Australia is weeks away from longest property downturn in history

Australia will have entered its longest-running property downturn in history within two months should price falls continue, in what is becoming one of Australia’s most unusual downturns.

Australian housing values have fallen 6.8 per cent since the last peak in October 2017, but the decline has been larger across Australia’s capital cities, where prices have fallen 8.6 per cent.

And if this decline continues for another two months, this will be the longest-running national housing downturn.

Related story: Mortgage brokers are safe from change, for now

Related story: 6 most expensive homes in the world revealed

Related story: 10 common mistakes investor make during a property downturn

“With values now falling across most capital cities the question of course becomes when do the falls stop,” CoreLogic analysts asked.

“No one really knows the answer to that question. [But] our models show, at least for the short-term, that values are likely to continue trending lower, with the rate of decline easing later this year and into 2020.”

Narrowing it down to the capital city markets, property values are also heading towards their largest decline since 1980.

This is what that looks like:

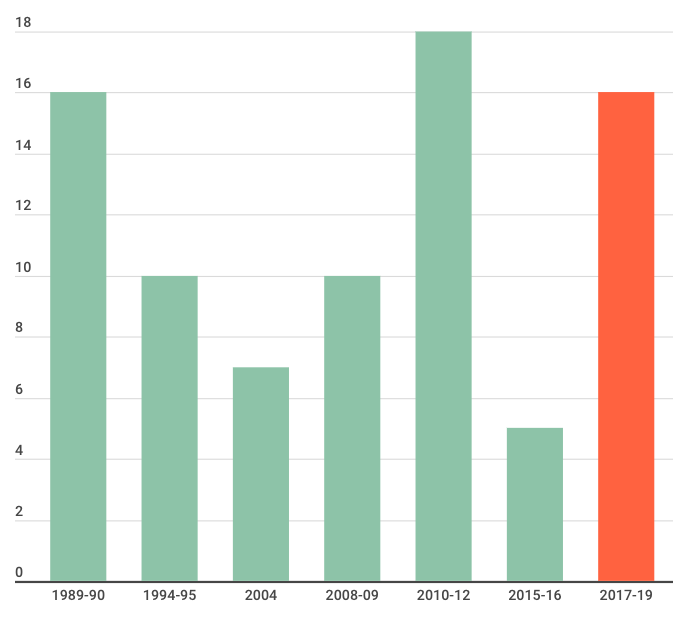

The length of Australian housing market downturns in months

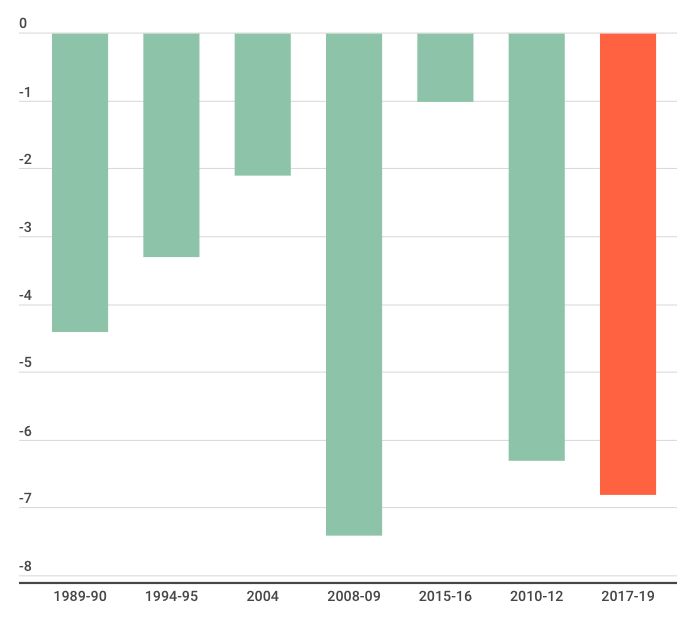

The severity of Australian housing market downturns in percentage fall in dwelling value

And it’s becoming more widespread

While Sydney and Melbourne are the faces of the housing downturn, all other capital city values bar Hobart have taken a hit.

But now Hobart’s growth is showing signs it’s beginning to slow.

Although it’s still rising, the annual rate of growth slowed in February this year to just 7.2 per cent – its weakest recorded since October 2016. Dwelling values added only 0.8 per cent over the month.

“Housing affordability has been a big driver of growth over recent years however, housing affordability has been eroded and there is a likelihood that the rate of growth will continue to ease over coming months,” CoreLogic said.

The question is, when will it tick back up?

The housing downturn won’t go on forever, but it will last until at least 2020, CoreLogic analysts suggested.

“Historically, market recoveries from their trough have generally been fairly rapid however, the recoveries have generally been driven by lower interest rates or a mix of stimulus such as the first home buyers grant boost,” they said.

“Although there is an expectation that interest rates may move lower, we probably won’t see the entire rates cuts passed through to mortgage rates and the much tighter credit conditions are likely to limit any rebound in the housing market, particularly given borrowers are being assessed on their ability to repay a mortgage at a much higher rate (above 7 per cent).”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance