Insurer sold policy to ‘distressed’ man with Down Syndrome

A 26-year-old man with Down Syndrome was pushed into a life insurance policy during a cold call that even the insurer’s CEO considered unsettling, the royal commission has heard.

The royal commission into the banks and finance sector today heard how ASX-listed Freedom Insurance sold around $100,000 in life insurance to a 26-year-old man with Down Syndrome.

Also read: GET YOUR SUPER BACK: Millions of Aussies to get thousands back

Recording of the salesman’s discussion with the 26-year-old are harrowing, with even Freedom CEO, Craig Orton, admitting the phone calls “do not make for comfortable listening.”

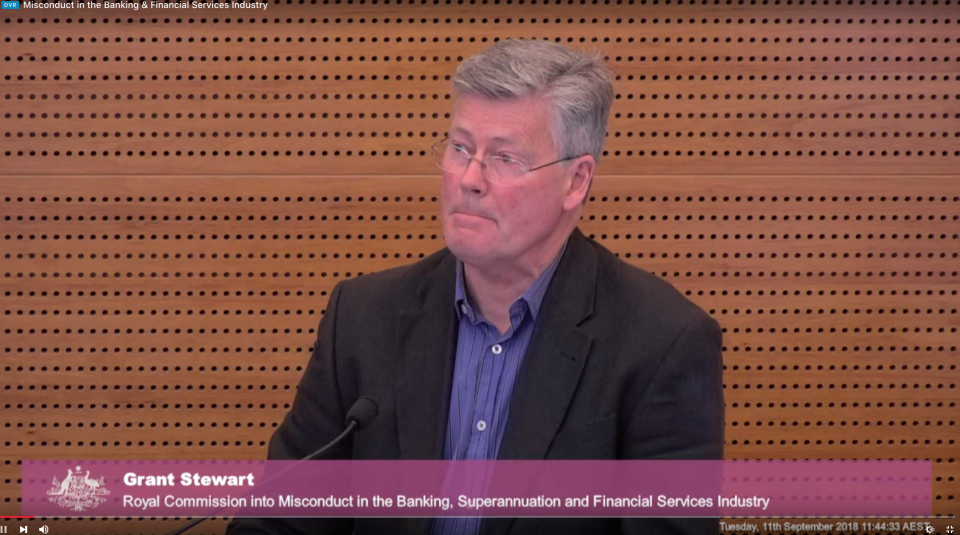

The father of the 26-year-old, Grant Stewart told the royal commission that his son has “reasonable” literacy and numeracy skills. However, he argued the phone calls highlights how his son did not understand the product he was signing up to; a life insurance product with fortnightly direct debit payments.

The audio includes long pauses in which Mr Stewart’s son attempts to answer questions, and also shows the salesman rebuffing Mr Stewart’s sons attempts to end the conversation while referring to him as “buddy”.

Listening back to the 18-minute phone call, Mr Stewart said he was “quite disturbed by the whole process.”

“I really didn’t think during the call that our son indicated any understanding of what he was signing up for, why the information was wanted. He was being compliant and trying to be polite, but didn’t understand.”

Also read: Lawyers file $100 million class action against Woolworths

Mr Stewart said his son has “difficulty understanding” abstract concepts. However, when approached by Mr Stewart over the policy, Freedom Insurance’s responded initially by arguing the salesman wouldn’t have known about his son’s disability.

Mr Stewart said it took three attempts to cancel the policy after phone calls and emails went unanswered.

Ultimately, Freedom Insurance required Mr Stewart’s son to say “I wish to terminate the policy” over the phone.

“He found it difficult to articulate the words, let alone understand what it meant,” Mr Stewart told the royal commission.

Also read: 5 Habits That Will Prevent You From Being Financially Secure

He continued, describing his son as “quite distressed” by the experience.

“He believed he’d done something wrong and was quite embarrassed and didn’t know what he’d done.”

This case study comes just weeks after a damning report by the corporate regulator, ASIC, on the life insurance industry.

ASIC said Australian consumers had been sold products they didn’t want, couldn’t afford and which didn’t perform.

“Aggressive selling practices and products that don’t pay out when consumers expect undermine trust in the industry,” ASIC chair, James Shipton said in late August.

“Life insurance is a long-term product but cancellation rates and poor claim outcomes show that people are being sold products they don’t want, can’t afford, or don’t perform as they expected.”

Yahoo Finance

Yahoo Finance