Cash rate dropped to 0.75 per cent: Has your bank passed the October rate cut on?

The Reserve Bank of Australia has slashed rates again to a new record low of 0.75 per cent, after dropping rates first in June and then again in July to the then-record low of 1 per cent.

Now, those with variable home loans could see some more relief to their mortgage rates, but only if the banks choose to pass the rate on.

Also read: Should I choose a variable or fixed interest rate home loan?

Also read: This is what your variable home loan looks like now

Also read: Shock rate decision: Reserve Bank of Australia issues ‘death knell’ for country’s savers

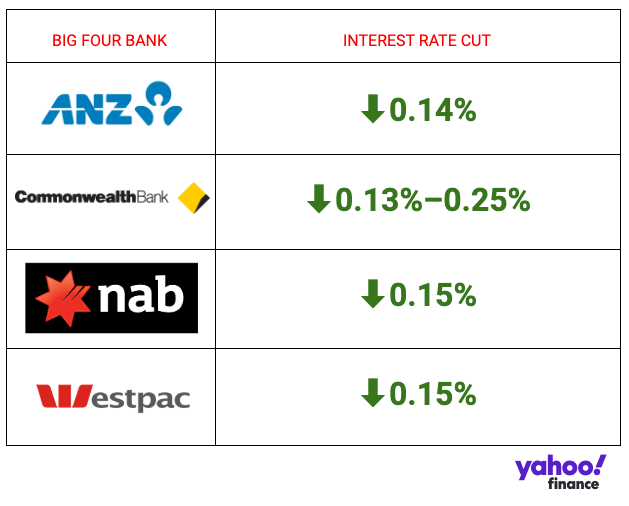

Has your bank passed it on?

CBA first to cut: 0.13% to 0.25%

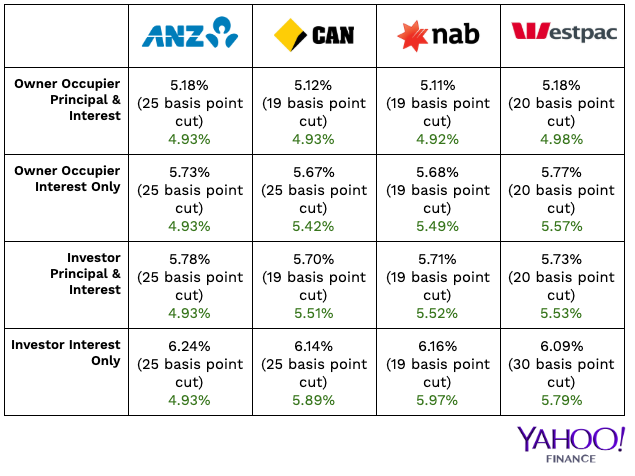

CBA’S new Standard Variable Rates

Owner Occupied Principal and Interest Standard Variable Rate home loans reduced by 0.13% per annum (p.a) to 4.80% p.a.

Investor Principal and Interest Standard Variable Rate home loans reduced by 0.13% p.a. to 5.38% p.a.

Owner Occupied Interest Only Standard Variable Rate home loans reduced by 0.13% p.a. to 5.29% p.a.

Investor Interest Only Standard Variable Rate home loans reduced by 0.25% p.a. to 5.64% p.a.

CBA’s new Fixed Rates

2 and 3 Year Owner Occupied Principal and Interest Fixed Rates in the Wealth Package reduced to 2.99% p.a. available from Thursday.

Following the RBA’s cash rate decision we have announced the reduction of the Standard Variable Rate for our home loan customers by between 0.13% p.a. and 0.25% p.a. and limited the base rate reduction on our NetBank Saver product by 0.05% p.a.

— CBA Newsroom (@CBAnewsroom) October 1, 2019

“As the Reserve Bank cash rate has reached record lows, we face a difficult balancing act between the multiple, valid interests of our stakeholders,” CBA group executive retail banking services Angus Sullivan said in a statement.

“Particularly given it is currently not feasible to pass on the full rate reduction to more than $160 billion of our deposits which are at, or near, zero rates.

“In balancing these interests, we have carefully considered how to best meet the needs of over 6 million savings customers – who may find it challenging to make ends meet with record low savings interest rates – with the needs of our 1.6 million home loan customers, who want to pay less on their mortgages; and the needs of our shareholders, many of whom are retirees who rely on our dividend.”

Take a look at the variable home loan rates after the July cut

ANZ was the only big four bank to pass on the entire cut, Westpac passed on a 0.20 per cent cut, while CBA and NAB each passed on a 0.19 per cent cut.

My bank hasn’t passed on the interest rate cut. What can I do?

The RBA has been slashing rates, but the big four banks haven’t passed on the entire cut to consumers.

So, if you’re a customer of the big banks, it might be time to consider switching banks to get a better rate. InfoChoice currently lists 22 three-year fixed rate products from independent lenders with rates under 3 per cent per annum.

If you’d prefer to stay with your current bank, here’s how to talk your way to cheaper home loan too.

And here’s a check-list of things you should have done after the RBA started cutting rates.

Yahoo Finance will keep you updated once we know which banks have passed on the rate cuts.

Make your money work with Yahoo Finance’s daily newsletter. Sign up here and stay on top of the latest money, news and tech news.

Yahoo Finance

Yahoo Finance