What you can actually do if you’re stressed about your finances

Most Aussies think they’re good with money – and yet we’re losing sleep over our finances.

According to a 2019 Choosi Dollar survey of 5,000 Australians, nearly four-in-five of all Australians see themselves as ‘money-smart’, but nearly half (47 per cent) are worrying about money on a weekly or daily basis.

Related story: Stressed about your finances or your mortgage? There’s an app for that

Related story: Here’s an alternative way to deal your with financial stress

Related story: 9 things Australian financial advisers wish you knew

Worryingly, more than three-in-five (62 per cent) say they are struggling with the cost of living.

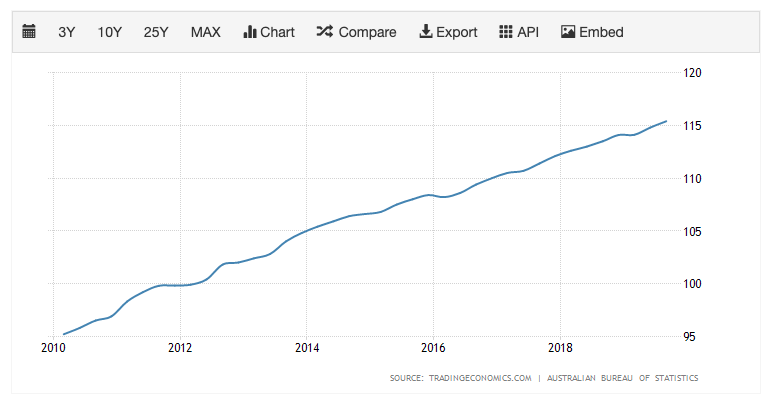

And there’s good reason for it: wage growth is at a standstill, while the consumer price index – which tracks the cost of typical household goods – has been steadily rising.

So what can we actually do about it?

According to social researcher and ‘Hello Gen Z’ author Claire Madden, there are five things we can do if we’re feeling stressed about our money:

1. Train yourself up

There’s no way of getting around it: if you’re looking to get more financially literate, Madden recommends taking a financial acumen course or training – but this doesn’t have to cost you.

“It is easier than ever to access online resources, blogs, articles and podcasts to learn about finances,” she told Yahoo Finance.

“While this is a great starting point, it is when we take the time to dive deeper in our learning that we can move from 'financial information' to 'financial wisdom'. Taking the time to do a course about finances and talking to those who have a proven track record in financial wisdom can add layers to our understanding we would otherwise miss.”

2. Get appy

Knowledge is power – so you’ll need to see where your money is going. Use budgeting or saving apps to monitor your spending habits, Madden said.

“Particularly for our Gen Zs who have grown up in a digital era and an increasingly cashless society, it can be difficult to grasp the value of money, and with frictionless transactions and regular automatic deductions it has become effortless to spend money.

“While this has greatly increased convenience, it can be far too easy to spend more money than we have available. Making use of budgeting apps and tools can be a great way to track and manage expenses in our increasingly cashless society."

3. Swap notes with people you know

According to Finder data, Aussies don’t actually tend to turn to the money experts when it comes to financial advice: instead, 42 per cent of us prefer to speak to a family member for money help.

And it’s no wonder, we trust the people we know and especially older generations who can pass down their wisdom. But the key is to take advantage of this, Madden said.

“Many wealthy families actually lose their wealth by the time it has been passed down to the second or third generations, and this may be because while they pass on the wealth, they don't take the time to pass on the keys to managing and growing wealth,” she said.

“Whether it be friends, parents, neighbours or colleagues, we can all learn from the people around us. If you know someone who has excelled in financial management, don't be afraid to ask their advice on your next steps!"

4. Review your insurance

Are you familiar with what your insurance covers? Make sure you take the time to shop around and pick a policy that’s right for you before you buy it.

“People often only realise the true value of your insurance when it comes time to make a claim,” said Madden.

“Be proactive, ask questions, get advice, do your research and make sure you are comfortably covered.”

5. Speak to an adviser for your financial decisions

Getting reliable financial information – freely available online and to the general public – is not the same as financial wisdom, which is tailored insight and understanding that helps you figure out what to do next, according to Madden.

“Accessing trusted advisers is a way that people can help make sense of all the options and know what their next step can be.”

What else can you do?

When it comes to financial stress, there are two issues at play: the money problems, and the stress itself.

Headspace has rolled out some meditations specifically aimed at tackling the stress, while the Financial Mindfulness app aims to tackle both at once.

The app both addresses the way stress is handled as well as using a mix of financial literacy, goal-setting and positive reinforcement to create new behaviours for money management.

UK-based finance management website Pound Place released a flow-chart that can help you better understand how stressed you really are.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance