3 take-outs from the banking royal commission’s interim report

Australia’s banks and financial services were motivated by greed and the banking watchdogs failed in their duty to properly punish misconduct.

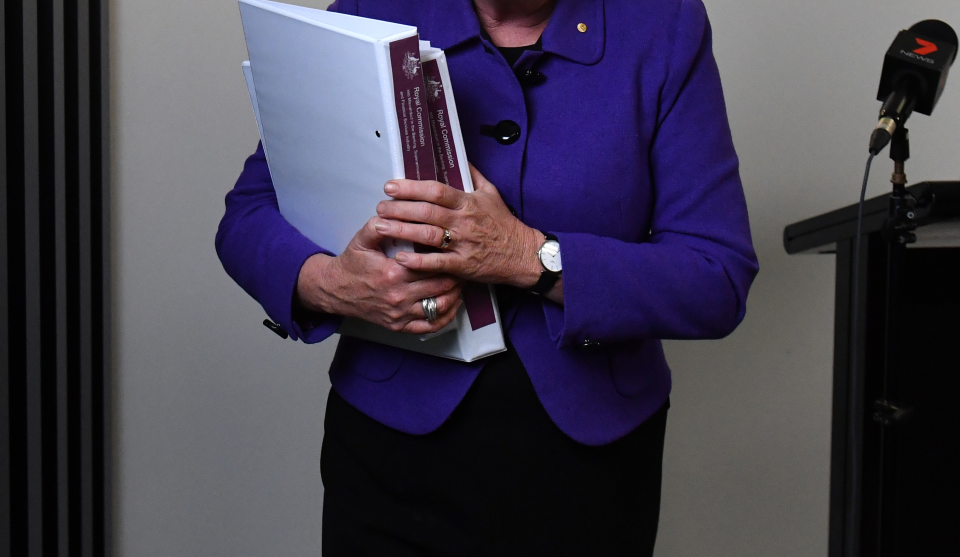

That was the finding of the interim report by the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, handed down by Royal Commissioner Kenneth Hayne on Friday.

The 1000-page report outlined in painstaking detail the damning revelations of the first four rounds of the major inquiry.

Here are some of the core take-outs from the report:

1. Banks broke the law because, well, they’re greedy.

Hayne is direct about why banks and financial services firms went against the client’s best interests and lined their pockets with customers’ money.

“Too often, the answer seems to be greed – the pursuit of short term profit at the expense of basic standards of honesty.

“How else is charging continuing advice fees to the dead to be explained?”

The form that this misconduct takes is neatly summarised:

“taking a customer’s money when not entitled to take it (for example by charging a fee for service when no service was given);

preferring personal financial interest over the customer’s interest when obliged to act in the customer’s best interests;

misleading or deceiving the customer; and

breaking some specific requirement of the law including, but not limited to, provisions intended to protect the customer.”

2. Industry watchdogs haven’t kept the banks in line.

Too often, the financial institutions did as they pleased – and this was in part because the corporate and prudential regulators, the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulatory Authority (APRA), didn’t crack down hard enough on misbehaving entities, according to Hayne.

Also read: Five things you need to know about the banking royal commission

“If competitive pressures are absent, if there is little or no threat of enterprise failure, and if banks can and do mitigate the consequences of customers failing to meet obligations, only the regulator can mark and enforce those bounds.

“But neither ASIC nor APRA has done that in a way that has prevented the conduct described in this report.”

ASIC in particular has been called out by the Royal Commissioner for having an ineffective approach from the get-go.

“When deciding what to do in response to misconduct, ASIC’s starting point appears to have been: How can this be resolved by agreement?

“This cannot be the starting point for a conduct regulator.”

3. We should consider simplifying the law, not adding to it.

The findings have been clear: major players in the financial services industry have fallen well below community standards and expectations, broken the law, and in some instances compounded the mental and emotional stress of customers.

However the report does not recommend introducing a bunch of new legislation, arguing this would add an extra layer of complexity to an already complex regulatory regime. Instead it suggests existing laws may need to be simplified and enforced differently in the future.

Also read: The ‘horror week’ in insurance revealed

Hayne points out that our existing regulations can in fact be pared down to a number of “very simple” premises:

“Obey the law; do not mislead or deceive; be fair; provide services that are fit for purpose; deliver services with reasonable care and skill; when acting for another, act in the best interests of that other.”

“Their simplicity points firmly towards a need to simplify the existing law rather than add some new layer of regulation,” Hayne writes in his report. “But the more complicated the law, the easier it is to lose sight of them.”

Yahoo Finance

Yahoo Finance