The $150,346 rort your big bank doesn’t want you to know

Six years ago, when the Big 4 started really going rogue on rates, I developed an Interest Integrity Index to catch them at it.

And have I ever.

Back in 2013, the cost of lifetime loyalty to a big bank, as opposed to the cheapest bank or institution, was $78,948. That’s horrifying enough.

Until you realise that today, our money monoliths are slugging the average Aussie with over-the-odds interest on their mortgage, personal loan and credit card debt of close to double that amount… $150,346.

That’s almost twice the $85,000 average annual wage.

Related story: How to save more cash when savings rates are this low

Related story: The banks offering sub-3% home loan rates

Related story: Savings accounts that return 2% or more

It would fund a comfortable retirement nearly 3.5 years early, according to the Association of Superannuation Funds of Australia (priced at $43,601 for a single).

It’s like throwing away a Maserati GranSport.

In the past six years, despite the Reserve Bank slashing official interest rates from 2.5 percent to a record low of 0.75 percent, the Big 4 have hoarded and hiked at whim.

Of the three RBA cuts this year, 0.75 percent’s worth, the big banks have delivered mortgage holders just 0.57 percent.

But going further back to when I developed my index of ‘rate rorts’ six years ago, the banks were charging 3.31 percentage points over and above the cash rate, exclusive Mozo data for my index reveals.

It’s now leapt to a profiteering 4.05 points.

Worse than all that, though, Mozo says our big banks are now a crazy 2.21 points more expensive than the – note fierce – competition. You used to pay only a 1.42-point premium.

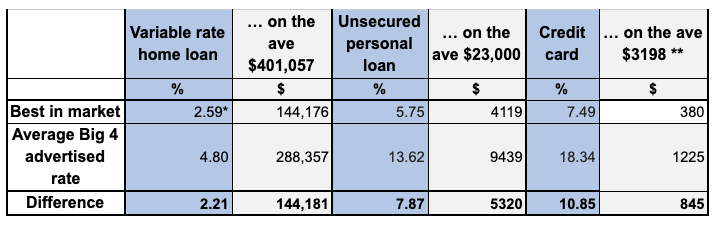

Indeed, you could be on a mortgage interest rate of just 2.59 percent as opposed to 4.8 percent. And pocketing $144,181 on the average $401,057 home loan, the value of which is up 34 percent from $299,700 in 2013 (with apologies if you’re in Sydney or Melbourne and those averages make you feel like crying!).

With some 80 percent of Australia’s $2 trillion residential mortgage market held with a big 4 bank, last week the federal government announced an ACCC inquiry into this very thing. But in virtually the same breath Ministers confirmed they’re not prepared to legislate to compel conformity.

“We don't plan on abolishing profit… a profitable banking sector is in everyone's interests,” Senator James Paterson, chair of the parliamentary joint committee on corporations and financial services, said.

Except that it’s not. It’s in shareholders’ best interests.

Senator Paterson continued: “I don't think it's unreasonable to ask them [the banks] to demonstrate to the public and the government… the way that they make the decisions that they do. And for them to reflect on those decisions.”

So expect knuckles to be barely rapped. But if you’re a customer, realise that making savings is up to you.

You can – yourself – slash the cost of the typical $23,000 personal loan (based on the average search on mozo.com.au) by $5320; swap the 13.62 percent big bank rate for the market-leading 5.75 percent from Symple Loans (depending on the borrower, loan size and term).

Equally, if you are paying the average big 4 credit card rate of 18.34 percent, know that this has increased as rates have plummeted – such that on the now-smaller average $3198 balance, you’re still paying $845 excess interest. That’s based on the cheapest, 7.49 percent credit card, from G&C Mutual Bank.

The big one, though, is your mortgage. At least ask a bank for a discount; in secret they are giving some customers the equivalent of four rate cuts off the advertised variable rate.

But remember you could instead secure yourself nearly nine rate cuts – instantly.

That 2.59 percent, $144,181-saving home loan I mentioned earlier? It’s available to borrowers with a 20 percent deposit, from Reduce Home Loans. (You can get 2.79 percent with only a 10 percent deposit, if you are a first homebuyer, from G&C Mutual Bank.)

Don’t forget that mortgage exit fees were abolished way back in 2011 so you have nothing to lose from a switch… and $481 a month to gain.

Nicole Pedersen-McKinnon is a financial educator and commentator, and the author of How to get mortgage-free like me, available from November 16 at www.nicolessmartmoney.com.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance