This the safest investment you can make in 2019

Investment professionals around the world are doing their best not to let last year’s volatility and cautious forecast get the better of them.

But uncertainty will be in the horizon for global markets this year, especially if US President Donald Trump doesn’t reach an agreement with China anytime soon.

So where should investors turn to when everything they seem to touch turns to dust?

The answer: Gold.

“We don’t expect the landscape to change, which should put gold front and centre as a safe refuge this year,” ETF Securities chief executive Kris Walesby said.

What is it about gold that makes it a ‘safe haven’?

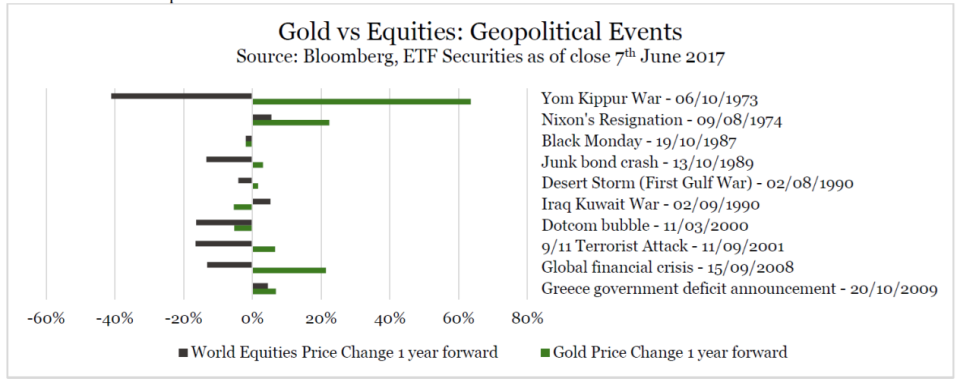

There are two dominant reasons: the first is that gold is negatively correlated with equities – meaning it doesn’t move with stock markets – and the second is that gold protects against shockwaves sparked by geopolitical events.

1. Gold protects portfolios against volatility

The most efficient portfolio is one that takes the least risk whilst making the highest return – to reduce risk, investors tend to diversify within and across asset classes.

“Gold has traditionally been seen as a useful risk reduction tool as it has low or negative correlation with traditional asset classes and historically during periods of extreme economic volatility gold has performed well relative to equities,” ETF Securities co-head of sales Kanish Chugh said.

For example, this December, global equity markets – including Australia’s – performed badly, but gold didn’t. “Having exposure to physical gold can act as a safe haven asset.”

2. Gold shines in tough times

Investors have no shortage of things to be worried about: the US-China trade tensions, Brexit uncertainty, the US government shutdown, the US Federal Reserve’s rate hikes, and general elections across a number of countries (including Australia).

But amongst the chaos, gold often emerges as a strong performer.

“Gold has had an historical tendency to rise during times of crisis and turbulence,” Chugh said.

In this sense, gold provides an ‘event hedge’, which reduces the impact of ‘black swan’ type events that are uncommon but potentially very damaging to a portfolio.

“This is illustrated … where in nine out of ten of the geopolitical events we see a positive return when held within an investor portfolio relative to world equities.”

Is it time to return to the drawing board and freshen up your investment strategy to include the precious metal?

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Read next: Why these super funds are outperforming the rest

Yahoo Finance

Yahoo Finance