Teledyne Technologies (TDY) Q3 Earnings Beat, '19 View Raised

Teledyne Technologies Inc. TDY reported third-quarter 2019 earnings of $2.84 per share, which surpassed the Zacks Consensus Estimate of $2.53 by 12.3%. The bottom line also improved 16.9% from the year-ago quarter’s $2.43 on solid sales and record improvement in the operating margin.

Operational Highlights

Total sales in the third quarter amounted to $802.2 million, which exceeded the Zacks Consensus Estimate of $781 million by 2.7%. The top line also rose 10.6% from $725.3 million reported a year ago. Notably, all segments recorded solid year-over-year sales in the quarter.

Segmental Performance

Instrumentation: Sales at this segment grew 10.4% year over year to $282.9 million in the third quarter. Increased sales of test and measurement instrumentation, and environmental instrumentation led to the upside.

Operating income surged 45.7% year over year to $52 million on account of higher sales and improved margins across most of its product lines.

Digital Imaging: Quarterly sales at this division increased 10.6% year over year to $244 million. The improvement can be attributed to higher sales of X-ray detectors for life sciences applications and aerospace, defense and MEMS products along with a $23.5-million contribution from acquisitions of the scientific imaging businesses of Roper Technologies, Inc and Micralyne Inc.

Operating income declined 2.6% year over year to $41.2 million due to unfavorable product mix.

Aerospace and Defense Electronics: At this segment, quarterly sales of $177.1 million rose 10.5% from the prior-year quarter, owing to increased sales of defense electronics.

Operating income grew 19.7% year over year to $39.5 million, driven by higher sales and improved margins.

Engineered Systems: Sales at this division grew 11.5% year over year to about $98.2 million in the third quarter on higher sales of engineered products and services, and turbine engines.

Operating income rose 10.4% to $10.6 million on account of higher sales.

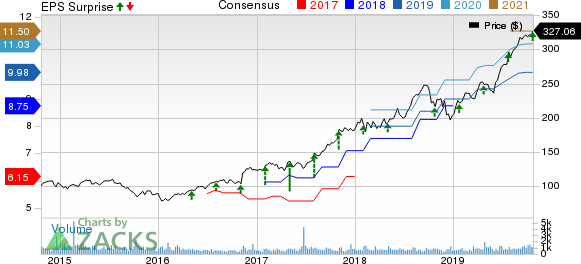

Teledyne Technologies Incorporated Price, Consensus and EPS Surprise

Teledyne Technologies Incorporated price-consensus-eps-surprise-chart | Teledyne Technologies Incorporated Quote

Financial Condition

Teledyne’s cash totaled $128.5 million as of Sep 29, 2019, compared with $142.5 million at the end of 2018. Total long-term debt summed $719.3 million compared with $610.1 million at 2018 end.

Cash provided by operating activities was $150.9 million for the third quarter of 2019 compared with $141.9 million for the third quarter of 2018.

In the reported quarter, capital expenditures amounted to $25.1 million compared with $20.9 million in the year-ago quarter. Moreover, the company generated free cash flow of $125.8 million in the third quarter, reflecting 4% annual growth.

Guidance

Teledyne expects to generate GAAP earnings of $2.71-$2.76 per share in the fourth quarter of 2019. The Zacks Consensus Estimate for fourth-quarter GAAP earnings is pegged at $2.58, lower than the company’s bottom-line expectations.

For 2019, the company raised its earnings expectations from $9.86-$9.96 to $10.37-$10.42 per share. The Zacks Consensus Estimate for Teledyne’s full-year earnings stands at $9.98, lower than the company’s expectations.

Zacks Rank

Teledyne carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Defense Releases

Lockheed Martin Corp. LMT reported third-quarter 2019 earnings of $5.66 per share, which surpassed the Zacks Consensus Estimate of $5.03 by 12.5%. The bottom line also improved 10.1% from $5.14 in the year-ago quarter.

Textron Inc. TXT reported third-quarter 2019 earnings from continuing operations of 95 cents per share, which surpassed the Zacks Consensus Estimate of 85 cents by 11.8%. The bottom line increased 55.7% from the year-ago quarter.

General Dynamics Corporation GD reported third-quarter 2019 earnings from continuing operations of $3.14 per share, which beat the Zacks Consensus Estimate of $3.06 by 2.6%. The bottom line also improved 10.2% from the prior-year quarter’s $2.85.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Teledyne Technologies Incorporated (TDY) : Free Stock Analysis Report

Textron Inc. (TXT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance