Insider-Owned Growth Companies To Watch On US Exchanges In June 2024

As of June 2024, the U.S. stock market exhibits a cautious tone, with investors weighing the implications of recent Treasury auctions and Federal Reserve decisions amidst ongoing political uncertainties in Europe. In such a market environment, growth companies with high insider ownership can be particularly noteworthy as these insiders may have a vested interest in the company's long-term success, potentially aligning their goals closely with those of external shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.1% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Celsius Holdings (NasdaqCM:CELH) | 10.4% | 21.7% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 15.2% | 84.1% |

BBB Foods (NYSE:TBBB) | 18.1% | 99.4% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

Here's a peek at a few of the choices from the screener.

Corcept Therapeutics

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Corcept Therapeutics Incorporated focuses on the discovery and development of drugs for severe endocrinologic, oncologic, metabolic, and neurologic disorders in the United States, with a market capitalization of approximately $3.32 billion.

Operations: The company generates its revenue primarily through the discovery, development, and commercialization of pharmaceutical products, totaling approximately $523.53 million.

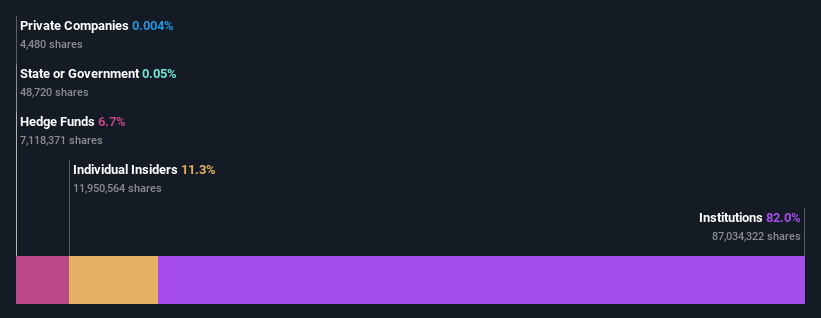

Insider Ownership: 11.3%

Revenue Growth Forecast: 13.2% p.a.

Corcept Therapeutics, a company with significant insider ownership, is poised for substantial growth with earnings expected to increase by 26% annually, outpacing the US market's 14.7%. Although revenue growth projections are modest at 13.2% annually, they still surpass the market average of 8.5%. Recent activities include multiple shelf registration filings and promising clinical trial results for relacorilant in treating Cushing's syndrome, indicating a proactive approach in expanding its financial and therapeutic reach.

Ryan Specialty Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ryan Specialty Holdings, Inc. provides specialty insurance products and solutions across the US, Canada, the UK, Europe, and Singapore, with a market capitalization of approximately $14.00 billion.

Operations: The company generates its revenue primarily through its insurance brokerage segment, which achieved $2.12 billion in sales.

Insider Ownership: 19.4%

Revenue Growth Forecast: 16.4% p.a.

Ryan Specialty Holdings, with high insider ownership, is set to outperform with its earnings forecasted to grow at 76.5% annually, significantly above the US market average. Despite a high debt level and the impact of one-off items on financial results, the company's robust profit growth and strategic mergers and acquisitions aim to sustain long-term value. Recent activities include strong Q1 performance with revenue up to US$552.05 million and net income at US$40.68 million.

Warby Parker

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Warby Parker Inc. operates in the United States and Canada, specializing in eyewear products with a market capitalization of approximately $2.01 billion.

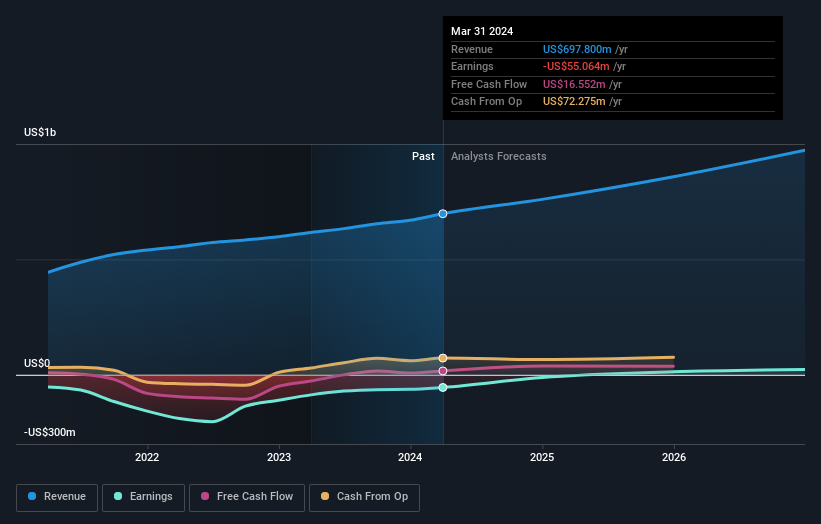

Operations: The company generates its revenue primarily from the sale of optical supplies, totaling approximately $697.80 million.

Insider Ownership: 20.1%

Revenue Growth Forecast: 11.8% p.a.

Warby Parker, characterized by high insider ownership, is navigating a growth trajectory with expectations of substantial revenue and profit increases. The company forecasts a revenue increase to US$753 million to US$761 million for 2024, up approximately 13% year-over-year. Despite experiencing shareholder dilution over the past year, Warby Parker's strategic focus remains strong as it aims for profitability within three years—a rate significantly above average market predictions. Recent improvements in financial performance are evident from Q1 results showing reduced losses and increased sales.

Summing It All Up

Embark on your investment journey to our 181 Fast Growing US Companies With High Insider Ownership selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:CORT NYSE:RYAN and NYSE:WRBY.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance