Housing affordability hasn’t improved this much since 2013

Australia’s slowing but spreading housing downturn has been a source of pain for property investors – but a boon for first-home buyers.

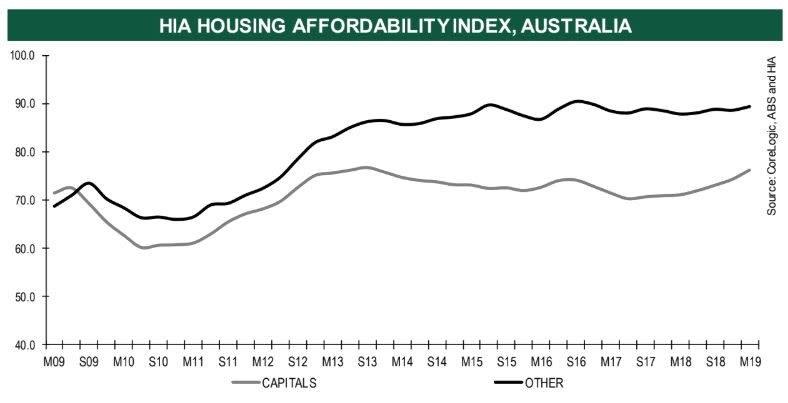

The Housing Affordability Index, which takes into account the latest house prices, mortgage interest rates and wage growth, rose by 2.2 per cent over the March quarter.

“[It’s] the most significant improvement in affordability since September 2013,” said Housing Industry Association (HIA) chief economist Tim Reardon.

Housing affordability improved across the nation with the exception of Tasmania and the ACT, where prices have continued to rise, meaning affordability has plateaued.

Buyers in east coast capital cities in particular will enjoy the improvement in affordability: where it used to take two average Sydney incomes to afford repayments on an average home in Sydney in June 2018, this has now improved to only requiring 1.8 standard incomes to buy the same home.

“Similarly, in Melbourne the Affordability Index has improved by almost 10 per cent in a year,” Reardon added.

The index for Sydney rose by 12.4 per cent, followed by Melbourne at 9.6 per cent and then Perth at 7.7 per cent. Darwin also saw an increase in housing improvability of 5.9 per cent, and Brisbane saw modest growth of 2.5 per cent.

Related story: There's good times ahead for Aussie property, here's why

Related story: Thanks to the property downturn, some houses are going for $7,000

Related story: Sold the family home? Here are Sydney’s most popular downsizer suburbs

Meanwhile, affordability has gotten worse in Hobart, Canberra and Adelaide. HIA’s index dropped -5.1 per cent in the Tasmanian and ACT capitals and -1.1 per cent in the South Australian capital.

Reardon pointed to the improvement in home building over the last five years as one of the key factors behind the improvement in housing affordability.

“With completion of new homes remaining at elevated levels, affordability is poised to continue to improve,” he added.

Challenges ahead

Speaking to Yahoo Finance, property expert Michael Yardney said homebuyers were facing two key challenges in the upcoming months.

Aussies will find it harder to convince banks to lend them money for 5 per cent deposits, let alone the 10 per cent or 20 per cent that many homebuyers require, Yardney said.

“This is difficult in a period of high rentals and low wages growth,” he told Yahoo Finance.

On top of that, banks are tightening the criteria by which a bank assesses whether you’ll be able to make your loan repayments.

A quick comparison of mortgage home loan interest rates shows most rates at just under 4 per cent.

But “following macro prudential controls introduced by APRA, banks assessment criteria in these days of prudential lending calculate your ability to repay a principal and interest mortgage at around 7.25 per cent interest,” Yardney said.

“While this ‘stress test’ made sense as a time of rising house values and the potential of rising interest rates, it makes no sense today in the current climate where home values are falling and interest rates are likely to drop.”

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance