Montauk Renewables Reports Q1 2024 Earnings: Revenues Surge but Miss Analyst Expectations

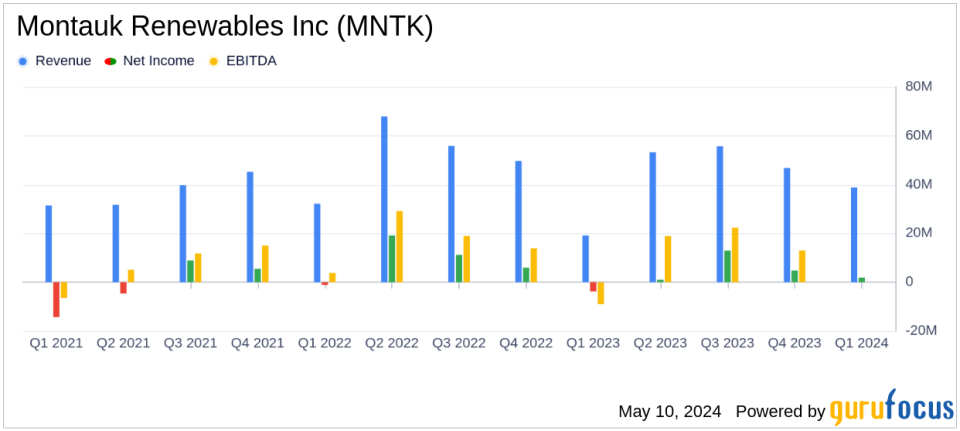

Revenue: $38.8 million, a significant increase of 102.5% year-over-year, falling short of the estimated $44.92 million.

Net Income: $1.9 million, showing a substantial improvement from a net loss of $3.8 million in the same quarter last year, but below the estimated $3.68 million.

Earnings Per Share (EPS): Reported EPS of $0.01, meeting the estimated earnings per share of $0.01.

Adjusted EBITDA: Reached $9.5 million, a significant increase of 212.7% compared to the first quarter of 2023.

RNG Production: Slightly increased by 4.4% to 1.4 million MMBtu compared to the previous year.

RINs Sold: Experienced a sharp rise of 167.5% to 7.9 million, indicating strong market activity.

Operating Income: Turned positive at $2.4 million, compared to an operating loss of $14.2 million in the first quarter of 2023.

On May 9, 2024, Montauk Renewables Inc (NASDAQ:MNTK) disclosed its financial outcomes for the first quarter ended March 31, 2024, through an 8-K filing. The company, a leader in renewable energy specializing in biogas recovery and conversion, reported significant year-over-year revenue growth, yet fell short of market expectations.

Financial Performance Overview

Montauk Renewables showcased a robust increase in its financial metrics compared to the first quarter of 2023. The company's revenue soared by 102.5% to $38.8 million, up from $19.2 million. This increase was primarily driven by a strategic shift in the self-monetization of Renewable Identification Numbers (RINs) and a 61.7% rise in realized RIN pricing. Despite this impressive growth, the revenue fell short of the analyst expectations of $44.92 million.

The net income experienced a substantial rise, reaching $1.9 million, a stark contrast to a net loss of $3.8 million in the previous year. This translates to an earnings per share of $0.01, aligning with analyst estimates. Additionally, Montauk reported a significant improvement in its Adjusted EBITDA, which stood at $9.5 million, marking a 212.7% increase from the prior year.

Operational Highlights

Operationally, Montauk Renewables reported a slight increase in RNG production, totaling 1.4 million MMBtu, up by 4.4% year-over-year. The company also highlighted the successful commissioning of the last expansion of its Pico digestion capacity project, which contributed to a 39% increase in MMBtu production compared to Q1 2023.

Strategic Developments and Market Dependence

The company's profitability remains highly dependent on the market prices of environmental attributes, particularly RINs. Montauk strategically withheld some RINs from transfer in Q1 2024, resulting in approximately 3,351 RINs in inventory. This decision is a part of its broader strategy to navigate the volatile market for RINs effectively.

Challenges and Forward-Looking Statements

Montauk Renewables faces challenges related to market dependency and operational risks. The company's future performance is contingent upon several factors, including market prices for RINs and the successful execution of strategic initiatives such as the feedstock supply agreements aimed at expanding hog space access.

The company has reaffirmed its 2024 full-year outlook, expecting RNG revenues to range between $195 million and $215 million, and renewable electricity revenues anticipated to be between $18.0 million and $19.0 million.

Conclusion

Montauk Renewables' first quarter of 2024 demonstrated significant revenue growth and a return to profitability. However, the company's performance fell short of analyst revenue expectations, highlighting the challenges of market volatility and strategic decision-making in the renewable energy sector. Investors and stakeholders will likely watch closely how Montauk navigates these challenges in the upcoming quarters.

For more detailed information and to follow Montauk's progress, visit their investor relations page at Montauk Renewables Investor Relations.

Explore the complete 8-K earnings release (here) from Montauk Renewables Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance