House prices fall further: latest figures

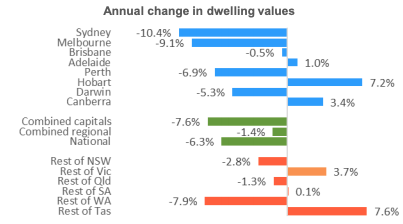

Australian house values fell again in February, down 0.7 per cent across the country.

The decline marked a slight easing nationally in what was previously a shuddering decline, the latest figures from property insights firm CoreLogic revealed today.

Sydney has seen a staggering 10.4 per cent reduction in house prices over the last year, falling 1.0 per cent in February.

The biggest declines in February were in Darwin and Perth, down 1.7 per cent and 1.5 per cent respectively.

The slowdown has extended to other cities falling across all cities bar Adelaide and Hobart. Canberra fell 0.2 per cent, from an annual increase of 3.4%.

“The national rate of decline eased relative to January and December, when dwelling values were down by around 1 per cent, however the February results remain overall weak, with the geographic scope of negative conditions broadening,” CoreLogic head of research, Tim Lawless summed up.

“The fact that we are seeing weakening housing market conditions across regions where home values were previously rising at a sustainable pace and economic conditions are relatively healthy is a sign that tighter credit conditions are having a broad dampening effect on buyer activity,” he added.

Give me the numbers

Here’s what happened across the country in February:

Hobart was the only city to see an increase in home prices, up 0.8 per cent in February and 1.1 per cent over the quarter. The southern city has also seen the best growth over the last year – up 7.2 per cent to a median value of $457,186.

Despite’s Sydney’s house price decline, properties are still the most expensive, with a median value of $789,339.

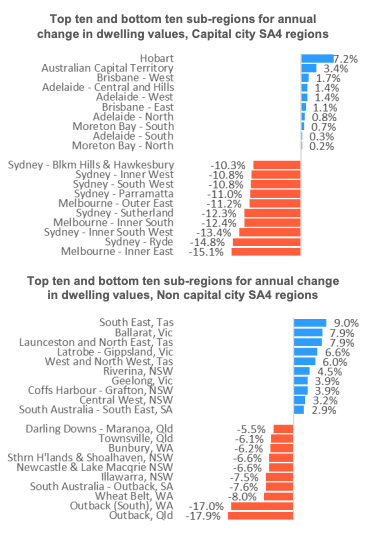

Let’s break it down further

The headline figures largely haven’t translated into significantly greater affordability for one major reason: it’s the most-expensive properties suffering worst.

As CoreLogic noted, the cheaper portions of the market haven’t seen the same price slides.

“The stronger conditions across the more affordable properties can be explained by the surge in first home buyer activity in these cities, as these buyers take advantage of stamp duty concessions available in NSW and Vic,” added Lawless.

“Another factor could be that lenders are likely reducing their exposure to borrowers with high debt levels relative to their incomes which could be skewing demand towards the middle to lower end of the housing market in the most expensive cities.”

But these are the areas where property values have changed the most

The outlook?

We’re not at the bottom yet.

Figures from both the RBA and ABS show that less Australians are seeking and receiving loans as restrictions on investment activities, economic concerns and low wage growth take effect.

“While a slowdown in investment was a key driver of slowing housing markets since 2015, the recent decline in owner occupier lending is far more significant considering owner occupier lending is more than twice the value of investment lending,” Lawless said.

“Stricter lending standards are a logical outcome following the Royal Commission and we are likely in the early phases of a ‘new normal’ for mortgage lending where borrowers will face closer scrutiny around their expenses and ability to service a loan and conversion rates on loan applications are likely to remain lower than they have been over prior years.”

Despite this, buyers are “firmly in the driver’s seat” and in good position to capitalise on softness as more housing stock enters the market and prices continue to soften.

Then there’s the fact that mortgage rates are still hovering at their lowest levels since the 1960s.

Lawless said there’s an expectation values will continue falling over coming months.

“While the rate of decline in Sydney and Melbourne has slowed a little over the month, other cities have weakened. With values expected to fall further, the attention now turns to what impact this could have on future household consumption which accounts for around 60% of the economy.

“If households reduce their spending as the wealth effect continues to reverse, then interest rate cuts or other policy intervention could become more likely.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Now read: Renters: Here’s how to make the most of falling house prices

Now read: Here’s how much Aussie property prices are being slashed all across Australia

Now read: Arrears pain is dull but mortgage regulation is excruciating

Yahoo Finance

Yahoo Finance