Is it still a renters' market in your capital city?

Rental prices across houses and units have been fairly steady over last quarter, but with vacancy rates starting to drop the market could be tipping in the landlord’s favour.

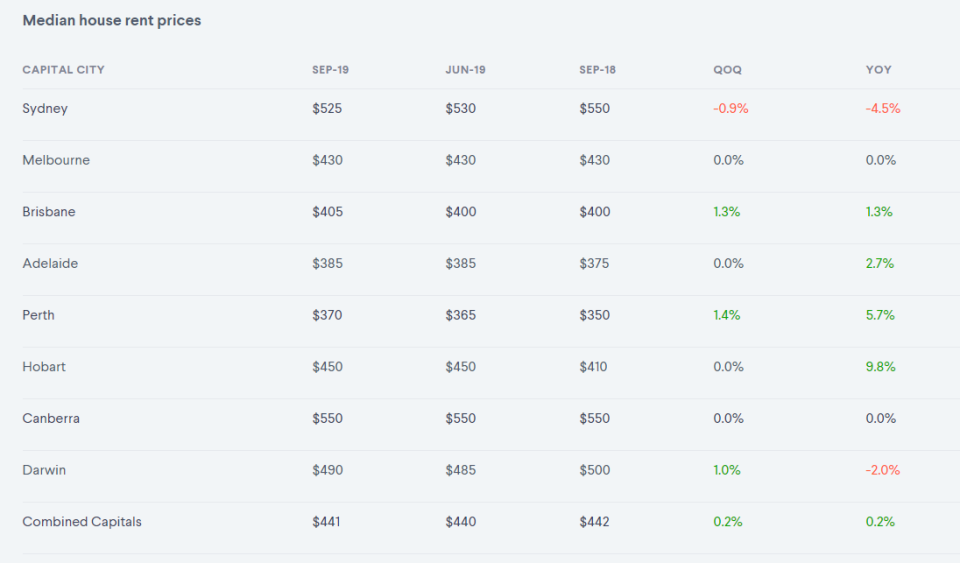

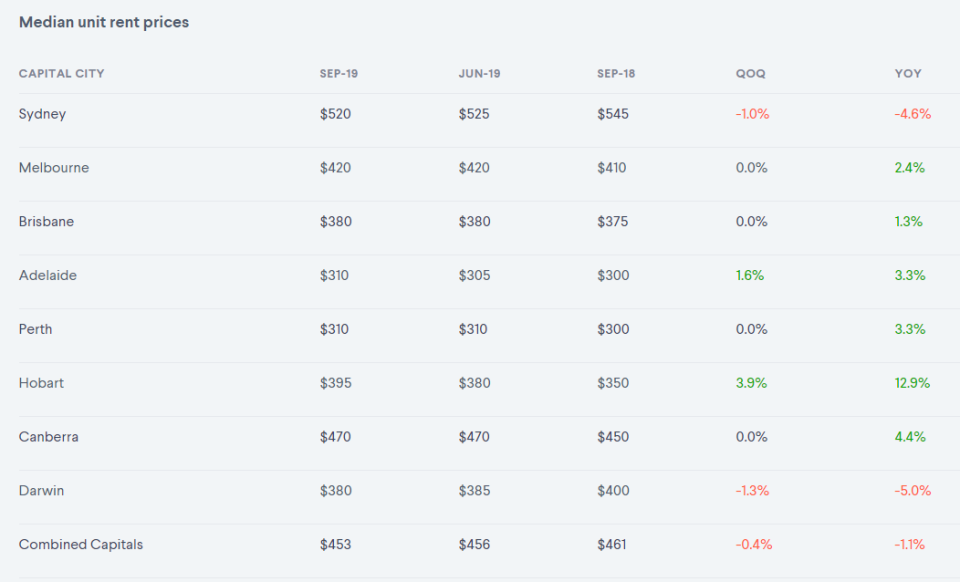

Domain’s rental report shows rents across houses and units nationally held still over the quarter ending September 30, with median weekly asking rents for houses increasing just 0.2 per cent to $441, and decreasing slightly to $453 for units.

But while there’s been minimal movement at the national level, it’s a different story in each state capital.

Sydney

In Sydney, median rent prices are 4.5 per cent below where they were a year ago, reaching $525, and unit rents are down 4.6 per cent over the year to $520.

And though rents fell over the quarter, there were fewer properties to lease.

“The vacancy rate declined modestly, signalling that the rental market is again starting to tighten, and rents could be close to bottoming out,” the Domain report stated.

Melbourne

In Melbourne, median rent prices remained unchanged over the year, and while unit rents were unchanged over the quarter at $420, it still represents a 2.4 per cent increase over the year.

According to Domain, it might be a good time to pivot from renting to owning.

Adelaide

In Adelaide, median rent prices have shown a steady upward trajectory, with median rents for houses up 2.7 per cent over the year to $385 and for units, a similar increase of 3.3 per cent to $310.

Median rent prices increased the most in the central and hills region and in Adelaide’s south due to a combination of slow population growth and minimal investment activity.

Perth

Perth’s rental market has strengthened over the year, which isn’t good news for renters.

But, it could be a sign of a broader turnaround in the Perth property market and the WA economy, Domain stated.

Median asking rents for houses in Perth were up 5.7 per cent over the year to $370, which is the strongest annual growth rate in house rents for over six years.

“In another sign of a stronger rental market, the rental vacancy rate fell by 70 basis points to 2.7 per cent over the past year.” read the report.

Hobart

Hobart is Australia’s tightest rental market, meaning tough conditions for renters who battled the steepest year-on-year increase of all capital cities.

Median house rent prices rose 9.8 per cent to $450 over the year, while unit rents rose 12.9 per cent to $395.

Canberra

Canberra remains the most expensive city to rent a typical house at $550.

But, stabilising rents and the rising vacancy rate may mean the market could tip back in renters’ favour.

Darwin

According to Domain, the Darwin rental market has demonstrated the “most significant boom-and-bust pattern” of the capital cities, with median house and unit rent prices peaking at $700 and $570 per week respectively in 2013, then plummeting to $490 and $380 per week respectively this year.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance