WisdomTree Inc (WT) Surpasses Analyst Earnings Estimates in Q1 2024

Diluted Earnings Per Share (EPS): Reported at $0.13, surpassing the estimated $0.11.

Net Income: Achieved $22.1 million, exceeding the forecast of $17.47 million.

Revenue: Total operating revenues reached $96.8 million, surpassing the expected $94.25 million.

Assets Under Management (AUM): Ended the quarter at $107.2 billion, marking a 7.1% increase from the previous quarter.

Net Inflows: Recorded $2.0 billion, primarily from international developed equity and U.S. equity products.

Gross Margin: Slightly decreased to 79.4% from the previous quarter's 79.7%.

Operating Income Margin: Improved to 28.9%, a slight increase from 28.7% in the prior quarter.

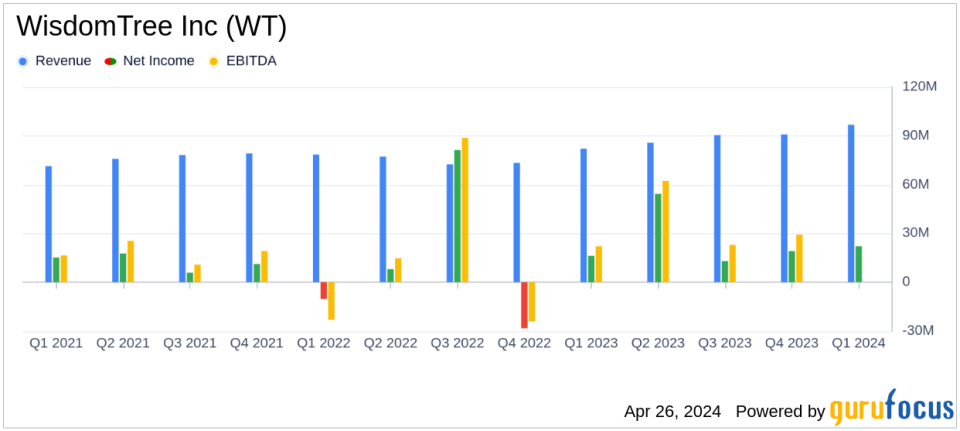

On April 26, 2024, WisdomTree Inc (NYSE:WT), a pioneer in exchange-traded products (ETPs) and digital financial solutions, disclosed its first-quarter earnings for 2024, revealing a performance that exceeded analyst expectations. The company announced its results through an 8-K filing, reporting a diluted earnings per share (EPS) of $0.13, surpassing the estimated EPS of $0.11. Net income stood at $22.1 million, also above the forecast of $17.47 million. Operating revenues reached $96.8 million, indicating a significant rise from the expected $94.25 million.

WisdomTree Inc is renowned for its diverse range of ETFs and ETPs, alongside innovative digital financial products including blockchain-enabled assets and a digital wallet, WisdomTree Prime. This quarter's strong performance is underpinned by a record $107.2 billion in assets under management (AUM), a 7.1% increase from the previous quarter, driven by market appreciation and robust net inflows, particularly into international developed equity and U.S. equity products.

Financial and Operational Highlights

The company's operating income margin improved to 28.9%, with a slight adjustment to 29.6% when excluding non-recurring items. This represents an 870 basis points increase compared to Q1 2023. WisdomTree's strategy of expanding its product offerings and enhancing its digital capabilities appears to be paying dividends, reflected in the substantial inflows of $2.0 billion during the quarter.

Despite a challenging environment characterized by volatile markets and rising costs, WisdomTree managed to maintain an average advisory fee of 0.36% and declared a quarterly dividend of $0.03, payable on May 22, 2024.

Analysis of Financial Statements

WisdomTree's balance sheet remains robust with total assets amounting to $931.7 million as of March 31, 2024. The firm has effectively managed its liabilities and equity, showcasing a prudent approach to financial management. The detailed income statement and cash flow activities further reflect a stable financial posture, with strategic fund management and administration expenses aligning with the company's growth trajectory.

Executive Insights

Jonathan Steinberg, CEO of WisdomTree, emphasized the strategic initiatives driving the firm's growth, stating:

"Our focus on expanding our suite of ETPs and enhancing our digital offerings has allowed us to capture significant market share and deliver substantial value to our shareholders and clients alike."

Jarrett Lilien, COO and President, highlighted operational efficiencies and market opportunities that have supported the firm's performance amidst market fluctuations.

Looking Forward

WisdomTree's impressive first-quarter results reflect its resilience and adaptability in a dynamic financial landscape. The company's strategic focus on innovation and customer-centric products continues to support its growth and market position. As WisdomTree navigates through 2024, it remains well-positioned to leverage opportunities within the ETF and digital asset sectors, potentially leading to sustained growth and profitability.

For detailed financial figures and future projections, interested parties can access the full earnings report and join the upcoming webcast scheduled for April 26, 2024, detailed on WisdomTree's investor relations website.

For more insights and detailed analysis, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from WisdomTree Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance