Australian property downturn is slowing but spreading

The Australian housing downturn recorded its smallest monthly decline in March, indicating the prolonged slump could be reaching the bottom.

But while the speed of the decline has lessened, its impact has widened, with the previously capital city-based decline increasingly denting values in regional areas, the CoreLogic national home value index for March has revealed.

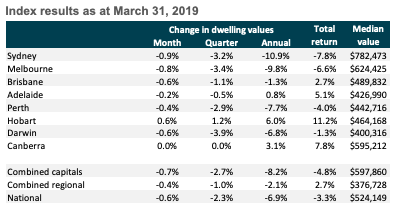

Home values across the country declined 0.6 per cent in March, the slightest month-on-month decline since values slumped 0.5 per cent in October 2018.

March marks the 17th month of consecutive declines, shedding a cumulative 7.4 per cent around the country since their October 2017 peak.

Related story: Cut, hold or hike: what to expect at tomorrow’s cash rate announcement

Related story: Aussie property prices to drop another $60,000 by the end of the year

Related story: Labor sets date for negative gearing changes

“While the pace of falls has slowed in March, the scope of the downturn has become more geographically widespread,” CoreLogic head of research Tim Lawless confirmed this morning.

“Although this is a positive development, the outlook for the housing market will continue to be affected by uncertainty related to the federal election, lending policies and more broadly, domestic economic conditions.”

“Federal elections generally cause some uncertainty, which is likely amplified more so this time around considering the potential for a change of government which will also involve significant changes to taxation policies related to investment.”

Sydney and Melbourne hardest hit

Sydney and Melbourne were again the hardest hit, falling 0.9 per cent and 0.8 per cent respectively.

They were followed by Brisbane and Darwin which both fell by 0.6 per cent.

Hobart was the only city to record positive growth, up 0.6 per cent, while Canberra values remained steady.

Values remain at record highs in these cities, but the last twelve months have seen noticeable slides in growth, Lawless said.

“The silver lining here is that housing is now very affordable and first home buyers are proportionally much more active relative to other areas of the country.”

The exceptions

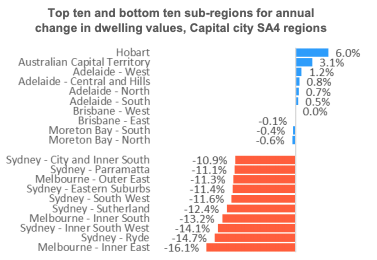

Hobart and the Australian Capital Territory have recorded the strongest annual growth in dwelling values.

On the other end of the spectrum, Melbourne’s inner east and Ryde in Sydney have suffered the worst falls.

Outside of the capital cities, Launceston and south east and north east Tasmania have outstretched the rest, while the Queensland Outback and the South Western Australian Outback have slumped the most.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance