Groupon Inc (GRPN) Q1 2024 Earnings: Surpasses Revenue Estimates Amidst Challenges

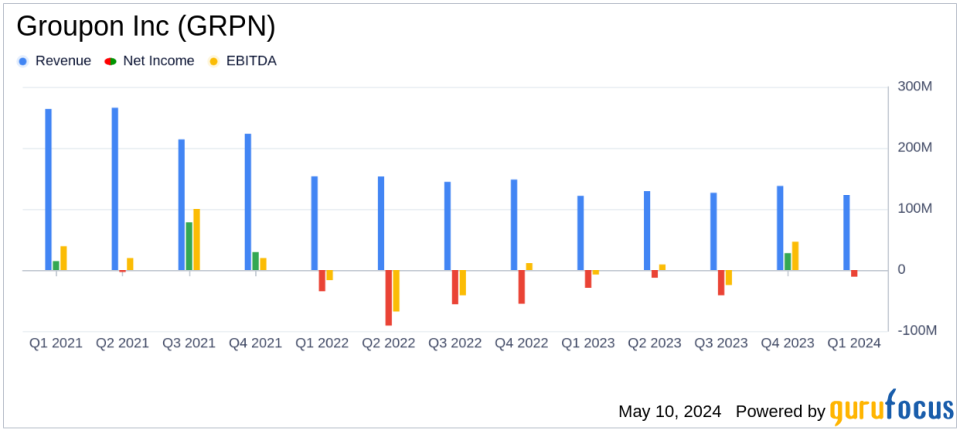

Revenue: $123.1 million, up 1% year-over-year, exceeding estimates of $117.45 million.

Net Loss: $11.5 million, an improvement from a net loss of $28.6 million year-over-year, but above estimates of a $7.00 million loss.

Adjusted EBITDA: Positive at $19.5 million, a significant improvement from negative $4.9 million in the prior year period.

North America Revenue: Increased by 6% to $94.1 million, driven by higher demand in the Travel category and favorable refund rates in the Local category.

International Revenue: Decreased by 11% to $29.0 million, primarily due to an overall decline in demand across categories.

Free Cash Flow: Reported as negative $13.8 million, reflecting ongoing operational investments.

Cash and Cash Equivalents: Ended the quarter with $158.7 million, indicating a solid liquidity position.

Groupon Inc (NASDAQ:GRPN) released its 8-K filing on May 9, 2024, revealing a quarter that surpassed revenue expectations but still faced significant challenges. The company, a well-known intermediary offering discounted goods and services through its online platform, reported a consolidated revenue of $123.1 million for Q1 2024, marking its first revenue growth since 2016.

Company Overview

Groupon operates primarily in two segments: North America and International, with the majority of its revenue generated from the North American segment. The company earns its revenue from commissions on sales made on behalf of third-party merchants and through digital coupons.

Financial Performance Highlights

The reported revenue of $123.1 million represents a 1% increase year-over-year, slightly above the analyst estimate of $117.45 million. This growth is particularly notable as it excludes the Goods category, with the North America segment alone growing by 8%. Adjusted EBITDA was positive at $19.5 million, a significant improvement from the negative $4.9 million in the prior year. However, Groupon reported a net loss of $11.5 million, which, while lower than the previous year's loss of $28.6 million, indicates ongoing profitability challenges.

Operational Efficiency and Market Challenges

Significant reductions in SG&A expenses, primarily due to decreased payroll costs, contributed to the improved financial metrics. Marketing expenses, however, increased to $28.8 million or 26% of gross profit. The company also faced a decline in active customers in both North America and International segments, which could impact future revenue growth.

Strategic Initiatives and Leadership

Under the leadership of newly appointed CEO Dusan Senkypl, Groupon is focusing on becoming a prime destination for local experiences and services. Senkypl's optimistic outlook on reinvigorating the company's growth trajectory reflects confidence in strategic adjustments aimed at enhancing operational efficiency and market reach.

Financial Health and Outlook

Groupon exited the quarter with $158.7 million in cash, providing a stable financial base to support its strategic initiatives. The company's effort to streamline operations and focus on high-margin categories may be crucial as it navigates through the competitive landscape of online deal marketplaces.

Investor and Analyst Perspectives

While Groupon has shown signs of stabilization and slight growth, the ongoing loss and customer attrition pose concerns. Investors and analysts will likely watch closely how the new CEO's strategies unfold in upcoming quarters, impacting the company's ability to sustain growth and improve profitability.

In conclusion, Groupon's Q1 2024 results reflect a company at a pivotal stage, managing to increase revenue against odds but still striving to overcome profitability challenges. The strategic shifts and leadership changes could be key to defining its trajectory in the competitive online deals marketplace.

Explore the complete 8-K earnings release (here) from Groupon Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance