RBA cuts interest rates to 0.10%: What will happen to your savings?

When the official cash rate gets cut, it’s a tale of two Aussies: homeowners rejoice, but savers are left reeling.

Over the last 10 months, savers have taken a 0.90 per cent hit to their savings, and after today’s 0.15 per cent cut to interest rates, Aussie savers could lose more if banks choose to pass that on.

That’s a big issue for Australians who rely on the interest they earn on their savings as an income, like retirees. It also means younger Aussies trying to save up for a house deposit won’t earn as much interest on their savings, pushing their home ownership dreams further and further away.

Gen Z-ers aren’t immune either: with the average Gen Z Aussie saving almost half of their total income, a cut to savings rates will make it tougher for them to bulk up their bank accounts.

“The trend of rate cuts for savers is likely to continue,” Canstar’s group executive of financial services, Steve Mickenbecker, said.

“Savers have been doing it tough and will continue to do so, as the Reserve Bank Governor has indicated the cash rate will stay low for years to come.”

But banks are unlikely to send rates negative, Mickenbecker said. However, this should still serve as a wake-up call for Aussies to search for higher rates.

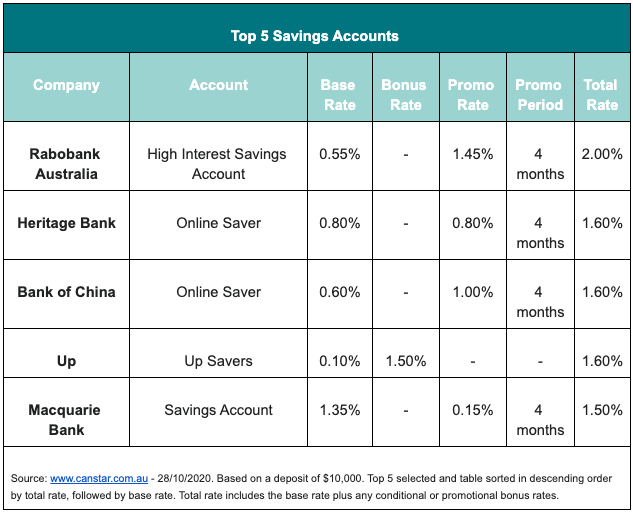

“We may be close to zero percent savings rates but there are still rates of up to 2 per cent available that are government guaranteed up to $250,000.”

What will happen to savings rates at the major banks?

Commonwealth Bank and NAB cut their savings rates in the lead up to today’s cut, but they could cut further.

CBA dropped its introductory rate from 0.80 per cent to 0.70 per cent, and its bonus rate for balances above $50,000 from 0.75 per cent to 0.65 per cent.

NAB reduced its bonus rate from 0.75 to 0.65 per cent also, and its introductory rate was chopped from 0.80 to 0.70 per cent.

“Base rates have been cut to the core so you can now expect bonus rates to start sliding,” Canstar’s editor-at-large, Effie Zahos said. “Keep an eye on what you’re actually earning because in a low rate environment things can move pretty fast with deposits.”

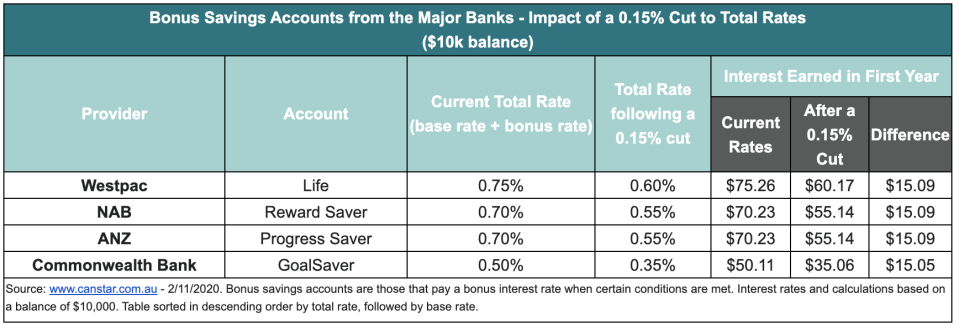

At CBA, bonus rates are currently at 0.50 per cent, which means on a balance of $10,000, Aussies are earning around $50.11 in the first year. Following a 15 basis point cut, that bonus rate will see Aussies earn just $35, or a difference of $15.

At Westpac, the bonus rate is 0.75 per cent, meaning on a $10,000 balance customers are earning $75.26. That could drop to $60 if the banks pass the cut on.

Back in 1981, savings rates averaged 5.93 per cent. They reached an all-time high of 17.25 per cent in October 1989. That would mean savers reap a whopping $1,725 per year on a $10,000 balance.

Here’s what savings rates could look like at the big four banks after the official cash rate cut:

Can savings rates go negative?

Yes, they can.

In Japan for example, the central bank charges commercial banks a fee of 0.1 per cent on a portion of the reserves they keep with it.

But it’s unlikely we’ll see the same thing in Australia.

“I’d think the banks would be afraid of losing depositors if they go negative, particularly given they are getting cheap funding from the Reserve Bank,” AMP chief economist Shane Oliver said.

Canstar’s Mickenbecker said any cuts to savings rate will happen “not to the already near zero per cent base rates, but to bonus rates and introductory rates”.

What are the best savings rates on offer?

Older Aussies hit the hardest

Retirees are losing the most from slashed savings rates, because many use term deposits to store their money safely, and bring in income from the interest they earn.

But with term deposit rates slashed to near-zero as the cash rate falls, they are losing thousands of dollars in income.

“The income from a ‘low-risk’ term deposit cannot meet their cost of living, sending their capital on a downward spiral,” Martin Currie said in an investment update.

This financial stress is exacerbated by the fact that many companies have cut their dividends, or chosen not to pay them out at all, as a result of the economic impact of coronavirus.

On Monday, Westpac declared a final dividend of 31 cents per share, compared with 80 cents it paid last year. That comes just months after it revealed that it would not pay out first-half dividends at all.

Commonwealth Bank’s dividends reduced to 98 cents per share for the half-year, or $2.98 for the full-year. That’s down from $4.31 in 2019.

Savings vs shares

With savings rates this low, Australians may be tempted to enter into riskier investments such as the stock market, where annual returns tend to be much higher than the rates offered by financial institutions.

For example, if you put $100,000 into the exchange-traded fund IOZ back in 2010 you could have earned around $25,000, and received $4,500 in dividends.

But with great reward comes great risk. If the last few months have proved anything, it’s that the stock market is a risky place to be.

The benchmark ASX200 lost billions as the nation went into lockdown, but in mid-October, hit above 6,200 points again - its highest level since 6 March. Now, it’s tracking under 6,000 points once again ahead of the US election.

What else could I do with my money?

If getting into the stock market isn’t your cup of tea, but you’re also not benefiting from a bank deposit, you could think about just spending your money, Zahos said.

“With interest rates so low, you could be better off spending your money,” Zahos said.

“Consider prepaying your regular household expenses, like car insurance and health insurance, as the upfront discounts may be worth more than any interest you would earn on your money sitting in a bank account.”

Then there’s property. There are a few first home loan deposit schemes running at the moment, as well as the HomeBuilder scheme which offers $25,000 to those who build a new home.

Here’s a list of every grant available to each first home buyer in each state.

If you have enough saved to afford a 20 per cent deposit for a home loan, and can access some concessions, now could be a good idea to enter the property market, according to money expert Nicole Pedersen-McKinnon.

But, the time to buy is when you’re ready, not rushed, she said.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, economy, property and work news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance