RBA cuts rates to lowest ever: What your new mortgage looks like

Homeowners with variable home loan rates could see more cash in their pockets, after the Reserve Bank of Australia (RBA) cut the official cash rate to a record low of 0.10 per cent today.

Aussies with variable mortgage rates will save the most they have in decades on their home loans, if banks pass on the cut.

Homeowners with a fixed rate mortgage, could also see some relief, according to AMP chief economist Shane Oliver, due to the combination of low rates and bond-buying by the RBA.

Also read: RBA cuts interest rates to 0.10%: What will happen to your savings?

Also read: House prices predicted to soar after RBA’s ‘historic’ cut

Will the banks pass on the rate cut?

Given the RBA is assisting the banks through cheap financing, there is major pressure for the banks to pass the cut on to customers.

But after the RBA cut rates to 0.25 per cent in March, three of the four big banks didn’t pass anything on to their existing variable rate customers, opting instead to cut fixed rates.

ANZ was the only major bank to pass on a cut of 0.15 per cent to variable rate customers.

“Some banks may argue it’s too hard to pass on the full cut to their existing variable customers because there’s no room left at the other end to cut savings rates,” RateCity research director Sally Tindall said

“However, the Reserve Bank Governor has made it clear he wants genuine relief for Australian homeowners and it’s likely the central bank will start offering cheaper funding in a bid to help lenders achieve this.”

Has your bank passed on the interest rate cut?

Athena Home Loans has passed on the entire rate cut to new and existing customers, bring variable rates to 2.19 per cent for owner occupiers (principle and interest), and 2.54 per cent for investors.

Commonwealth Bank has passed on a 100 bps reduction to 1.99 per cent per annum four its four-year fixed rate home loans; two-and three-year fixed rate home loan for owner occupiers have been reduced to 2.14 per cent per annum; and new one-year fixed rate home loans are 2.19 per cent per annum.

Westpac has reduced its fixed rates for home loans. Four-year terms for owner occupies customers are reduced to 1.99 per cent, and one, two and three-year terms have been reduced to 2.09 per cent.

None of the big four banks have passed on the rate cut yet. Yahoo Finance will update this chart once the banks make their announcement.

What’s my new home loan rate?

Since May 2019, the cash rate has dropped from 1.50 per cent to 0.25 per cent. But, the big four banks have passed on an average of 0.86 per cent in total.

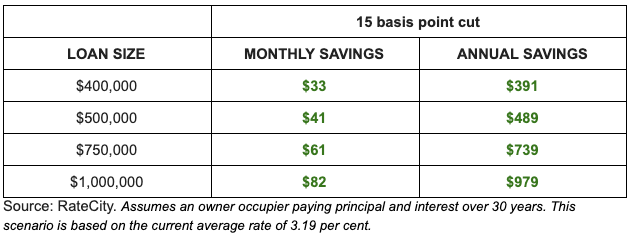

The average variable interest rate is currently 3.19 per cent, with a 15 basis point cut taking the average rate to 3.04 per cent.

That means owner occupiers could save up to $979 per year on their home loans, should the banks pass on a 15 basis point rate cut, depending on the size of their mortgage.

For a home loan of $400,000, Aussies stand to save $33 per month, or $391 per year. Over the course of a 30 year home loan, that’s a total saving of $11,730.

For home loans of $500,000, Aussies will save $41 per month or $489 per year. That increases to $61 for home loans of $750,000, or $739 annually, and $82 for home loans of $1,000,000, or $979 annually.

Here are the potential savings if banks pass on predicted 0.15% cut:

Around 2.9 million Australians are mortgage holders, and one-in-three are looking to refinance over the next year, Finder data reveals. In fact, 5 per cent plan to refinance in the next month, and one-in-ten plan to refinance within the next two to six months.

“The pandemic has made people assess where every dollar they earn goes and refinancing a mortgage can lead to a huge leap in savings,” Finder insights manager, Graham Cooke, said.

Currently, the big four banks are offering sub-3 per cent home loans.

Commonwealth Bank is offering 2.69 per cent for variable home loans, and 2.29 per cent for two or three-year fixed mortgages.

Westpac has a two-year variable rate offer of 2.19 per cent, and then 2.69 per cent after that. For fixed loans, the rate dips to 2.19 per cent.

ANZ has the highest variable rate at 2.72 per cent, and 2.29 per cent for fixed loans, while ANZ is offering 2.69 per cent for variable loans, 2.19 for two-year fixed loans and 2.29 per cent for three-year loans.

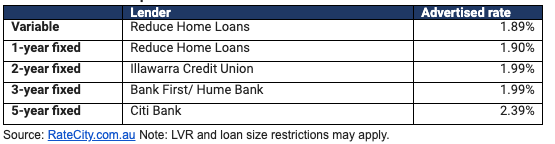

What are the lowest home loan rates on the market?

Reduce Home Loans offers a 1.89 per cent variable rate, and a 1.90 per cent one-year fixed rate.

Those are the two cheapest loans on the market. Illawarra Credit Union offers a two-year fixed rate of 1.99 per cent, and Bank First offers a three-year fixed rate of 1.99 per cent. Citi Bank offers a five-year fixed rate of 2.39 per cent.

Here’s a chart:

Should I fix my home loan?

With interest rates at record lows, it’s never been cheaper to repay a home loan. The big question now is whether you should fix your home loan at these lows, or hope they go down further.

“While now wouldn’t be the silliest time to fix, fixing isn’t for everyone,” Tindall said.

“Fixed loans are less flexible, with caps on extra repayments, limited or no access to an offset account and break fees if you want to get out early.

“If you are thinking about fixing, think through the pros and cons carefully before locking yourself in.”

That means looking at your finances over the next few years. If you need certainty, and can afford the fixed rate, that might be an attractive option.

Here’s what else you should think about when deciding whether to fix your mortgage.

You can also opt to split your home loan, which means fixing a portion of it while keeping the remainder on a variable rate.

“This way, you can reap the benefits of a variable rate while enjoying the security that a fixed rate offers,” Finder money expert Bessie Hassan said.

But regardless of whether you choose to fix your loan or not, there are plenty of competitive rates on offer.

“If you aren’t in a position to refinance right now, it’s still worth negotiating with your current lender,” Tindall said.

“Find out what rate they’re offering new customers for the exact same loan and ask them, as a loyal customer, to match it.”

I’m about to refinance my home loan. Are cash back deals worth it long-term?

With interest rates becoming increasingly competitive, banks are offering customers cash back in return for choosing their product.

This year, 29 lenders are offering between $1,000 and $4,000 cash back to homeowners who refinance their home loans and become a customer of the lender.

All of the big four banks are offering cash back loans at the moment. If you refinance to a CBA or NAB variable loan, you could get $2,000 back. Westpac and ANZ are offering $3,000. Suncorp, St George and BankSA are the only lenders offering cash back deals of $4,000.

“Banks are increasingly offering sign-up specials on their lowest rate loans, making them far more competitive than they used to be,” Tindall said.

And while it sounds like a tempting offer, buyers should be careful.

“While a low ongoing rate typically trumps a sign-up special over the longer term, if you’re someone who refinances regularly, and knows how to drive a hard bargain on rate and fees, you could end up ahead in the first couple of years.”

“Don’t just assume you’ll be better off with a cash back special. Do the maths yourself to work out if the whole package is going to put you ahead or leave you in the red,” Tindall said.

Here’s how the cash back deals compare against refinancing to the lowest rate lender on the market:

If you chose to refinance with CBA and reap the $2,000 cash back, you would be paying $2,280 extra over two years, and $8,052 more over five years, when compared to the lowest rate lender.

If you chose to refinance with Westpac, you’d earn $3,000 cash back, and save $2,843 over two years, and $910 over three years. The Westpac loan becomes less economic across five years, where customers end up paying $2,813 more when compared to the lowest rate lender.

In fact, all loans with cash back offers became more expensive than the lowest rate lender after five years.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and economy news and more.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance