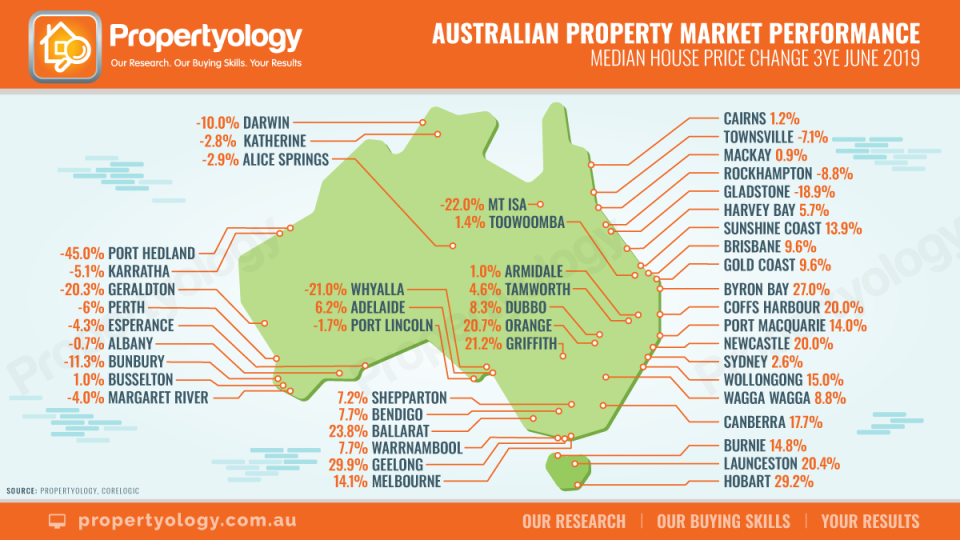

This map shows where house prices have risen the most in 3 years

Property markets in Australia are a mixed bag, with house price growth in some cities rising dramatically while others have fallen just as startlingly.

For instance, property investors who placed their bets in Geelong or in Hobart three years ago will be rewarded for it handsomely, with median house prices in these cities rising by 29.9 per cent and 29.2 per cent respectively.

According to Propertyology, property investors who purchased a dwelling in Byron Bay or Ballarat will also be pleased with their purchases as house values rose by 27 per cent and 23.8 per cent in the last three years.

Related story: Housing market sprints ahead as buyers urged to get in now

Related story: House prices to hit near-peak levels by 2021

Related story: Property investors flock to Sydney once again

However, it’s a very different picture for Port Hedland and Geraldton property investors, who would have seen their house values fall by 45 per cent and 20.3 per cent on average.

In June 2016, Mount Isa and Whyalla would have been bad investments too, with median house prices falling 22 per cent and 21 per cent since then.

Geraldton (-20.3 per cent) and Gladstone (-18.9 per cent) would have resulted in losses, too.

Here’s a look at how 48 property markets in Australia fared in the last three years:

Breaking it down: Regional property markets perform best

Speaking to Yahoo Finance, Propertyology managing director Simon Pressley said that Australians’ knowledge of regional property markets was “appalling” and “far from reality”.

“The single biggest myth in real estate is that population growth has the biggest influence on property prices (completely not true). The second biggest myth is that capital city property markets perform better than non-capitals (regional locations,” said Pressley.

“Without exception, there have always been (and will continue to be) real estate markets in parts of regional Australia which perform better than capital cities every single year.”

In the last 3 years, cities like Burnie and Launceston have outperformed Brisbane, Perth, Adelaide, Sydney, and Darwin, he pointed out.

“Orange (20.7 percent), Griffith (21.2 percent), Geelong (29.9 percent), Coffs Harbour (20 percent) and Ballarat (23.8 percent) have been among Australia’s best-performed property markets over the last 3 years,” Pressley added.

“Conversely, weak economic conditions in Queensland, Western Australia South Australia and NT in recent years have contributed towards the poor performance of regional property markets in their respective states. That said, the opposite may occur in future years.”

Economic conditions are much better in some parts of regional Australian than what many capital city residents realise: the lifestyle can be “exceptional”, and city-dwellers are moving as a result, Pressley said.

“Our analysis of internal migration data confirms that an increasing number of people are relocating away from expensive congested cities.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance