The ‘legal scam’ 1,000 people fall for every day

More than 1,000 travellers a day fall prey to confusing ATM language in foreign countries, new research has found.

According to currency transfer service, TransferWise, more than 1,000 customers who use its recently launched multi-currency card end up paying more at ATMs than they need to every day.

Related story: How to get free accommodation on your overseas getaway

Related story: 18 international destinations you could fly to with your tax return

Related story: Business class flights are set to get a whole lot cheaper

That’s because of what TransferWise refers to as a legal scam: Dynamic Currency Conversion.

What is Dynamic Currency Conversion?

When travellers attempt to take money out at a foreign ATM or go to pay for something like shops or a hotel room, they’re faced with choices over whether to make the exchange in AUD, or pay in the local currency.

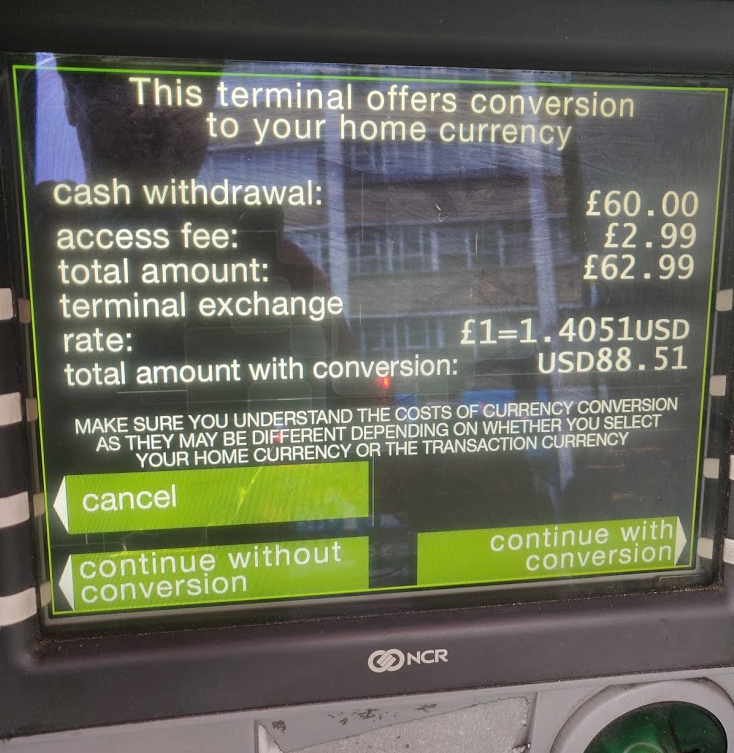

“When ATMs and checkout terminals abroad offer to make the conversion, they always intend to profit from the bad exchange rate they use by presenting confusing options on screen that causes travellers to pay more than they need to in foreign exchange fees – anywhere between 6 per cent (sometimes 12 per cent) more in conversion charges,” TransferWise co-founder himself Kristo Käärmann said.

This could look like this:

According to Canstar, one benefit of paying in Australian dollars is that it may help travellers understand the amount they’re spending, or withdrawing in Australian dollars. It can also help travellers get the exchange rate at the time of transaction.

But, customers can also get stung by fees in three ways: conversion fees, a poor exchange rate and a foreign transaction fee.

“And for an extra kick in the pants… When using a Dynamic Currency Conversion system for local credit card transactions, the card is likely to treat any transactions as overseas transactions still – so you could be charged the currency conversion fee regardless of whether you’re already paying in AUD or not,” Canstar said.

What do I do when faced with Dynamic Currency Conversion?

There are three ways ATMs will pose the tricky question. Here’s how to answer them:

If you see ‘continue with conversion’ and ‘continue without conversion’ – choose to continue without the conversion.

Presented with ‘debit in your home currency, or debit in the local currency’ – choose ‘local currency’.

And if you are offered ‘let us convert the money for you – yes or no’ – just say ‘no’.

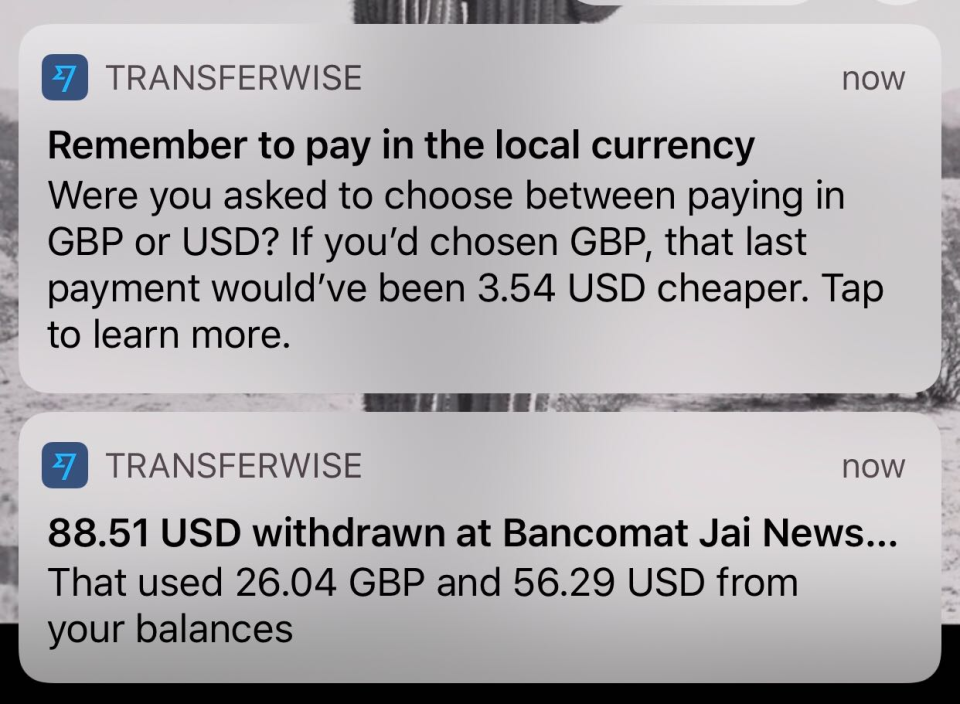

TransferWise has also begun sending card users a message whenever they fall for the scam, reminding them to pay in the local currency the next time an ATM machine tries to pull a fast one on them.

“We can't block Dynamic Currency Conversion on our cards,” Käärmann said.

“But we certainly can help our cardholders make this mistake only once. Now, when you use your card abroad and get conned into Dynamic Currency Conversion - at least you'll know it.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance