How long does it take to save for a house deposit in your capital city?

Housing affordability has gotten better in the last two years – but in cities like Sydney and Melbourne, owning a house doesn’t come cheap.

While we’re due to see a flood of newcomers to the property market, the first step to owning a home – saving for a deposit – is still out of reach for some.

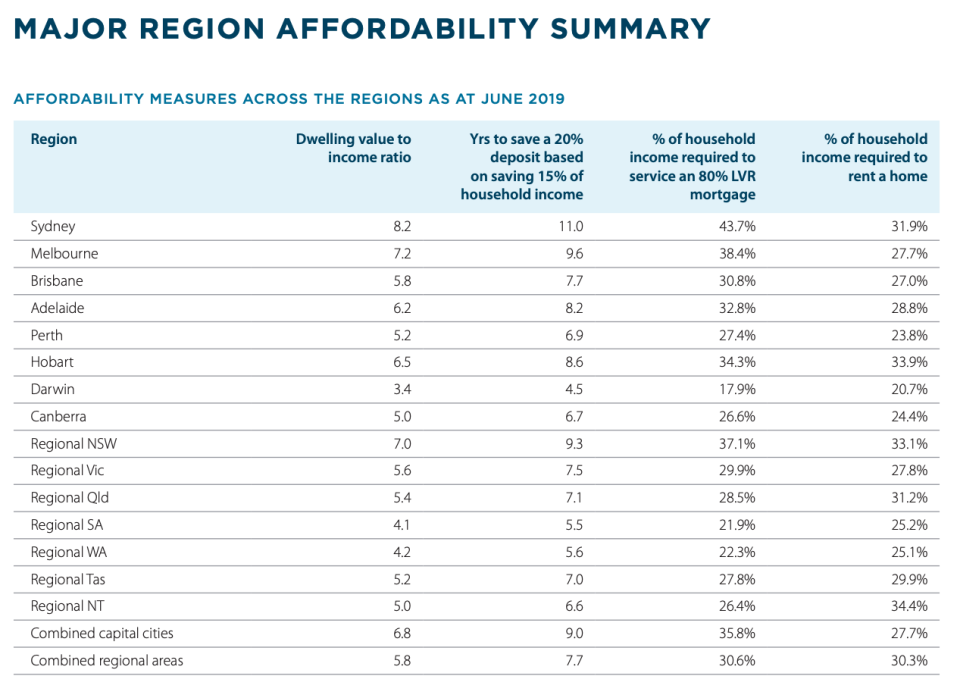

New research from ANZ-CoreLogic’s latest Housing Affordability Report has revealed that, naturally, the time it takes for you to save for a house deposit will depend on where you live.

Unsurprisingly, Sydneysiders will take the longest to save up for a deposit.

On average, it would take someone living in Sydney 11 years to save up a 20 per cent deposit if they regularly set aside 15 per cent of their household income for it.

Melbourne is not much better, with residents needing 9.6 years to build a deposit, while an Aussie living in regional NSW would take 9.3 years to save for a 20 per cent deposit if they saved 15 per cent of their income.

Hobart has also become more unaffordable, taking 8.6 years to save for a deposit, and Adelaideans would take 8.2 years.

Brisbanites would have to save for 7.7 years in order to afford a 20 per cent deposit, and those living in Perth would take 6.9 years to amass a deposit.

Canberrans would be saving for 6.7 years, while those living in Darwin have it best – it would take them just 4.5 years to save for a 20 per cent deposit.

If all of this sounds like a lot of time to you, the figures have actually improved from levels seen a year ago and a decade ago.

“Regional households saving 15 per cent of their income will typically need to save for 7.7 years in order to accrue a 20 per cent deposit; a slight improvement from one year ago (7.8 years) and down from the recent peak of 9.0 years in 2008,” the report said.

“To save for a house deposit it currently takes 7.9 years which is slightly shorter than a year ago (8 years) but well down from the recent peak of 9.2 years in early 2008.”

If you wanted to save for a deposit for a unit instead, it takes less long – but only just, at 6.9 years (down from 7.1 years 12 months ago).

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance