High Insider Ownership Growth Companies On UK Exchange In June 2024

Amidst a backdrop of fluctuating global markets, the United Kingdom's FTSE 100 shows resilience with marginal gains, influenced by rate cuts from the ECB and a positive commodities sector. In such an environment, growth companies with high insider ownership on the UK exchange could offer interesting opportunities as these insiders often have a deep commitment to their companies' futures.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

Name | Insider Ownership | Earnings Growth |

Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

Petrofac (LSE:PFC) | 16.6% | 124.5% |

Getech Group (AIM:GTC) | 17.2% | 86.1% |

Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

Spectra Systems (AIM:SPSY) | 23.1% | 26.3% |

Velocity Composites (AIM:VEL) | 28.5% | 140.5% |

TEAM (AIM:TEAM) | 25.8% | 58.6% |

B90 Holdings (AIM:B90) | 22% | 142.7% |

Afentra (AIM:AET) | 38.3% | 99.2% |

Let's uncover some gems from our specialized screener.

Property Franchise Group

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Property Franchise Group PLC, operating in the United Kingdom, manages and leases residential real estate properties with a market capitalization of approximately £275.80 million.

Operations: The company generates revenue primarily through property franchising and financial services, with segments reporting £25.78 million and £1.50 million respectively.

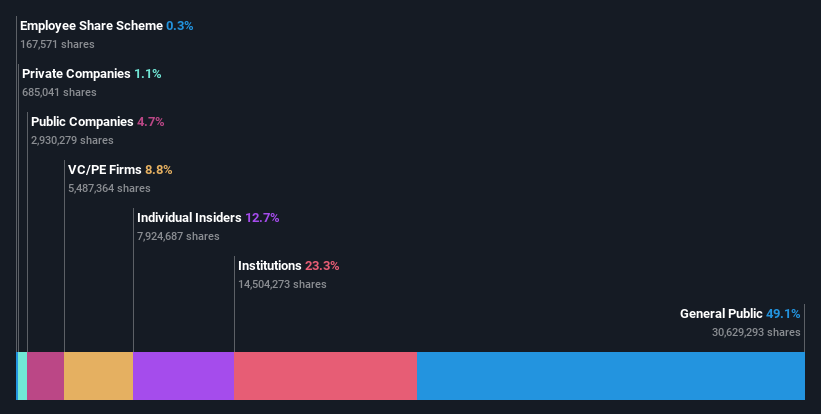

Insider Ownership: 12.7%

Earnings Growth Forecast: 36.7% p.a.

The Property Franchise Group PLC, a UK-based entity, is poised for robust growth with projected revenue and earnings increases of 44.7% and 36.71% per year respectively, outpacing the broader UK market. Despite this promising outlook, concerns arise from substantial shareholder dilution over the past year and an unstable dividend track record. Additionally, the upcoming retirement of CFO David Raggett in 2025 could signal a pivotal transition period for the company's financial leadership amidst recent acquisitions.

Hochschild Mining

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hochschild Mining plc is a precious metals company that operates in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United States, Canada, Brazil, and Chile with a market cap of approximately £0.96 billion.

Operations: Hochschild Mining's revenue is primarily generated from its operations in San Jose ($242.46 million), Inmaculada ($396.64 million), and Pallancata ($54.05 million).

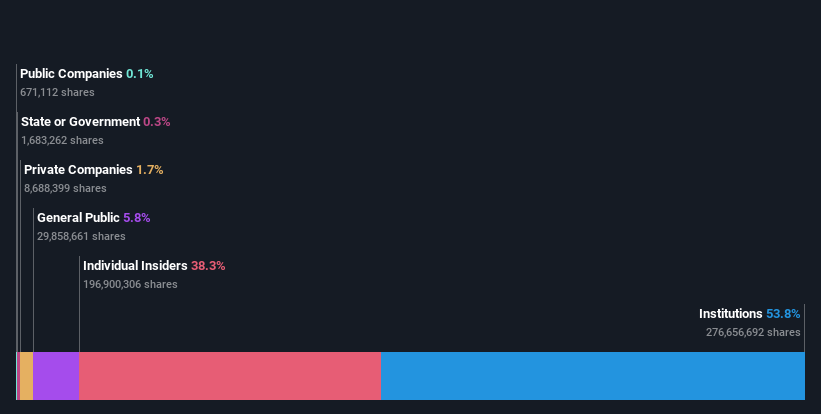

Insider Ownership: 38.4%

Earnings Growth Forecast: 58.2% p.a.

Hochschild Mining is expected to become profitable within three years, with anticipated earnings growth significantly outpacing the UK market average. Although revenue growth projections are modest at 8.4% annually, this still exceeds general market expectations. Recent insider transactions show more buying than selling, indicating confidence from those closest to the company. Additionally, recent production increases and positive guidance for 2024 suggest operational improvements, supporting a potentially brighter financial future despite past losses.

Playtech

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Playtech plc is a global technology firm specializing in gambling software, services, content, and platform technologies with a market capitalization of approximately £1.48 billion.

Operations: The company's revenue is segmented into €684.10 million from Gaming B2B, €946.60 million from Gaming B2C, €18.20 million from B2C - HAPPYBET, and €73.40 million from B2C - Sun Bingo and other B2C activities.

Insider Ownership: 13.5%

Earnings Growth Forecast: 20.6% p.a.

Playtech, a UK-based growth company with significant insider ownership, reported a substantial increase in earnings, with net income rising to €105.1 million in 2023 from €87.6 million the previous year. Analysts predict Playtech's revenue and earnings will continue to outpace the market, expecting an annual growth of 4% and 20.6% respectively. Despite these strong forecasts and trading at 54.7% below its estimated fair value, concerns about its low forecasted Return on Equity at 8.9% persist alongside recent extensive board restructuring which could impact governance dynamics.

Dive into the specifics of Playtech here with our thorough growth forecast report.

Our expertly prepared valuation report Playtech implies its share price may be lower than expected.

Turning Ideas Into Actions

Unlock our comprehensive list of 67 Fast Growing UK Companies With High Insider Ownership by clicking here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include AIM:TPFGLSE:HOC LSE:PTEC and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance