UK Growth Companies With At Least 12% Insider Ownership

The UK market is showing signs of resilience, with the FTSE 100 poised for its first weekly gain after three consecutive weeks of losses. This positive momentum reflects a broader optimism in financial markets, despite ongoing regulatory and economic discussions. In such an environment, growth companies with high insider ownership can be particularly appealing as they often suggest a strong alignment between company insiders and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

Spectra Systems (AIM:SPSY) | 23.1% | 26.3% |

Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

B90 Holdings (AIM:B90) | 22% | 142.7% |

Afentra (AIM:AET) | 38.3% | 99.2% |

Let's review some notable picks from our screened stocks.

Property Franchise Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC, operating in the United Kingdom, manages and leases residential real estate properties with a market capitalization of £275.80 million.

Operations: The company generates revenue through two primary segments: Financial Services (£1.50 million) and Property Franchising (£25.78 million).

Insider Ownership: 12.7%

The Property Franchise Group, a UK-based entity, exhibits promising growth with expected revenue and earnings increases of 44.7% and 36.71% per year respectively, outpacing the UK market significantly. Despite this, challenges such as shareholder dilution over the past year and an unstable dividend track record may concern investors. The company's recent activities include presenting at the Mello2024 Investor Conference and reporting a slight increase in annual sales to £27.28 million with net income rising to £7.4 million.

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market capitalization of approximately £0.96 billion.

Operations: Hochschild Mining's revenue is primarily generated from its operations at Inmaculada, which contributed $396.64 million, San Jose with $242.46 million, and Pallancata adding $54.05 million.

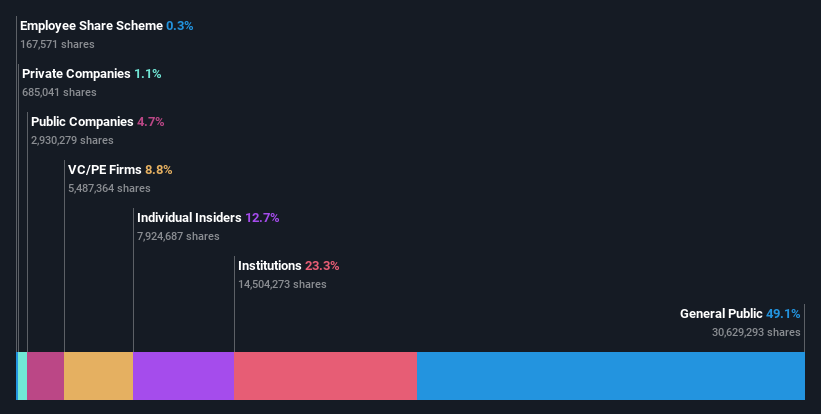

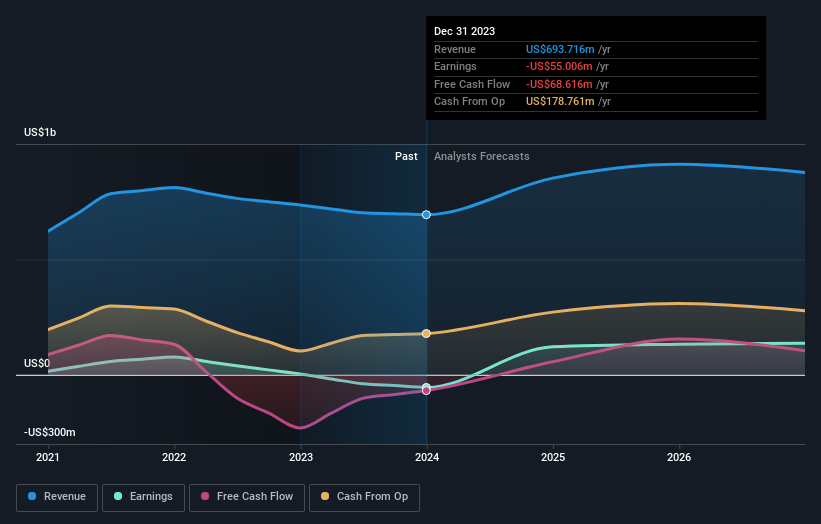

Insider Ownership: 38.4%

Hochschild Mining, a UK-based growth company with significant insider ownership, is navigating a complex landscape. Despite recent financial struggles marked by a net loss of US$55.01 million in 2023, the firm anticipates profitability within three years, supported by an expected revenue growth rate of 8.4% annually—above the UK market average. The company is actively pursuing strategic mergers and acquisitions in Latin America to bolster its portfolio, emphasizing disciplined capital allocation and targeting high internal returns of around 50%.

Playtech

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a global technology company specializing in gambling software, services, content, and platform technologies with a market capitalization of approximately £1.48 billion.

Operations: Playtech's revenue is derived primarily from its Gaming B2B and Gaming B2C segments, which generated €684.10 million and €946.60 million respectively, along with additional contributions from B2C operations like HAPPYBET and Sun Bingo totaling €91.60 million.

Insider Ownership: 13.5%

Playtech, a UK growth company with significant insider ownership, is trading at 54.7% below its estimated fair value and has shown robust earnings growth of 158.9% over the past year. Analysts project a further 20.62% annual earnings increase and anticipate the stock price to rise by 45.8%. Recent board restructuring aims to enhance governance, aligning with strategic growth objectives despite some concerns about low forecasted return on equity of 8.9% in three years.

Click here and access our complete growth analysis report to understand the dynamics of Playtech.

The valuation report we've compiled suggests that Playtech's current price could be quite moderate.

Turning Ideas Into Actions

Click through to start exploring the rest of the 64 Fast Growing UK Companies With High Insider Ownership now.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:TPFG LSE:HOC and LSE:PTEC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance