Yahoo Finance’s markets and economics outlook snapshot for 2019

A brand new year means long lunches, drinks in free-flow family time, and lengthy outlook pieces about the year ahead.

If you want get yourself up to speed with 2019 forecasts but don’t have time to spare ploughing through several in-depth pieces, this is a short and sweet collection of predictions from some of the best minds in economics, investments and finance in Australia.

Australian property

Politics will have a major influence; first home buyers move into the property market; bank valuations come in under purchase price; Aussies will pay down mortgages more aggressively; there will be fewer auctions; and rental vacancies will rise.

— Starr Partners CEO Douglas Driscoll

For a fuller outline, here are eight property predictions for 2019 in detail. Take a look at the 17 things we learnt about property this year.

Australian economy

Prospects for the Australian economy remain good. The Reserve Bank recently said that GDP growth would be around 31⁄2 per cent on average in 2018 and 2019. And we wouldn’t greatly disagree with the forecasts.

Aussie consumers are spending, underpinned by lower prices and a strong job market. Consumer confidence is above longer-term averages (or ‘normal’ levels’). Household consumption is growing close to 3 per cent – near the strongest annual rate in six years.

Overseas buyers continue to embrace our high quality mining and consumer goods while tourists and students flock ‘Down Under’.

As a result, business conditions and confidence are generally seen as good. Consumers are spending and profits are rising.

Businesses are also ploughing back money into their operations and are investing. Similarly, state and federal governments are actively spending on infrastructure. Transport infrastructure dominates, but the firm population growth rates across the country are necessitating more social infrastructure such as schools and hospitals.

Inflation and wage growth are lifting. In fact there is more evidence of labour shortages and higher wages, especially in the mining sector. Trends in these areas will prove pivotal to whether the Reserve Bank begins ‘normalisation’ – starts to lifts rates later in 2019.

In terms of the Aussie dollar, we think the US Federal Reserve is getting closer to pausing in the rate hiking cycle. At the same time, higher wages are the pre-requisite to higher rates in Australia. US-China trade discussions will also determine where the Aussie is headed. That said, China is already actively stimulating its economy. This time next year, the Aussie is seen closer to US75 cents.

— CommSec chief economist Craig James

And here are the four things JP Morgan predicts will be shaping the Australian economy in 2019.

Australian markets

We expect some of the dominant themes of 2018 to persist into 2019. The strong growth we’ve seen in the United States, which has been pushing up interest rates and inflation pressure, will continue.

On the political side, the trade tension between the United States and China, and the resulting slowdown in Chinese growth will also likely persist. In Europe, moderating growth and potential risks arising from the Italian bond market are also significant, adding to a backdrop of potential risk events for 2019.

Risky sectors: Banking, Mining

Opportunity sectors: Consumer Staples, Outdoor Advertising, FMCG

— Janus Henderson head of Australian equities Lee Mickelburough

Australian shares are likely to do okay but with returns constrained to around 8% with moderate earnings growth. Expect the ASX 200 to reach around 6000 by end 2019.

— AMP Capital chief economist Shane Oliver

Global economy

Volatility will stick around and growth will be slower.

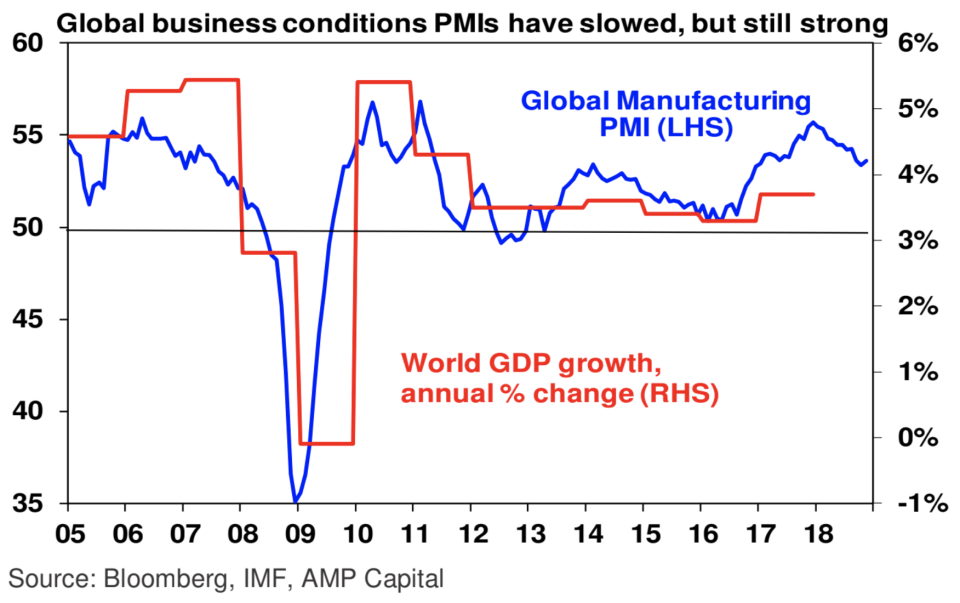

In a big picture sense, the global economy looks to be going through a mini slowdown like we saw around 2011-12 and 2015-16.

With uncertainty likely to remain high around US interest rates, trade and growth, volatility is likely to remain high in 2019 but ultimately reasonable global growth & still easy global monetary policy should drive stronger overall returns than in 2018.

Global growth will stabilise and then resynchronise.

Global growth is likely to average around 3.5% which is down from 2018 but this is likely to mask slower growth in the first half of the year ahead of some improvement in the second half as China provides a bit more policy stimulus, the Fed pauses in raising interest rates, the fall in currencies against the $US dollar provides a boost to growth outside the US and trade war fears settle down (hopefully). Overall, this should support reasonable global profit growth.

Global inflation to remain low.

With growth dipping back to around or just below trend in the short term and commodity prices down inflation is likely to remain low. The US remains most at risk of higher inflation due to its tight labour market, but various business surveys suggest that US inflation may have peaked for now at around 2%.

Monetary policy to remain relatively easy.

The Fed is likely to have a pause on rate hikes during the first half and maybe hike only twice in 2019 as it gets into the zone that it regards a neutral. Rate hikes from other central banks are a long way away. In fact, further monetary easing is likely in China and the European Central Bank may provide more cheap funding to its banks.

Geopolitical risk will remain high causing bouts of volatility.

The main focus is likely to remain on the US/China relationship and trade will likely be the big one. While Trump is likely to want to find a solution on the trade front before tariffs impact the US economy significantly & threaten his re-election in 2020, it’s not clear that this will occur before the March 1 deadline from the Trump/Xi meeting in Buenos Aires so expect more volatility on this issue. Wider issues including the South China Sea could also flare up along with negotiations around Italy’s budget.

— AMP Capital chief economist Shane Oliver

International markets

The US-China trade war will still influence markets around the world.

With two of our close trading partners in the midst of a fierce trade war, Australian market sentiment and investor confidence will largely be driven by the outcome of the 90-day truce between the US/China, which expires on 1 March 2019.

Forecasts on how much tariff-related costs will affect the many US organisations, such as technology companies Apple and Nvidia, who produce and sell in China, are already running into the billions – investors may want to exercise caution when considering investments in US companies exporting to China.

As US markets tend to lead global market sentiment, large losses for big US exporters could spark a global slow down in 2019 – for Australia this could hit our farmers, miners and manufacturers whose products are amongst our biggest global exports.

— CMC Markets head of sales trading Ashley Glover

For a more out-there take on improbable scenarios for 2019, these are Saxo Bank’s annual ‘outrageous predictions’ for 2019.

Author’s note: Some of the quotes have been edited for the sake of brevity. Every effort has been made to ensure the original meaning has not been altered in any way.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance