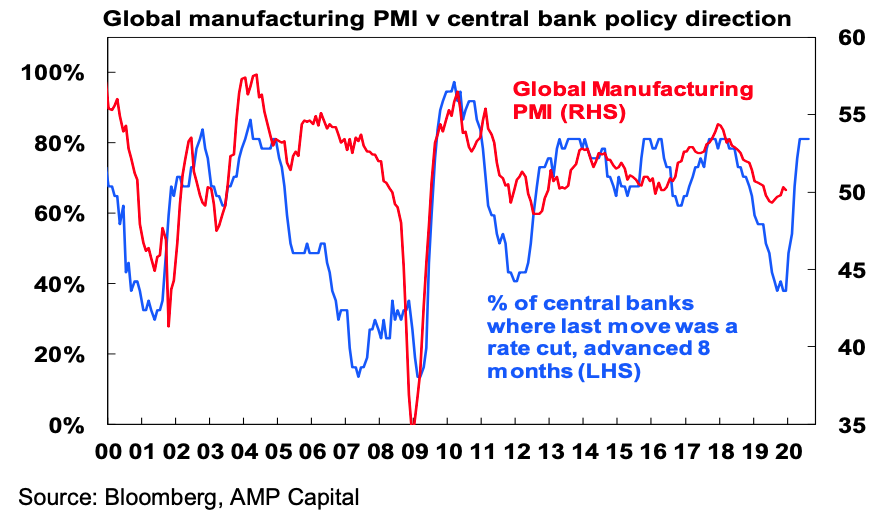

1. Global business conditions

Global Purchasing Managers Indexes (PMIs), which are surveys of purchasing managers at businesses in most major countries, are a great guide and indicator of the state of the global economy, according to Oliver.

What to look out for: Service sector PMIs were lower in 2018 and until mid-2019, but they’ve shown signs of improvement since then thanks to lower interest rates and quantitative easing.

“Going forward they will need to improve further to be consistent with our view that growth will pick up this year,” said Oliver.

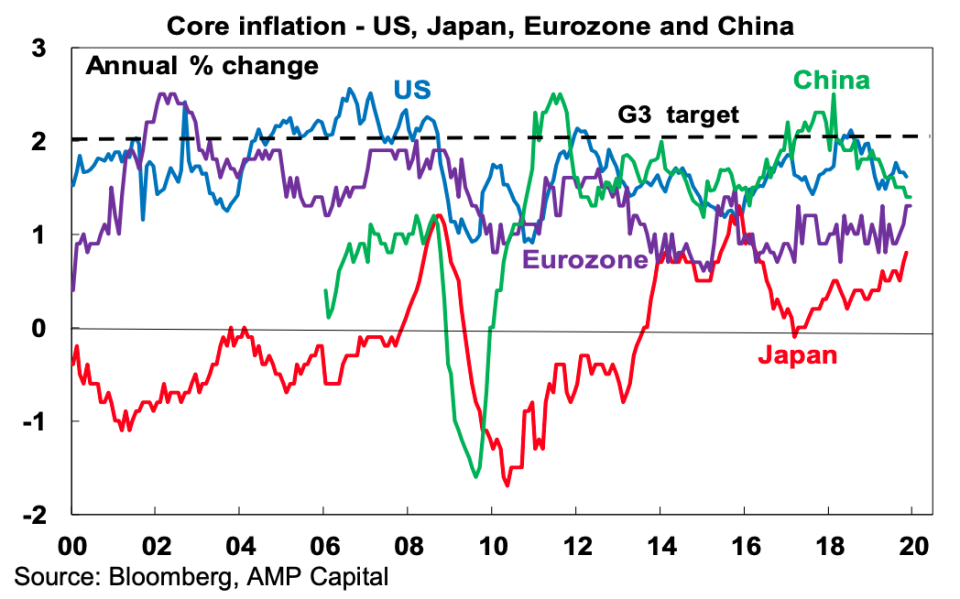

2. Global inflation

Inflation tends to rise before major economic downturns. It’s not something to worry about just yet, though.

“At present, core inflation - ie inflation excluding the volatile items of food and energy - in major global economies remains benign,” Oliver said.

What to look out for: A big spike. “A clear upswing in core inflation would be a warning sign that spare capacity has been used up, that monetary easing has gone too far, and that the next move will be aggressive monetary tightening. But at present we are a long way from that.”

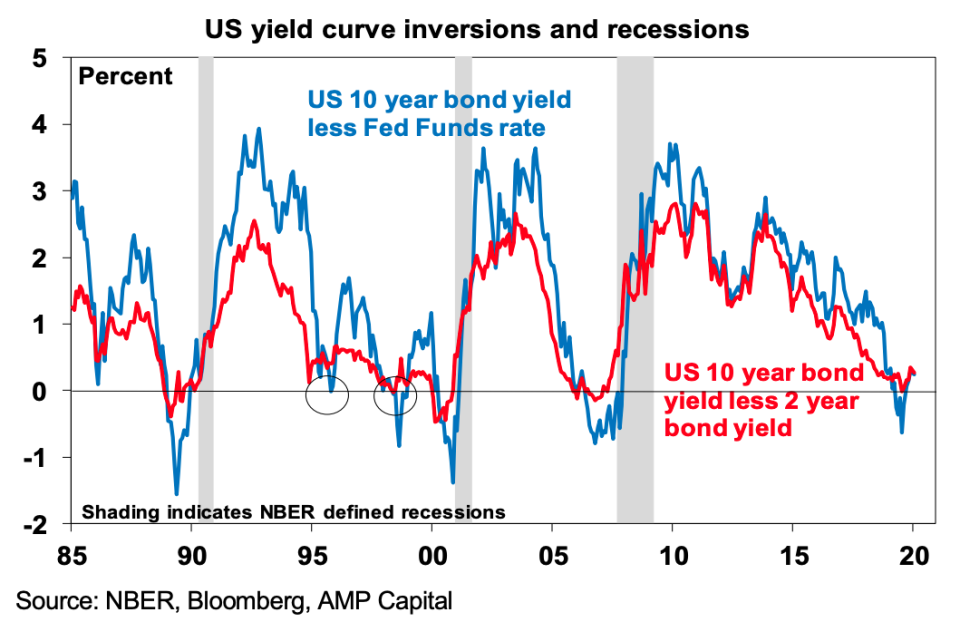

3. The US yield curve

The US yield curve made headlines last year after it inverted in March. The curve plots the interest rates paid on US Treasury bonds of different maturities. When short-term interest rates cost more than long-term interest rates, it’s generally bad news for the economy.

As a traditional indicator of a recession, pundits were thrown into a frenzy about whether or not a significant downturn was imminent.

What to look out for: Another inversion. At the moment, the yield curve is in a fairly stable position thanks to good economic data and the de-escalation of the US-China trade war, and there is confidence that last year’s inversion was a false signal.

“It’s a good sign that the US yield curve has been steepening in recent months. A return to yield curve inversion – which became deeper than seen last year – would be a concern of course.”

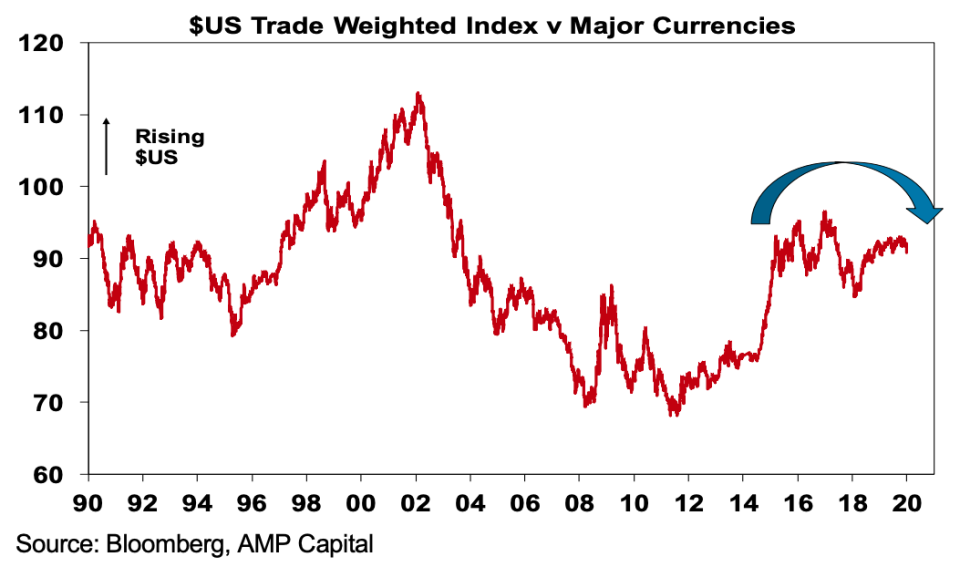

4. The US dollar

How global currencies move against the US dollar matter for two reasons, according to Oliver: it goes up when there are worries about global growth, and emerging countries have it tougher when the US dollar rises.

What to look out for: A US dollar that keeps climbing. But with global growth picking up and trade war risks low, and as long as the Iran conflict doesn’t balloon further, this shouldn’t be the case.

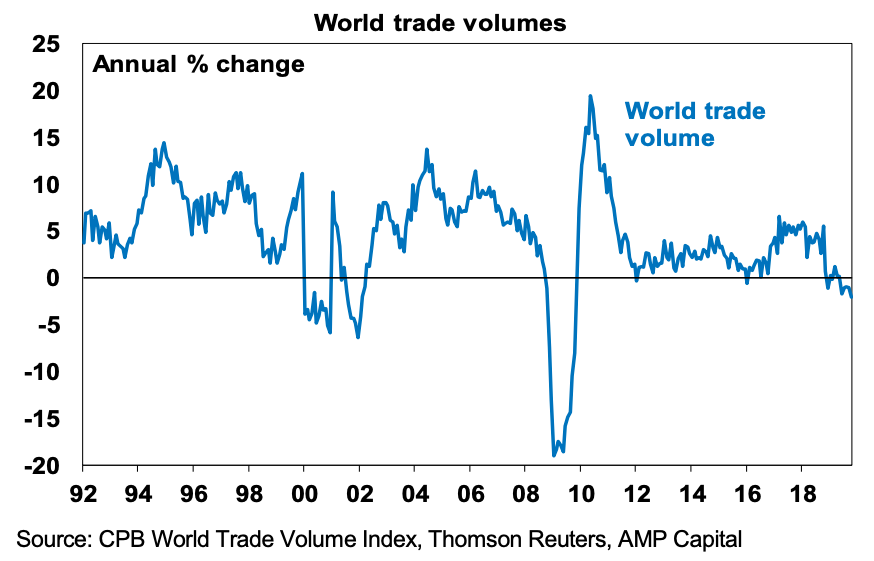

5. World trade growth

Global trade fell last year, but we can expect this to pick up in 2020, according to the chief economist.

What to look out for: A rise. We should see a reversal of the fall in global trade if trade wars don’t escalate and Trump focuses on strengthening the US economy to aid his re-election, and global growth picks up, according to Oliver.

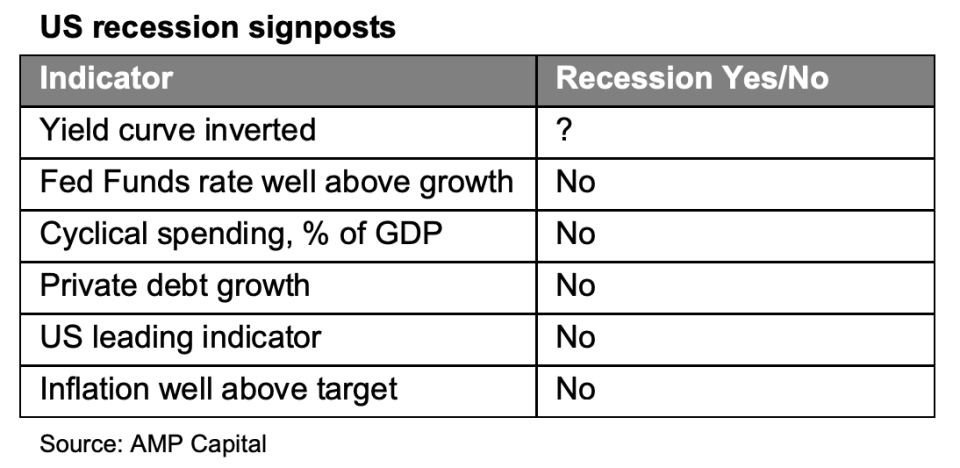

Are we going to see a recession in the US this year?

While fears for a US recession spiked last year, this isn’t a pressing concern. These are the signposts of a US recession:

“These indicators are still not foreshadowing an imminent recession in the US,” Oliver said.

“At present, most of these charts or indicators are moving in the right direction,” he added.

“But to be consistent with our view that this year will see good returns from shares we need to see further improvement and so these charts are worth keeping an eye on.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance