Teledyne Technologies (TDY) Q3 Earnings Beat, Ups '21 EPS View

Teledyne Technologies Incorporated TDY reported third-quarter 2021 adjusted earnings of $4.34 per share, which surpassed the Zacks Consensus Estimate of $3.68 by 17.9%. The bottom line improved 61.9% from the year-ago quarter’s $2.68.

Including one-time items, the company reported third-quarter GAAP earnings per share of $2.81 reflecting an increase of 13.3% from the year-ago quarter.

Operational Highlights

In the quarter under review, total sales amounted to $1,311.9 million, which exceeded the Zacks Consensus Estimate of $1,293.4 million by 1.4%. The top line surged 75.2% from $749 million a year ago. All segments reported year-over-year growth in sales.

Segmental Performance

Instrumentation: Sales in this segment rose 9% year over year to $287.1 million in the third quarter. Increased sales of environmental instrumentation, and test and measurement instrumentation and marine instrumentation contributedto the unit’s sales upside.

Operating income climbed 24.3% year over year to $63 million driven by higher sales and improved margins across most product categories, on account ofongoing margin improvement initiatives.

Digital Imaging: Quarterly sales at this division soared 217.3% year over year to $760.6 million. The improvement can be attributed to incremental net sales from the FLIR acquisition,and organic sales growth from industrial and scientific sensors and cameras, x-ray products and micro-electromechanical systems.

Operating income advanced 108.6% year over year to $94.9 million,driven bythe benefits of organic sales growth and FLIR acquisition.

Aerospace and Defense Electronics: In this segment, quarterly sales of $161.8 million increased 11.7% from the prior-year quarter on account of increased sales for defense and space electronics, and higher sales of aerospace electronics.

Moreover, operating income climbed 34.5% year over year to $35.9 million, driven by higher sales and a lower cost structure due to actions taken in 2020, and lower research and development costs.

Engineered Systems: Sales in this division increased 1.4% year over year to about $102.4 million in the third quarter on account of higher sales of engineered products.

Operating income decreased 8% to $11.5 million.

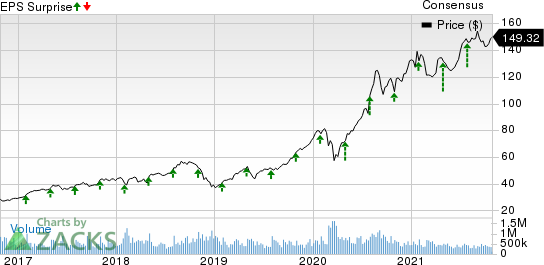

Teledyne Technologies Incorporated Price, Consensus and EPS Surprise

Teledyne Technologies Incorporated price-consensus-eps-surprise-chart | Teledyne Technologies Incorporated Quote

Financial Condition

Teledyne’s cash and cash equivalents totaled $551.8 million as of Oct 3, 2021, compared with $673.1 million at the end of 2020.

Long-term debt was $4,441.7 million compared with $680.9 million at 2020-end.

Cash from operations during the third quarter amounted to $192.8 million compared with $150.3 million during third-quarter 2020.

In the reported quarter, capital expenditures were $29.2 million compared with $15.2 million in the year-ago quarter. Moreover, the company generated adjusted free cash flow of $165.7 million compared with $135.1 million in the year-ago quarter.

Q4 & 2021 Guidance

Teledyne expects to generate adjusted earnings per share of $4.07-$4.17 in the fourth quarter of 2021. The Zacks Consensus Estimate for the same is pegged at $4.05 per share, which lies lower than the company’s guidance range.

For 2021, the company now expects to generate adjusted earnings per share in the range of $16.35 to $16.45, higher than the prior guided range of $15.25-$15.50. Currently, the Zacks Consensus Estimate for Teledyne’s full-year earnings is pegged at $15.57 per share, which lies lower than the company’s guidance range.

Zacks Rank

Teledyne currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Raytheon Technologies (RTX) third-quarter 2021 adjusted earnings per share (EPS) of $1.26 outpaced the Zacks Consensus Estimate of $1.07 by 17.8%.

Lockheed Martin (LMT) reported third-quarter 2021 adjusted earnings of $6.66 per share, which surpassed the Zacks Consensus Estimate of $1.96 by 239.8%.

Hexel Corporation (HXL) reported third-quarter 2021 adjusted earnings of 13 cents per share, which exceeded the Zacks Consensus Estimate of 8 cents by 62.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Hexcel Corporation (HXL) : Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance