Insmed Inc (INSM) Reports Q1 2024 Earnings: Misses EPS Estimates, Revenue Grows Amidst Clinical ...

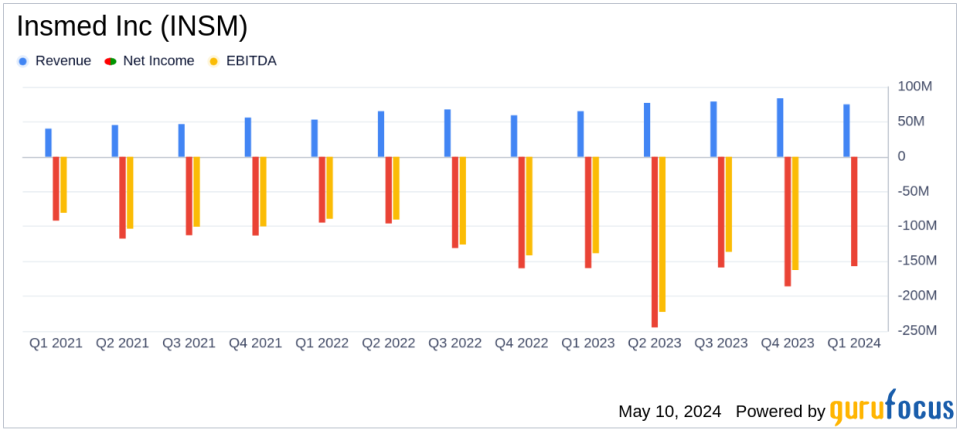

Revenue: Reported Q1 2024 revenue of $75.5 million, an increase of 16% year-over-year, slightly below the estimate of $77.76 million.

Net Loss: Q1 2024 net loss of $157.09 million, an improvement from a net loss of $159.76 million in Q1 2023, but still above the estimated net loss of $179.66 million.

Earnings Per Share: Basic and diluted net loss per share for Q1 2024 was $1.06, better than the estimated loss per share of $1.23.

Research and Development Expenses: Decreased to $121.08 million in Q1 2024 from $127.87 million in the same period last year.

Selling, General and Administrative Expenses: Increased to $93.10 million in Q1 2024 from $79.91 million in Q1 2023.

2024 Revenue Guidance: Reiterated global ARIKAYCE revenue guidance for 2024 in the range of $340 million to $360 million, indicating expected double-digit growth year-over-year.

Cash Position: Cash and cash equivalents stood at $595.73 million as of March 31, 2024, up from $482.37 million at the end of 2023.

On May 9, 2024, Insmed Incorporated (Nasdaq:INSM), a prominent biopharmaceutical entity dedicated to transforming the lives of patients with serious and rare diseases, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a net loss of $157.09 million with a loss per share of $1.06, which did not meet the analyst expectations of a $1.23 loss per share. However, it showcased a revenue of $75.5 million, reflecting a 16% growth year-over-year but slightly missing the estimated revenue of $77.76 million.

Company Overview

Insmed Inc is at the forefront of biopharmaceutical innovation, focusing on severe and rare diseases. Its flagship product, ARIKAYCE (amikacin liposome inhalation suspension), is approved in the US for treating Mycobacterium Avium Complex (MAC) lung disease. Insmed's pipeline includes Brensocatib for non-cystic fibrosis bronchiectasis and INS1009 for pulmonary arterial hypertension, highlighting its commitment to addressing unmet medical needs.

Financial Highlights and Strategic Developments

The first quarter of 2024 was marked by significant clinical and operational milestones for Insmed. The company reiterated its 2024 global revenue guidance for ARIKAYCE, projecting it between $340 million to $360 million, indicating robust growth prospects. Noteworthy clinical updates included positive safety and efficacy data from the Phase 2 studies of TPIP, a promising treatment under investigation for pulmonary diseases, which showed favorable outcomes in patient trials.

Detailed Financial Analysis

The consolidated statements of net loss revealed a narrowed operating loss of $145.5 million compared to $148.2 million in the same quarter the previous year. This improvement is partly due to a decrease in research and development expenses, which dropped from $127.9 million to $121.1 million. However, selling, general, and administrative costs rose from $79.9 million to $93.1 million, reflecting increased investment in commercial activities and administrative infrastructure.

The balance sheet remains robust with an increase in cash and cash equivalents to $595.7 million from $482.4 million at the end of December 2023. This financial strengthening supports Insmed's strategic initiatives and upcoming clinical trial activities.

Market and Future Outlook

Insmed's strategic focus on advancing its clinical pipeline while expanding the commercial footprint of ARIKAYCE positions it well for future growth. The anticipated readouts from the Phase 3 ASPEN trial of Brensocatib and ongoing studies of TPIP could be pivotal in shaping the company's trajectory in the biopharmaceutical landscape.

Overall, Insmed Inc's Q1 2024 performance reflects a balanced execution of its operational strategies and clinical advancements, despite the slight miss on the EPS forecast. With a strong pipeline and a strategic focus on rare diseases, Insmed remains a key player to watch in the biopharmaceutical sector.

For detailed financial figures and more information, visit Insmed's website or access the full earnings report and webcast of the conference call.

Explore the complete 8-K earnings release (here) from Insmed Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance