This is why Aussies are shying away from Big 4 banks

If recent revelations emerging from the banking and financial services sector are anything to go by, bigger is most definitely not always better.

ANZ, Commonwealth Bank, NAB and Westpac have been slammed in the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry for dishonest service and failure to properly punish misconduct, and Aussies aren’t happy.

Also read: ‘Buy now, pay later’ firms and ‘debt vultures’ to face Senate inquiry

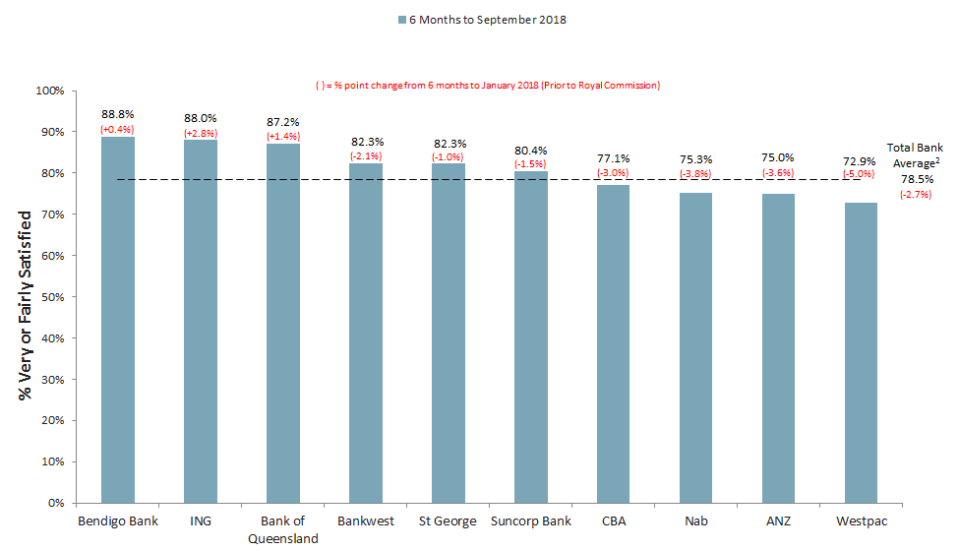

In the last six months, customer service at the big four banks have trailed behind the rest of the market. The percentage of customers who felt very or fairly satisfied with the big banks saw a 3.6 per cent drop, more than five times that of customers from other banks which recorded a fall of 0.7 per cent.

Of the four, customer satisfaction with Westpac fell the most.

In contrast, the last six months have seen a rise in the number of happier customers of Bendigo Bank, ING and Bank of Queensland, with Bendigo Bank leading the pack.

Customer banking satisfaction – 10 largest consumer banks

Roy Morgan industry communications director Norman Morris said the results were not unexpected.

“Given the continuing barrage of negative publicity from the Royal Commission, mainly focused on the big four, it is not surprising that satisfaction with them has shown the greatest decline this year,” he said.

“What needs to be noted, however, is that contrary to all the negative reporting on banks, the clear majority of their customers are satisfied with them and that only around 6% claim to be dissatisfied.”

Also read: Big banks move to stop charging fees to dead people

Despite negative publicity on the banking sector sparked by the royal commission, customer satisfaction is “well above the long term average” since 2001, Morris noted.

But he warned: “The release of the Royal Commission’s interim report represents a major challenge to retain bank satisfaction levels as it has recapped on a lot of problem areas.”

Demand to fill financial services risk and compliance roles is on the rise

In the meantime, interesting new employment trends have emerged in the banking industry. Job ads for compliance and risk jobs have soared by 48 per cent in the last year, according to Seek’s latest Employment Data Report.

At the moment, compliance and risk jobs make up 13.5 per cent of vacancies in the Australian banking and finance sector at large.

But by the same token, the number of advertisements seeking to hire professionals in financial planning and retail and branch have fallen.

Job roles available in banking and finance

The financial advice sector copped a bruising in the Royal Commission, with the second round of hearing entirely dedicated to the matter.

The widespread failure to operate in the best interests of the client was also an unwavering focus of the major inquiry, with multiple case studies demonstrating bank staff knowingly misled or took advantage of vulnerable Australians.

Also read: Insurer sold policy to ‘distressed’ man with Down Syndrome

Yahoo Finance

Yahoo Finance