The property hotspots worth investing in despite coronavirus

The shockwaves of the coronavirus crisis will no doubt affect the Australian property market, which had until recently returned to record highs – but that doesn’t mean Australians should turn their backs on property investing altogether.

Experts have tipped some property markets as less impacted than others by the Covid-19 pandemic, and have a track record of beating the value growth of capital cities.

“The leading markets in Australia for price growth over the past two years have been regional Victoria and regional Tasmania,” hotspotting.com.au managing director Terry Ryder told Yahoo Finance.

Also read: 10 regional property hotspots set to boom

Also read: This map shows where house prices have risen the most in 3 years

Also read: Why now is the right time to buy a house

“Regional areas like these attract both home buyers and investors because they offer much cheaper prices, higher rental yields and good prospects for growth if you buy in the right locations. A good regional purchase, therefore, can be a win-win-win situation.”

“I think now is a very good time for investors to be looking at buying … those able to think and act independently from the herd will find opportunities to buy well.”

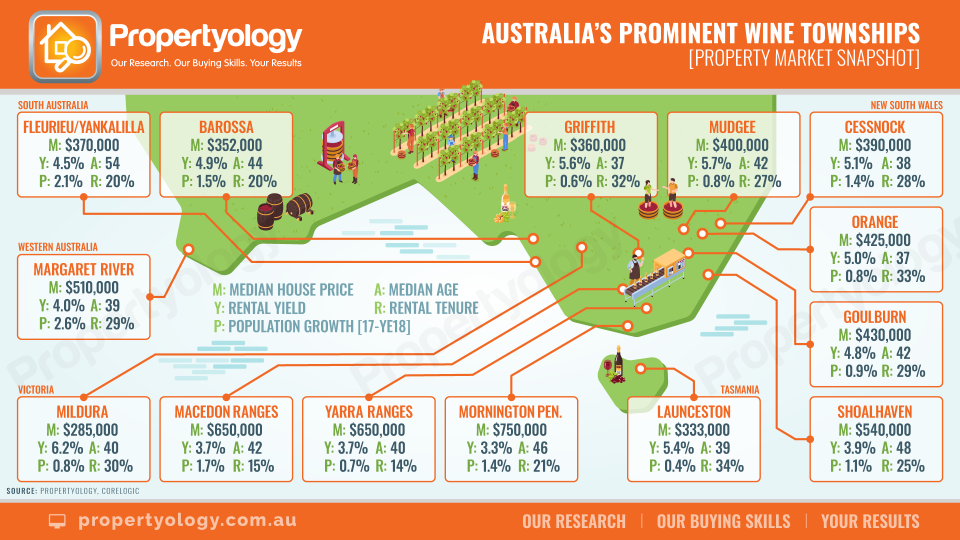

According to Propertyology head of research Simon Pressley, there are 14 wine regions where property price growth is slated to outperform that of Sydney’s.

“I’ve run the numbers and these regions smashed Sydney on both price growth and rental return – and indications are it’s set to continue,” said Pressley.

“Over the last 20-years, the 6.9 percent average annual rate of capital growth for a Sydney house was inferior to the municipalities of Cessnock, Goulburn, Launceston, Macedon Ranges, Mornington Peninsulas, Mudgee, Shoalhaven, Yankalilla and Yarra Ranges. The 6.4 percent average annual capital growth for Orange is similarly impressive,” he said.

Other areas earmarked for reliable property price growth are Mildura, Margaret River, Griffith, and Barossa.

“The property markets of these wine regions are also significantly less volatile than Sydney. While Sydney produced five calendar years of median house price declines during the last two decades, 12 out of these 14 wine regions saw price declines in only one to four years.”

On top of that, these regions that have one key advantage that could see the areas boom during self-isolation.

“Domestic consumption of wine actually accelerates during quarantine periods.”

He added that while domestic and international travel had temporarily halted due to social distancing restrictions, these areas will certainly bounce back when restrictions are lifted.

“Once it’s declared safe for Australians to come out of our cocoons, Propertyology anticipates there’ll be a big release of pent-up demand for all sorts of goods and services that we had to go without, including domestic tourism,” Pressley told Yahoo Finance.

“Post quarantine, large stimulus packages to supercharge the economy combined with record low interest rates will release the ‘pause button’ on property markets and quite possibly create a strong bounce as occurred in 2009-10 after the global financial crisis stimulus.”

Ryder told Yahoo Finance he favoured the wine regions of Orange, the Hunter Valley, Mudgee, Shoalhaven and Goulburn.

What’s driving property price growth in wine regions?

According to Pressley, the local economies of wine regions are driven by a few factors: viticulture, or wine-growing, as well as food manufacturing and strong tourism.

And those who are drawn to living in wine regions are people from all walks of life, he added.

“The demographics of these vibrant vino wonders include a mix of multigenerational farmers, some affluent white-collar professionals who have elected to escape stressful city life, creative artistic types, and some retired baby boomers who can finally rid themselves of the rat race.”

Additionally, home ownership rates in these areas are higher than the national average – yet the homes still remain “quite affordable”.

“One can buy a quality three- or four-bedroom house on a quarter-acre block that’s in a desirable and centrally located street for circa $400,000 in great regional cities like Orange, Launceston, Cessnock and Griffith.

“Unlike Australia’s big congested cities, many of these regional locations have a lower portion of their workforce in the construction industry so housing supply volumes are more consistent.

“There’s no such thing as high-rise apartments or passenger rail, and urban sprawl often isn’t a big issue. Consequently, local property markets don’t suffer from the volatility caused by significant peaks and troughs in dwelling construction volumes.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Follow Yahoo Finance Australia on Facebook, Twitter, Instagram and LinkedIn.

Yahoo Finance

Yahoo Finance