Warren Buffett's Market Indicator Nears 150% Ahead of Independence Day

On Thursday, the day prior to the Independence Day holiday weekend, Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) CEO Warren Buffett (Trades, Portfolio)'s favorite market indicator stood at 148.7%, up approximately 4.7% from the June 1 level of 144%.

U.S. markets eke out gains to start July following historic second-quarter surge

The Dow Jones Industrial Average closed at 25,828.45, up 93.48 points from Wednesday's close of 25,734.97 and just 15.58 points from Tuesday's close of 25,812.88. Earlier in the day, the 30-stock index soared to an intraday high of 26,204.41, up 469.44 points from the prior-day's close, on the heels of nonfarm payrolls expanding 4.8 million in June, smashing the expected increase of 2.9 million.

The U.S. Bureau of Labor Statistics further reported the unemployment rate improved to 11.1%, topping the estimate of 12.4%.

Despite the early surge, gains were capped as coronavirus cases in the U.S. continue setting new records daily. According to Johns Hopkins University statistics, the U.S. reported on Wednesday over 50,600 new cases, a new one-day record. Nonetheless, CNBC reported that economist Christian Scherrmann said the job reports in May and June offer "a blueprint for a fast recovery, but only once the virus situation is under control."

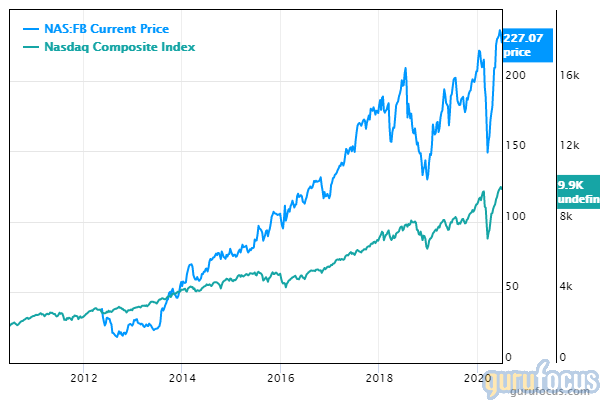

U.S. markets ended the second quarter with historic rallies: The 30-stock index soared 17.8%, the largest one-quarter rally since the first quarter of 1987's rally of over 21%. Likewise, the Nasdaq Composite Index, which closed above 10,000 for the first time in history on June 10, skyrocketed 30.6% in its largest quarterly rally since 1999.

Buffett indicator offers a straightforward way to measure implied market returns

Buffett said that the ratio of total market cap to gross domestic product is "probably the best single measure of where valuations stand at any given moment." The following video discusses the ratio and its applications to implied market returns.

As mentioned in the video, GuruFocus updated the calculation of the implied market returns in late June. The base-case implied market return now considers a reversion to the 20-year mean total market cap to gross domestic ratio instead of a fixed ratio of 80%. Based on this new calculation, the implied market return over the next eight years is 0.6% per year.

We also consider two scenarios: an optimistic case assuming a reversion to a market level at 130% of the 20-year-mean ratio and a pessimistic case assuming a reversion to a market level at 70% of the 20-year-mean ratio. Based on the current market valuation level, the implied market return ranges from -3.70% per year at the pessimistic case to 3.70% per year at the optimistic case.

See also

Apple Inc. (NASDAQ:AAPL), the top holding of Berkshire, closed at $364.11, unchanged from the previous close. Likewise, the Nasdaq closed at a new record high of 10,207.63, up 53 points from the previous close of 10,154.63.

Disclosure: The author is long Apple.

Read more here:

Buffett's Bank Holdings Surge on Lax Venture Capital Investing Regulations

Warren Buffett's Apple Sets New Record Close on WWDC Updates

Value Screeners Identify Opportunities Ahead of the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance