1 million Australian homes in bushfire danger zone

Nearly 1 million addresses across Australia are within 100 metres of bushland, placing them at the highest risk level of bushfires.

Related story: What would a global recession in 2020 look like?

Related story: Bushfire travel refunds: What the law says

Related story: Bushfires, drought to see grocery prices soar up to 50%

And, according to research from risk analysis firm Risk Frontiers, Halls Gap in Victoria is the most bushfire-imperiled suburb.

South-east Australia bears the brunt of the bushfire financial and insurance risk, general manager Andrew Gissing told Yahoo Finance.

Gissing with fellow Risk Frontiers researcher, Foster Langbein, has analysed the regions most at risk from natural perils and the associated costs.

Lismore in New South Wales is the most at risk from flooding, while Karratha in Western Australia has the highest risk of cyclones. Sydney is the most at risk from hail, and Dandenong in Victoria is the most at risk from earthquakes.

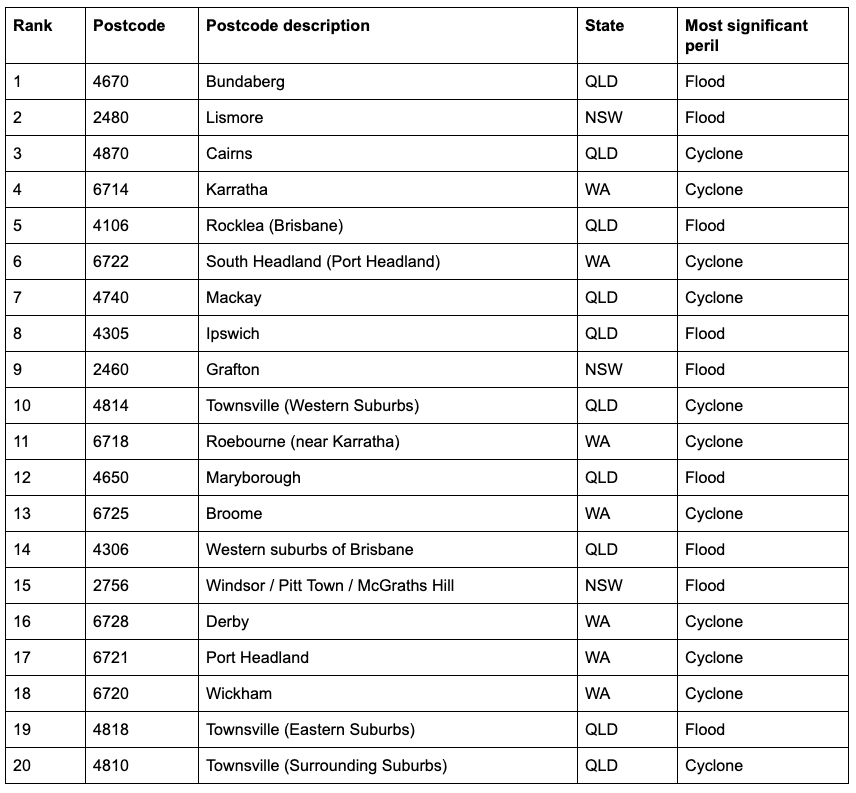

The researchers also ranked postcodes by their total average annual loss from floods, bushfires, earthquakes and hail, with Bundaberg facing the most significant flood peril.

In fact, within the top 20 suburbs, the largest financial risks were from flood and cyclones.

“Insurers invest significant efforts to understand natural hazard risks,” Gissing said, adding that these companies will use catastrophe loss models to quantify the distribution of losses under future climate scenarios and price premiums.

According to research from not-for-profit research group Energy and Climate Intelligence Unit, climate change is increasing the risk of extreme weather events like bushfires, flooding and droughts.

And for some locations in danger zones, climate change could see insurance premiums increase.

“There is a large degree of uncertainty in predicting risk over several decades. Scenarios can vary based on future emissions, demographic changes and adaptation efforts,” Gissing said.

“Given the uncertainty around future economic, social and climatic conditions it is essential that the uncertainty of any future impact estimates is appreciated when forecasting over long time horizons.”

Climate risk means 1-in-19 homes to become uninsurable

The Australian Climate Council has also warned that one in every 19 homeowners could be unable to insure their homes by 2030 as premiums become “effectively unaffordable”, which is defined as costing 1 per cent or more of the property value every year.

That means that a person with a home worth $500,000 will have to set aside more than $5,000 a year to cover extreme weather losses.

“Some Australians will be acutely and catastrophically affected,” the researchers said.

“Low-lying properties near rivers and coastlines are particularly at risk, with flood risks increasing progressively and coastal inundation risks emerging as a major threat around 2050.”

And, the Australian property market will hemorrhage $571 billion in value by 2030 should emissions remain at their current levels.

By 2050, that will rise to $611 billion and to $770 billion by 2100.

However, these costs will be borne by 5 to 6 per cent of properties, representing an “enormous cost” for those affected.

“These will be felt through increased insurance costs and will predominantly impact the same households that will experience the steepest losses in property values.”

And it’s the properties most at risk of flooding, coastal changes and bushfires that will be worst-affected.

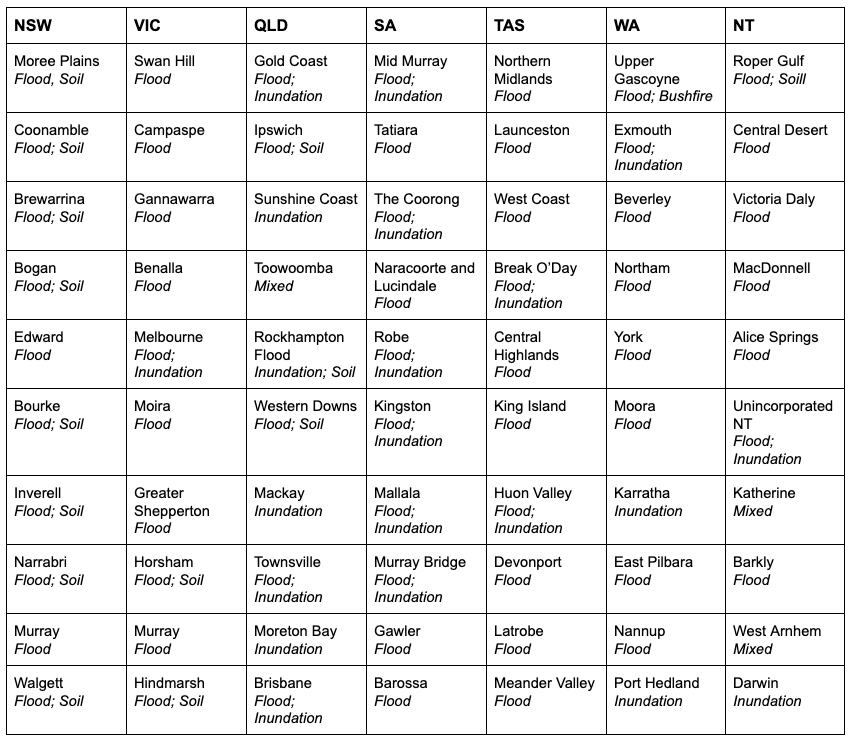

The Climate Council also identified the regions where the annual average risk cost would be 1 per cent or more of the property by 2100, based on the regions which will have the highest percentage of impacted properties.

It also named the prominent risk factors for the highlighted regions. Again, flood and inundation risks were the greatest.

The Climate Council researchers said emissions need to be reduced to net zero by 2050 and building codes need to be altered to ensure buildings can cope with the “increasingly frequent and severe” climate-change induced hazards.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, property and tech news.

Yahoo Finance

Yahoo Finance