Synaptics Inc (SYNA) Reports Mixed Q3 Fiscal 2024 Results, Slightly Exceeding Revenue Forecasts

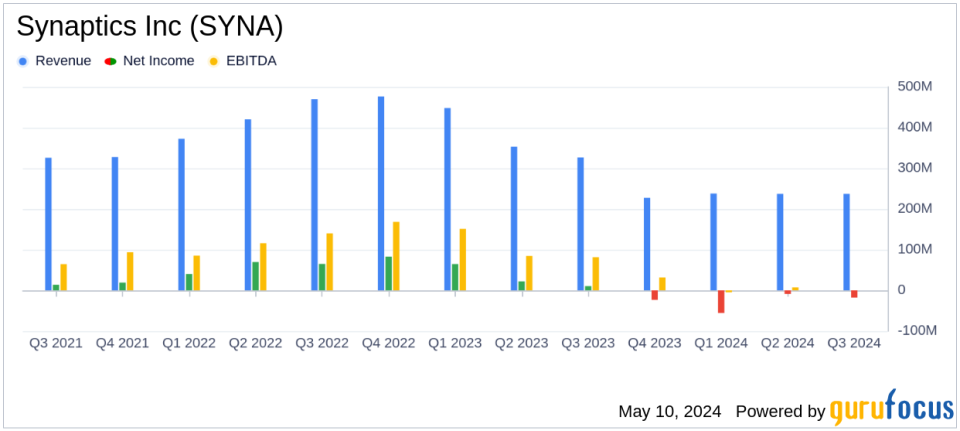

Revenue: Reported $237.3 million, slightly above the estimated $235.17 million.

Net Income: Non-GAAP net income was $21.0 million, surpassing the estimated $19.81 million.

Earnings Per Share: Non-GAAP diluted EPS of $0.53, exceeding the estimate of $0.49.

Gross Margin: Non-GAAP gross margin reached 52.9%, indicating a strong profitability metric.

GAAP Net Loss: Reported a GAAP net loss of $18.1 million, contrasting with non-GAAP positive earnings, highlighting significant adjustments.

Future Outlook: Expects Q4 revenue to range between $230 million and $260 million with a projected non-GAAP gross margin of 52.5% to 54.5%.

Cash Position: Ended the period with $828.1 million in cash and cash equivalents, down from $924.7 million at the beginning of the fiscal year.

Synaptics Inc (NASDAQ:SYNA), a leader in human interface solutions, announced its financial outcomes for the third quarter of fiscal year 2024 on May 9, 2024. The detailed financials can be found in their latest 8-K filing. Synaptics reported a revenue of $237.3 million, slightly surpassing the analyst's expectation of $235.17 million. However, the company faced a GAAP net loss of $18.1 million, translating to a loss per share of $0.46, while the Non-GAAP earnings were more positive at $0.53 per diluted share, aligning with the estimated earnings per share of $0.49.

Synaptics Inc, headquartered in San Jose, California, operates primarily in the semiconductor sector, focusing on innovative human interface technologies for a range of electronic devices. The company's significant presence in China contributes largely to its revenue streams.

Fiscal Performance Insights

The reported quarter saw Synaptics making considerable strides in its Core IoT product area, highlighted by the launch of its AstraTM platform. This launch targets the burgeoning market for embedded edge AI processors, which is valued over $20 billion. Sequentially, the Core IoT revenue surged by 26%, primarily driven by growth in the wireless product family. Despite these advancements, the overall financial health reflected a net loss on a GAAP basis, attributed to various operational and restructuring costs.

The company's balance sheet shows a robust cash and cash equivalents position of $828.1 million as of March 2024, although this is a decrease from $924.7 million in June 2023. This shift indicates significant investment and operational expenditures, including a notable advance payment on intangible assets amounting to $116.5 million.

Operational and Market Challenges

Despite the revenue exceeding expectations, Synaptics faced challenges reflected in the net losses recorded. The GAAP gross margin stood at 46.5%, while the Non-GAAP gross margin was higher at 52.9%, the difference largely due to amortization and share-based compensation adjustments. Operating expenses on a GAAP basis totaled $127.7 million, with research and development costs being a major component.

President and CEO Michael Hurlston noted the stabilization of the business with supply chain inventory levels returning to normal and improving demand conditions. However, he also acknowledged that the recovery pace was slower than anticipated, indicating potential ongoing challenges in scaling operations to meet market demands.

Looking Ahead

For the upcoming fourth quarter of fiscal 2024, Synaptics anticipates revenue between $230 million and $260 million. The projected Non-GAAP gross margin is expected to range from 52.5% to 54.5%, reflecting ongoing efforts to optimize cost efficiencies and enhance product offerings.

The company's strategic focus on expanding its IoT and AI-enhanced product lines is poised to capitalize on new market opportunities, albeit tempered by cautious optimism about the pace of economic recovery and market demand resurgence.

Investors and stakeholders are encouraged to review the detailed financial statements and projections, including the reconciliation of GAAP to Non-GAAP financial measures, to gain a comprehensive understanding of Synaptics' operational dynamics and financial health.

For further details, the earnings call and supplementary materials are accessible on the Synaptics Investor Relations website, providing additional insights into the company's strategic initiatives and financial performance.

Explore the complete 8-K earnings release (here) from Synaptics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance