Three German Dividend Stocks With Yields Up To 6.3%

Amid a backdrop of rising inflation and economic uncertainty in Europe, Germany's market has seen notable fluctuations, with the DAX index recently declining by 1.05%. In such an environment, dividend stocks can offer investors potential stability and steady income streams, making them an attractive option for those looking to navigate through turbulent markets.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.27% | ★★★★★★ |

Edel SE KGaA (XTRA:EDL) | 6.33% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.80% | ★★★★★★ |

MLP (XTRA:MLP) | 4.69% | ★★★★★☆ |

OVB Holding (XTRA:O4B) | 4.52% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.46% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.02% | ★★★★★☆ |

SAF-Holland (XTRA:SFQ) | 4.83% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.09% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.14% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

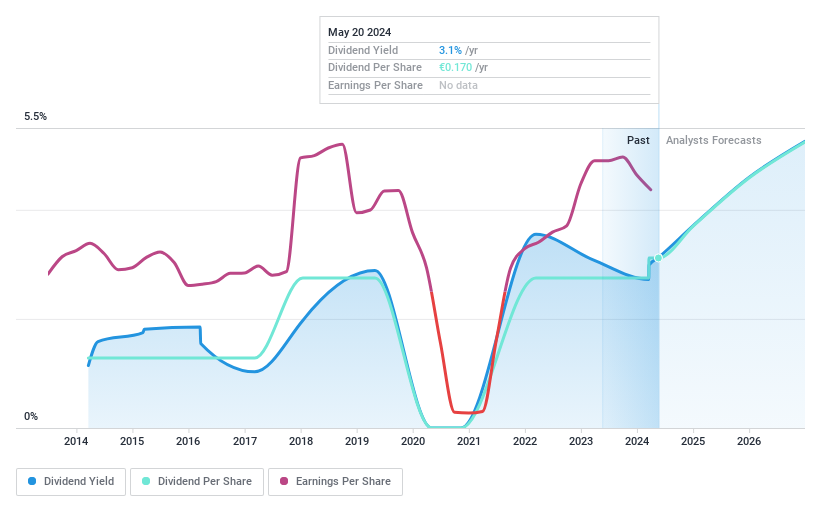

DEUTZ

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DEUTZ Aktiengesellschaft focuses on developing, manufacturing, and selling diesel and gas engines across various global regions including Europe, the Middle East, Africa, the Asia Pacific, and the Americas, with a market capitalization of approximately €0.65 billion.

Operations: DEUTZ Aktiengesellschaft generates revenue primarily through two segments: Classic, which brought in €2.01 billion, and Green, contributing €5.30 million.

Dividend Yield: 3.3%

DEUTZ has demonstrated fluctuating dividend reliability over the past decade, with significant annual drops exceeding 20%. Despite this, DEUTZ's dividends are currently well-supported by both earnings and cash flows, with a payout ratio of 22.7% and a cash payout ratio of 34.6%, respectively. However, its dividend yield of 3.29% is below the top quartile in the German market at 4.5%. Recent financials indicate a downturn, with Q1 earnings dropping to €8.8 million from €23.8 million year-over-year, alongside reduced sales figures.

Unlock comprehensive insights into our analysis of DEUTZ stock in this dividend report.

Our expertly prepared valuation report DEUTZ implies its share price may be lower than expected.

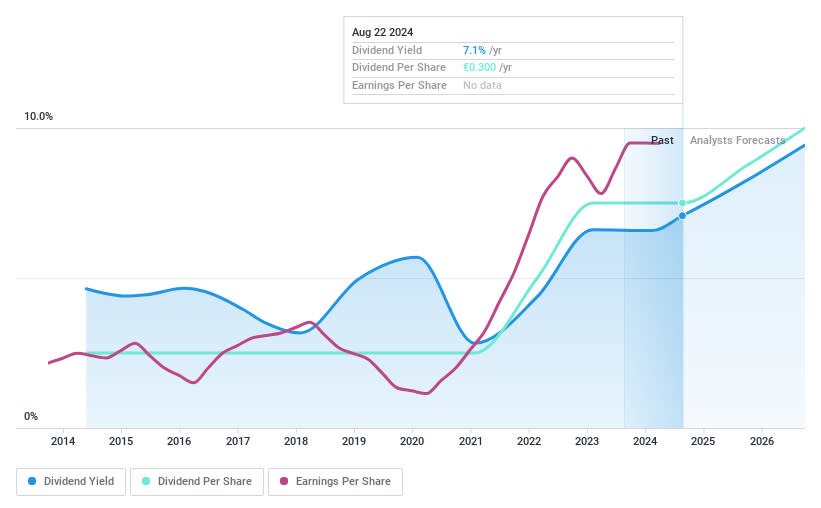

Edel SE KGaA

Simply Wall St Dividend Rating: ★★★★★★

Overview: Edel SE & Co. KGaA operates as an independent music company primarily in Europe, with a market capitalization of approximately €100.84 million.

Operations: Edel SE & Co. KGaA generates revenue through two main segments: Marketing and Sales (€135.56 million) and Manufacturing and Logistics (€144.67 million).

Dividend Yield: 6.3%

Edel SE KGaA offers a compelling dividend yield of 6.33%, ranking in the top 25% in the German market, supported by a sustainable payout ratio of 52.6% and cash payout ratio of 49.3%. Despite trading at a significant discount to its estimated fair value, concerns persist due to its high debt levels. The company's dividends have shown stability and growth over the past decade, with earnings increasing by 4.9% last year, reinforcing the reliability of its payouts.

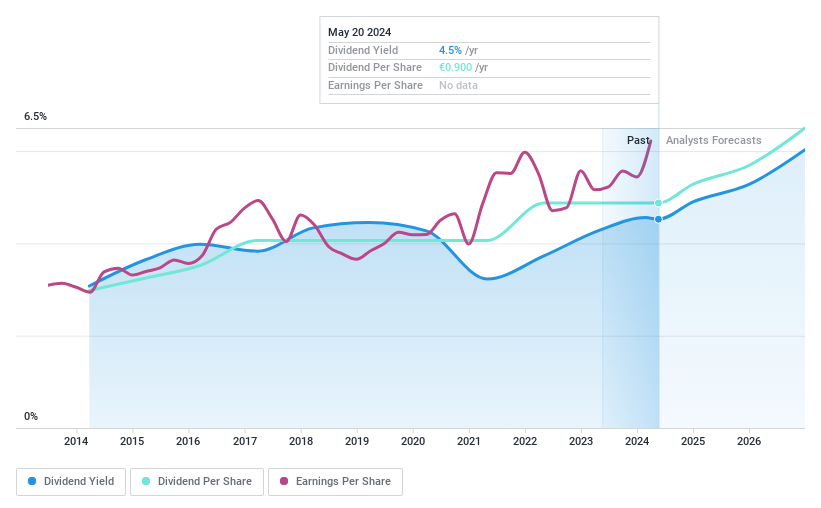

OVB Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: OVB Holding AG operates in Europe, offering advisory and brokerage services to private households, with a market capitalization of approximately €283.60 million.

Operations: OVB Holding AG generates its revenue primarily from insurance brokerage, amounting to €368.28 million.

Dividend Yield: 4.5%

OVB Holding boasts a dividend yield of 4.52%, placing it among the top 25% of German dividend payers. However, its dividends are not sufficiently covered by cash flows, with a cash payout ratio of 107.3%. While OVB has demonstrated reliability in its dividend payments over the past decade, showing both stability and growth, the sustainability is questionable as earnings and cash flows do not adequately cover payouts. Despite these challenges, OVB trades at a 15.1% discount to its estimated fair value.

Next Steps

Embark on your investment journey to our 31 Top Dividend Stocks selection here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:DEZ XTRA:EDL and XTRA:O4B.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance