Should you pay down your mortgage or invest?

The investing versus paying down your mortgage debate has sparked again with the recent fall in interest rates.

Related story: This $900k home has a pool in the kitchen

Related story: 5 Brisbane property hotspots home buyers should know about

Related story: The $150,346 rort your big bank doesn’t want you to know

The appeal of owning your home outright is top of the financial priority list for most people. Indeed, it’s usually better for homeowners to pay down a mortgage until they are comfortable covering monthly repayments and have a significant buffer in their offset account.

However, mortgage interest rates are now under 3 per cent and likely to fall further and mortgage repayments are becoming less of a financial burden on homeowners who have already paid down a large chunk of their mortgage.

Some homeowners will be looking at other investment possibilities to get their cash earning more for them. Should homeowners think about other investments instead of continuing to pay off their mortgage? If so, what should they consider and how will investing benefit their wealth position?

The simple math

A good example is if you have a mortgage of $100,000 and are paying $3,000 per year in interest (3 per cent), you would need to find an investment that earns a higher return than 3 per cent per year to be better off investing than paying down the mortgage (or adding to the offset account).

Should I buy a term deposit?

The short answer is no. It may seem like the safe option to put the extra money you have in savings or a TD, but you’d be worse off compared to paying down your mortgage (or adding to your mortgage offset account).

Term deposits currently pay around 2 per cent, this is less than a typical mortgage rate of 3 per cent so you’d be locking in a loss of 1 per cent per year. The interest earned on a term deposit will be taxable income if you are employed, whereas there is no tax deduction for interest on owner occupied home loans.

What investments should I consider?

If you want to invest instead of paying down your mortgage (or adding to the offset account), it only makes sense to consider investments which can achieve at least the same return as your mortgage interest rate.

Investments like Australian shares, international shares, bonds and gold have all exceeded the average mortgage interest rate over the long run.

Investing is a long-term play

You should only consider investing if you can do it for the long-term. The day-to-day market fluctuations of the sharemarket become much less relevant over time, so the decision to invest should be based on a long-term horizon.

As we always say at Stockspot, the longer you invest, the better your chance of success.

Also, because some of these asset classes do well at the same time that others do poorly it is a safer strategy to invest in a balanced portfolio with a mix of different assets. A diversified investment portfolio has earned 6-9 per cent over the long run and is much less risk than just owning shares for example.

We believe low-cost ETFs are the best and safest way to diversify your money across investments. It’s also important to keep your costs low when you invest as everything you pay in fees nibbles into your returns. This is particularly pertinent if you also have a mortgage.

Should I buy an investment property?

Q: What’s better than one property?

A: Two properties!

In Australia it’s almost seen as a rite of passage into adulthood to own a rental property. You might consider using your excess savings to invest in another property. The tax advantages of negative gearing can be attractive. It’s been a popular strategy in Australia but it’s risky as it concentrates your assets into one investment class and increases your debt as you’re likely to take out another mortgage.

Negative gearing means that more of your cash is spent on interest, and maintaining and managing a property than the rent received. According to SQM Research gross yield (rent income) received for houses in Australia is 3.2 per cent and for units 4 per cent. Even in a low interest rate environment it is easy to see how maintenance costs can exceed rental returns.

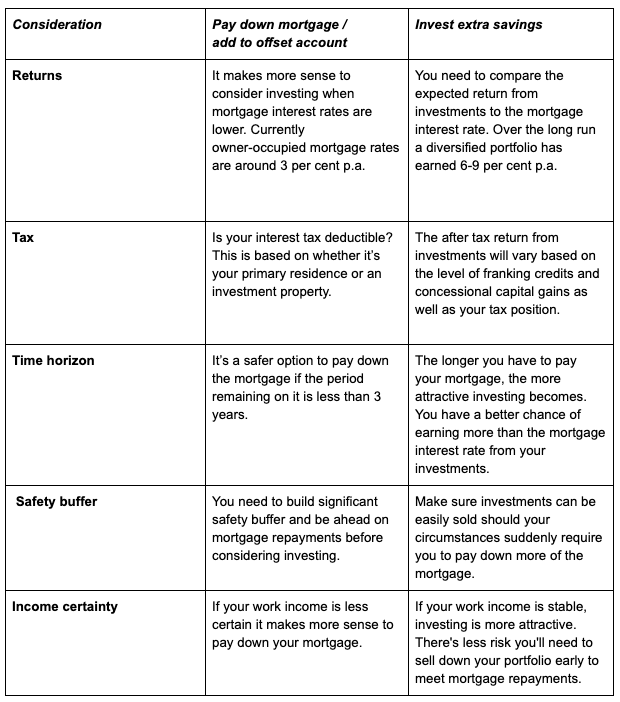

Factors to consider

If you’re lucky and your mortgage repayments are no longer a difficult financial burden, and you have spare savings available, there are options available to you. Rather than paying off the mortgage as quickly as possible, it may be a smart strategy to diversify your wealth across different investments.

Both paying down your mortgage and investing will result in increasing your savings so both are going to be positive for your overall wealth. The main difference is that paying down your mortgage will reduce your debt (borrowing) whereas investing will diversify your overall wealth and income.

There are other factors to think about such as your lifestyle, your risk tolerance and of course your marginal tax rate. The appeal of owning your home outright asap may be more important to you than earning a better return by investing.

Checklist

Here’s some of the key things you need to think about:

Chris Brycki is the Founder and CEO of Stockspot.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance