Are you one of 16.7m Aussies who don’t know what the interest rate is?

The Reserve Bank of Australia cut the official interest rate from 1.5 per cent to 1.25 per cent in June, and then again in July to 1 per cent.

And now, experts are speculating that the Reserve Bank of Australia will cut again in September and November.

But for the majority of Australians, this means absolutely nothing.

A new survey from Finder of more than 1,000 respondents showed that 86 per cent of Aussies – the equivalent of 16.7 million – were oblivious about the new cash rate.

Related story: Yes, the RBA will cut interest rates again – but when?

Related story: Has your bank passed on the RBA’s back-to-back interest rate cut?

Related story: It's been two months since the RBA started cutting rates, here's what you should have done by now

More than half of Australians (56 per cent) think the cash rate is higher than it is, with 13 per cent assuming the cash rate is between 5-10 per cent.

And it seems men are slightly more clued in than women when it comes to the cash rate, with only 10 per cent of women and 18 per cent of men able to correctly identify it.

Why does the interest rate matter to me?

Lower interest rates spell good news for mortgage holders, home buyers and small business owners, but not so much for retirees or savers.

For mortgage holders, it means paying less interest on repayments – if the banks pass on the rate cut.

And with lower interest rates, a rate cut also means borrowers can borrow more money, which means property buyers are more willing to come out of hibernation and enter the housing market, which pushes up property prices.

Small business owners also generally benefit from a rate cut, as the interest on their debts will go down. And when there is more confidence in the economy, consumers are more likely to spend, which means more money flowing through to small businesses.

However, for retirees – or those whose income comes from the interest on their savings – a rate cut means less money to live on.

And if you’re going on holiday, rate cuts push the Aussie dollar lower, meaning less bang for your buck when you’re overseas.

This still has nothing to do with me

The national interest rate has implications for the broader economy. The RBA’s recent cuts are designed to help stimulate the economy precisely by freeing up Aussies’ wallets and promote more spending, which injects more money into the economy.

More money in the economy means a rise in the inflation rate, which the RBA sorely wants right now (Australia has been undershooting underlying inflation targets for years, according to AMP Capital’s chief economist Shane Oliver). Some inflation is good – 2.5 per cent is the optimal target, but Australia is currently at 1.6 per cent.

When inflation is too low, the RBA will try to stimulate job creation in a bid to increase wages – which should in turn increase inflation.

But the problem is, wages aren’t rising, meaning we need more hands-on economic policies from the government, Centre for Future Work economist and director Jim Stanford told Yahoo Finance.

So, while there are some positive economic signs, the Australian economy is still in a bit of a pickle right now, which is precisely why the RBA is cutting rates and why the Coalition is providing those coveted tax sweeteners.

Mortgage holders need to take note

Finder money expert Bessie Hassan said keeping on top of the cash rate is vital for those wanting to get ahead with their mortgage.

“Even the smallest change to the cash rate can end up saving you tens of thousands of dollars over the life of your loan,” Hassan said.

“If borrowers fail to keep tabs on cash rate movements, they could be missing out on a golden opportunity to save big money by either negotiating a better rate, or looking elsewhere.”

For those Aussies who are unaware of the movements of the cash rate, it could cost them, Hassan warned.

“Keeping informed means knowing which direction rates are going. Next step is knowing how this impacts the interest on your mortgage.

“Take a look at your current interest rate and compare it to what’s being offered across the board. If it isn’t up to scratch, it may be time to refinance.”

Finder’s tips on how to negotiate a better rate on your home loan

Do your research. Know what rates are available on the market, including rates for new and existing mortgage customers.

Go to your lender and ask for them to match your offer. It’s as simple as just picking up the phone. Present two or three more competitive rates that you’ve found elsewhere, and don’t be afraid to haggle.

Get ready to refinance. If your lender refuses to meet the rate you want, shop around for a lender that will. But various fees might apply, so be sure to factor that in.

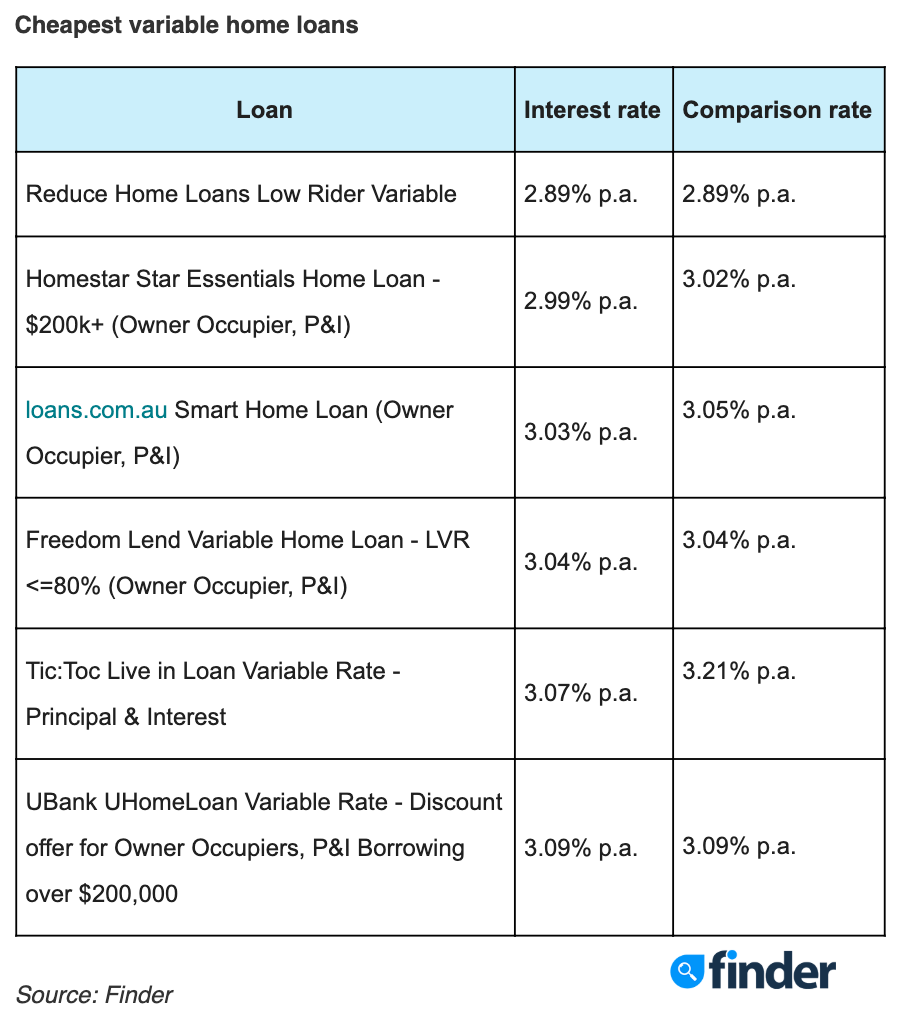

The cheapest variable home loans on the market right now

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance